Popular cryptocurrency hedge fund Hashed announced it has launched a $ 200 million fund focused to Web applications3.

Hashed is a Korean cryptocurrency investment fund broadly regarded for supporting several effective tasks this kind of as Axie Infinity or The Sandbox.

On December two, Hashed stated it would set up a new $ 200 million investment fund, The Hashed Venture Fund II, to incubate Webthree startups, spanning the fields of metaverse, NFT, and blockchain and DeFi gaming in excess of the upcoming two many years. Specifically, Hashed will actively participate in investment rounds from seed to series B of tasks in exchange for shares or tokens.

Congratulations to the new partners of @hashed_official! @baekkyoumkim and Sean Hong

– #Hashed (@hashed_official) December 1, 2021

A 12 months in the past, Hashed also launched a $ 120 million fund to invest in the cryptocurrency market, with names like dYdX, Mythical Games, Republic, Chai, and NFTBank. The sum earmarked for these tasks ranges from $ one to $ ten million.

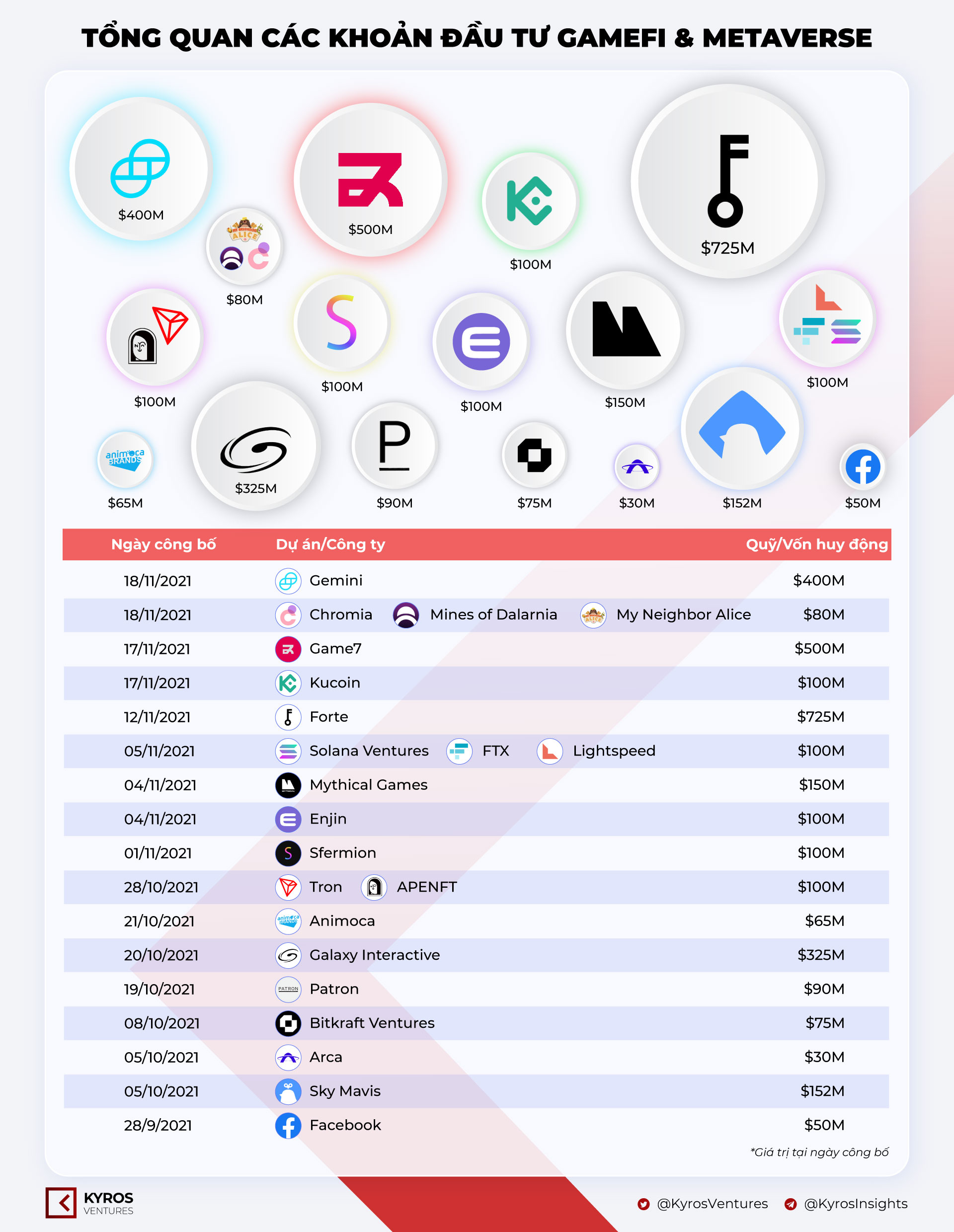

The cryptocurrency discipline in basic and NFT / gaming / metaverse in certain have continually noticed the emergence of big investment money in current many years. In addition to stimulus packages and ecosystem growth money really worth up to billions of bucks really worth of blockchain, several top names in the market also have several “heavy spending” moves, this kind of as Enjin (establishing a $ one hundred billion fund). bucks). million bucks to build the metaverse in the ecosystem), Animoca Brands (build metaverse for K-pop), TRON (one hundred million dollar fund for NFT), FTX / Solana (one hundred million dollar fund to build blockchain video games) , KuCoin (produce a $ one hundred million fund to invest in the game / metaverse), Chromia / My Neighbor Alice / Mines of Dalarnia (set up a $ 80 million fund to build the metaverse) and TIME Magazine (produce a separate column for the metaverse).

Synthetic Currency 68

Maybe you are interested: