Korean investment fund Hashed confirms far more than $ three billion in losses due to the LUNA-UST collapse for the 1st time.

In an interview with Bloomberg On August three, 2022, Hashed CEO Simon Seojoon Kim stated that Hashed bought thirty million LUNA tokens in the early days of the undertaking. That token was really worth $ three.six billion when LUNA’s cost peaked in early April this yr.

Simon Seojoon Kim, South Korea’s ideal-recognized cryptocurrency investor and an early proponent of the unwell-fated Luna token, explained he has not misplaced faith in the battered business and strategies to increase a third venture capital fund. https://t.co/R8Xd7k7jlw

– Bloomberg Asia (@BloombergAsia) August 3, 2022

This is the 1st time that Hashed has officially confirmed the extent of the reduction in the LUNA-UST crash. In May, CoinDesk After analyzing the on-chain information, Hashed was estimated to have invested virtually 50 million LUNA tokens, resulting in a reduction of more than $ three.five billion.

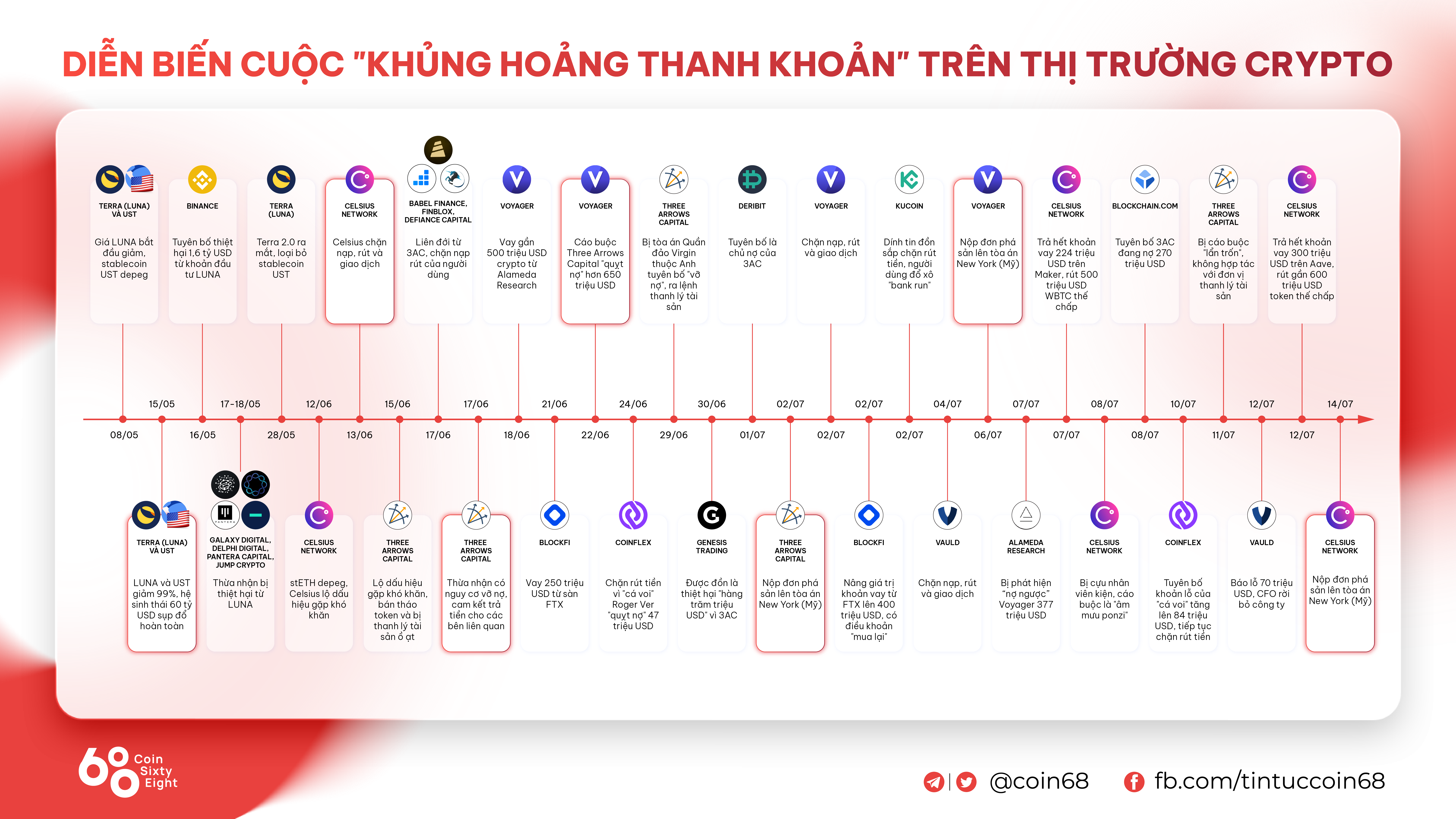

However, Hashed is not the most impressed title. The cryptocurrency neighborhood will never ever fail to remember the story of Three Arrows Capital (3AC), from a well-liked hedge fund slowly falling into a liquidity crisis major to default.

While the reduction was not a slight one particular, Hashed even now maintained his faith in the cryptocurrency industry. CEO Kim unveiled that the business strategies to increase a third fund in the 1st half of 2023. However, it is unclear how significantly the fund will increase.

According to Kim, if and when the business can increase new money, it will target on investing in blockchain gaming firms. In early 2021, Hashed’s 2nd fund raised $ 200 million and centered on web3.

Synthetic currency 68

Maybe you are interested: