[ad_1]

The Bitcoin hashrate of Chinese miners is undergoing a sharp drop after the Sichuan province ordered the national grid to cut off electricity source to 26 miners from the state.

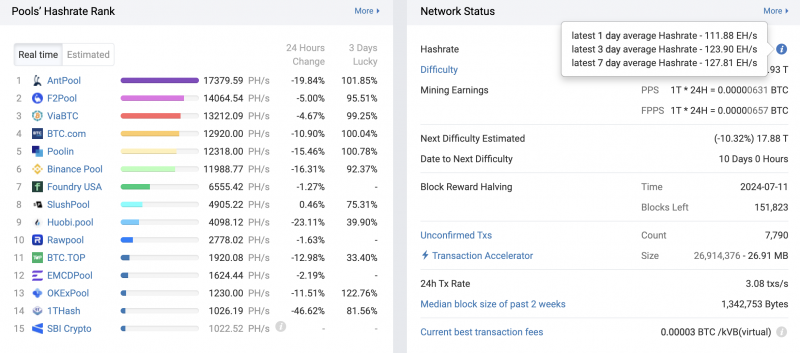

Data from BTC.com demonstrates that nearly all the 15 biggest bitcoin mining pools by real time computing power are seeing substantial declines in hashrate within the previous 24 hours, with some declines to forty six%.

These pools, with the exception of Foundry USA, Slushpool, and SBI Crypto, are based in China or a subsidiary of a cryptocurrency exchange which serves investors and mining clients in China such as Huobi. , OKEx and Binance.

Among the top five bitcoin mining pools, Antpool, BTC.com, and Poolin are seeing hashrates fall between 10% and 22% since June 18. The drops on F2Pool and ViaBTC are quite mild at less than 5 percent. . 1Thash, the private mining pool of Valarhash established in Sichuan, has seen a large drop of around 46% in 24 hours with real time hashrate (PH/s) down to approximately 1,000 petahashes per seconds. When the mining firm launched its own pool around 2019, it had over 10,000 PH/s.

What do these numbers mean?

The average overall hashrate of this bitcoin network now stands at approximately 111 exahashes per second (EH/s)down from 127 EH/s at the seven-day moving average prior to the Sichuan province decision was made.

According into a movie shared by 8BTCnews, miners have started dismantling the gear to get ready to “move house”.

Bye pic.twitter.com/3JrM5qw0E7

— 8BTCnews (@btcinchina) June 19, 2021

It remains to be seen if the hashrate increases after Sunday as June 20 is the final order deadline for these 26 bitcoin mining centers.

As Cointelegraph reported, as well as the 26 named mining centers — most of which can be found in government-approved industrial parks — there are also a substantial number of smaller ones working beneath the range of the government. Government using independently produced hydroelectric power.

Sichuan’s shutdown order comes more than a week after the Xinjiang government led power plants at the Zhundong Economic and Technological Development Zone to close on June 9.

Xinjiang and Sichuan have been and will be the top two bitcoin mining hubs in China and around the world because of their abundant hydroelectric and fossil fuel energy sources.

[ad_2]