Hedera Hashgraph (HBAR) has been stuck in an accumulation phase over the past month, preventing the altcoin from breaking out and achieving higher returns.

While the upward momentum remains, waning investor interest and reduced market activity are emerging as potential problems for HBAR’s future path.

Hedera Hashgraph Has a Chance

The Chaikin Money Flow Index (CMF) shows that capital inflows into HBAR have decreased significantly, while capital outflows are dominating. This shift signals that investors are withdrawing money, possibly due to uncertainty surrounding HBAR’s price action and its ability to maintain upward momentum.

These capital outflows underscore the growing caution among market participants, potentially holding back any short-term rally. Without stronger capital inflows and new investor confidence, HBAR’s price may continue to stay stable in the current range, delaying breakout opportunities.

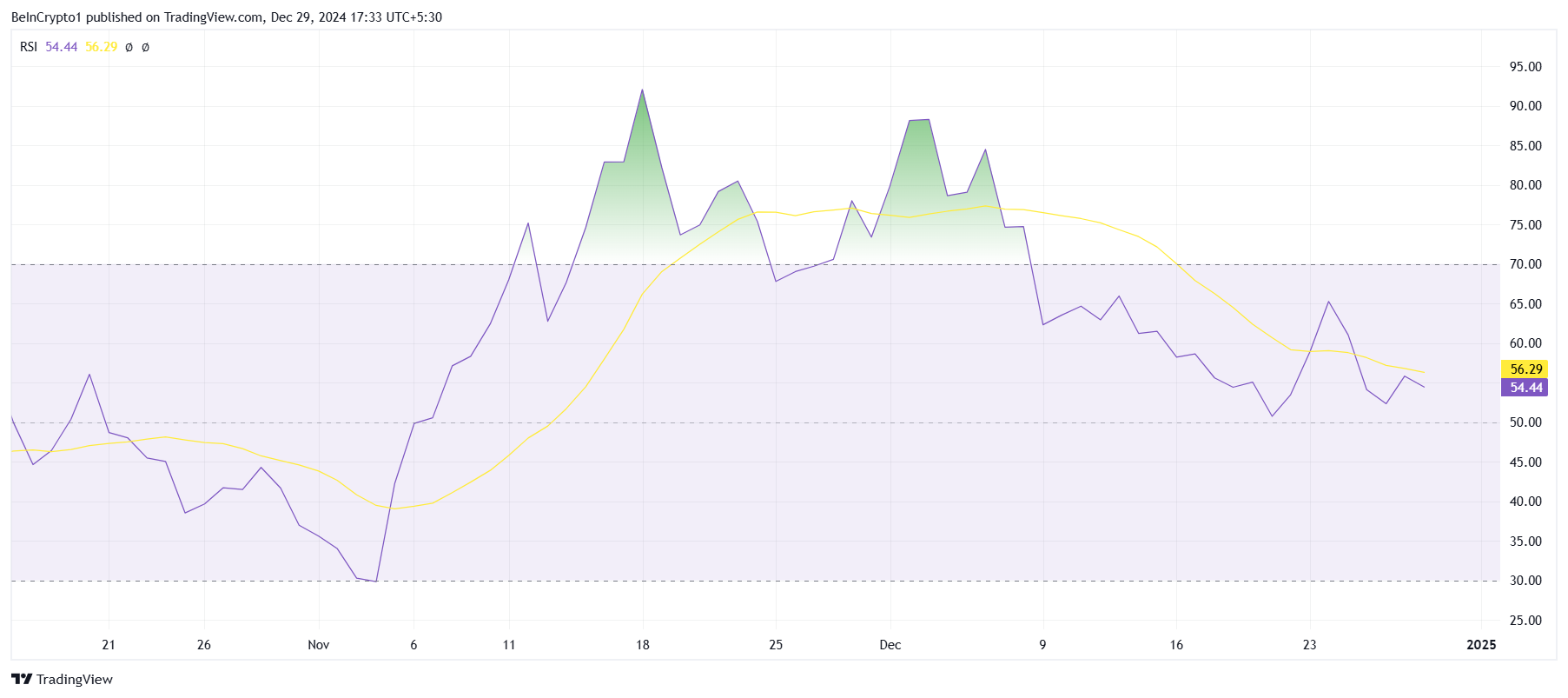

Hedera’s uptrend shows signs of bearish pressure. The Relative Strength Index (RSI) is falling, reflecting a gradual increase in bearish momentum. However, RSI is still above the neutral line of 50.0, showing that bearish control is not yet truly dominant.

This position leaves room for HBAR to attempt to raise prices if market conditions improve. The indecision entering the bearish zone indicates that this altcoin can still recover strength, provided it receives strong enough buying support from investors.

HBAR Price Prediction: Accumulation Continues

HBAR has been in an accumulation phase for a month, with the price currently trading at $0.28. Stuck between $0.40 and $0.25, the altcoin shows no immediate signs of a breakout, reflecting broader market uncertainty.

Mixed signals from market indicators suggest that HBAR could continue its accumulation phase through 2025. This prolonged stagnation requires clear bullish indicators to trigger a breakout and restore investor confidence in the upside potential of altcoins.

However, if investors start selling to take profits, HBAR could lose the important support mark of $0.25. This drop would negate the bullish outlook, potentially pushing the altcoin down to $0.18 and further increasing market skepticism.