Hedera Hashgraph (HBAR) has struggled to maintain significant momentum, with price action reflecting a bearish-neutral trend over the past month. Despite its potential, HBAR still faces difficulties in raising prices due to waning market enthusiasm.

Even longtime supporters of HBAR appear to be retreating as market conditions weigh heavily on investor sentiment.

HBAR Traders Are Frustrated

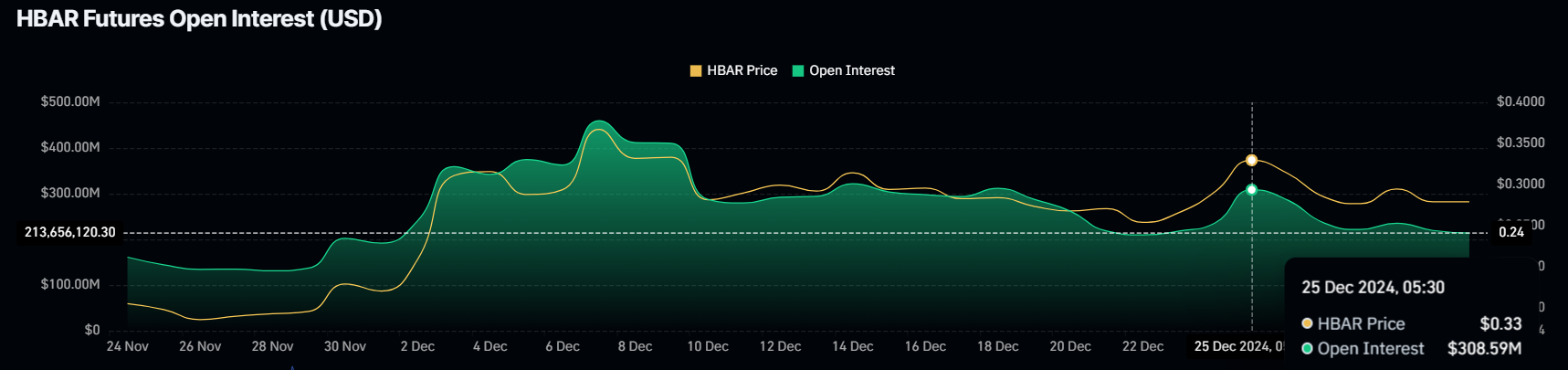

HBAR’s open volume has dropped by $95 million in just six days, showing a significant decline in trading activity. This sharp drop reflects traders withdrawing capital from assets, reducing liquidity and trading volume. The prolonged consolidation period is eroding confidence and reinforcing pessimism in the HBAR market.

The lack of sustained price volatility has caused traders to reduce investment levels as expectations of short-term profits decline. This psychological shift has intensified the downward pressure, making it increasingly difficult for HBAR to regain the momentum needed to recover. Assets are still stuck in a vicious circle.

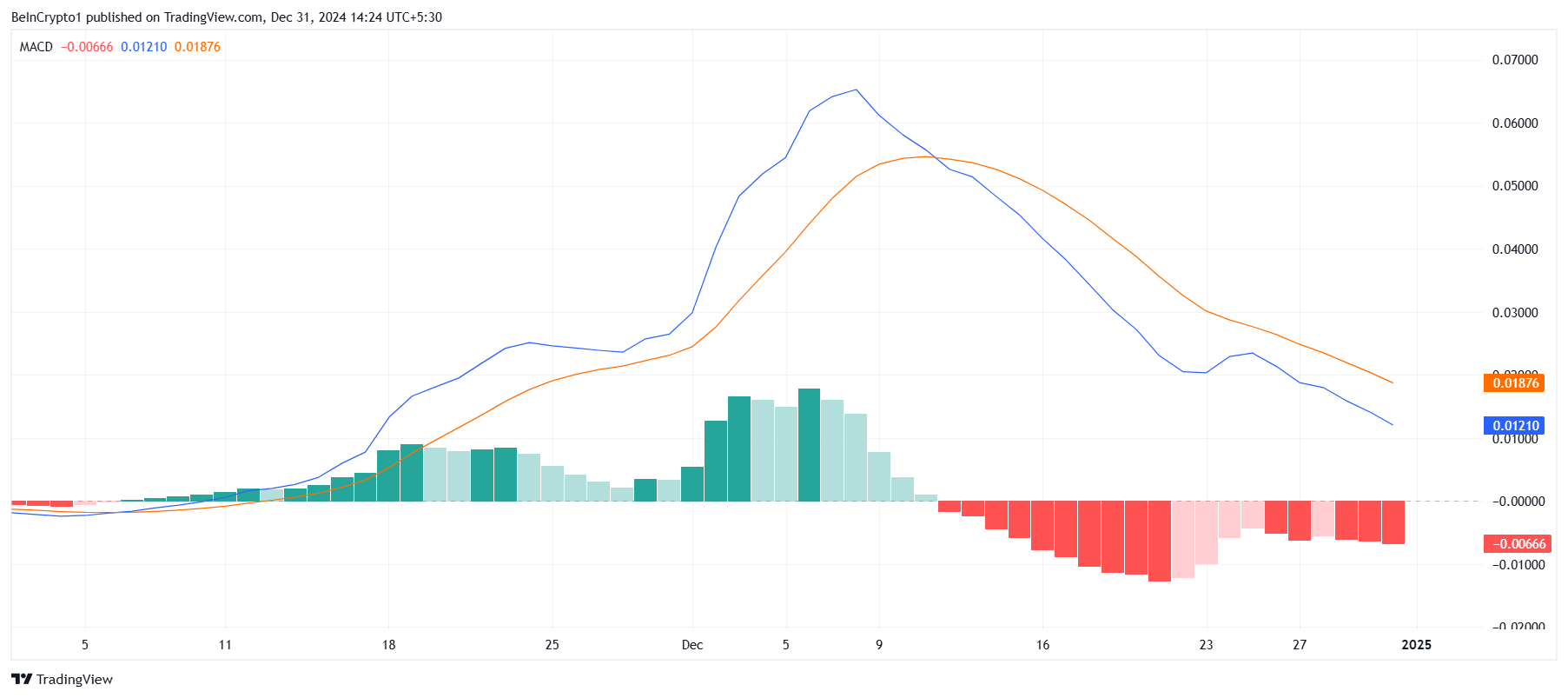

Technical indicators paint a concerning picture of HBAR’s macro momentum. The Moving Average Convergence Divergence (MACD) indicator shows that bearish momentum is strengthening after a brief pause, indicating increased selling pressure. This change suggests that the downtrend may accelerate, making it difficult for HBAR to break out of the current range.

Bearish divergence is a concern, when expected to decrease but increase instead. This new momentum suggests that HBAR price could come under pressure unless significant upside catalysts emerge. Without a reversal in macro trends, this altcoin could face further hurdles in the coming months.

HBAR Price Prediction: Breakout Arranged

HBAR has been consolidating between $0.39 and $0.25 for over a month, struggling to break out of this tight range. At the current price of $0.27, the all-time high of $0.57 is 109% away. To reach $0.57 and possibly set a new high, HBAR needs sustained upward momentum like the 637% surge in October.

While such a strong rally is unlikely in January 2025, moderate momentum could also push HBAR price higher. However, failure to break $0.39 could prolong the consolidation period or result in a fall below $0.25. In this case, HBAR could fall as deep as 0.18 USD.

Therefore, a break of the consolidation range between $0.25 and $0.39 is needed to initiate an uptrend and restore market confidence. Whether HBAR achieves a similar performance to October and posts a new high will depend on favorable market conditions and renewed investor interest, both of which remain uncertain at this time. in.