[ad_1]

HBAR, the native cryptocurrency of the Hedera Hashgraph network, has skyrocketed 41% over the past 24 hours. Currently, HBAR is trading at $0.24, surpassing the psychological threshold of $0.20 for the first time in the past two years.

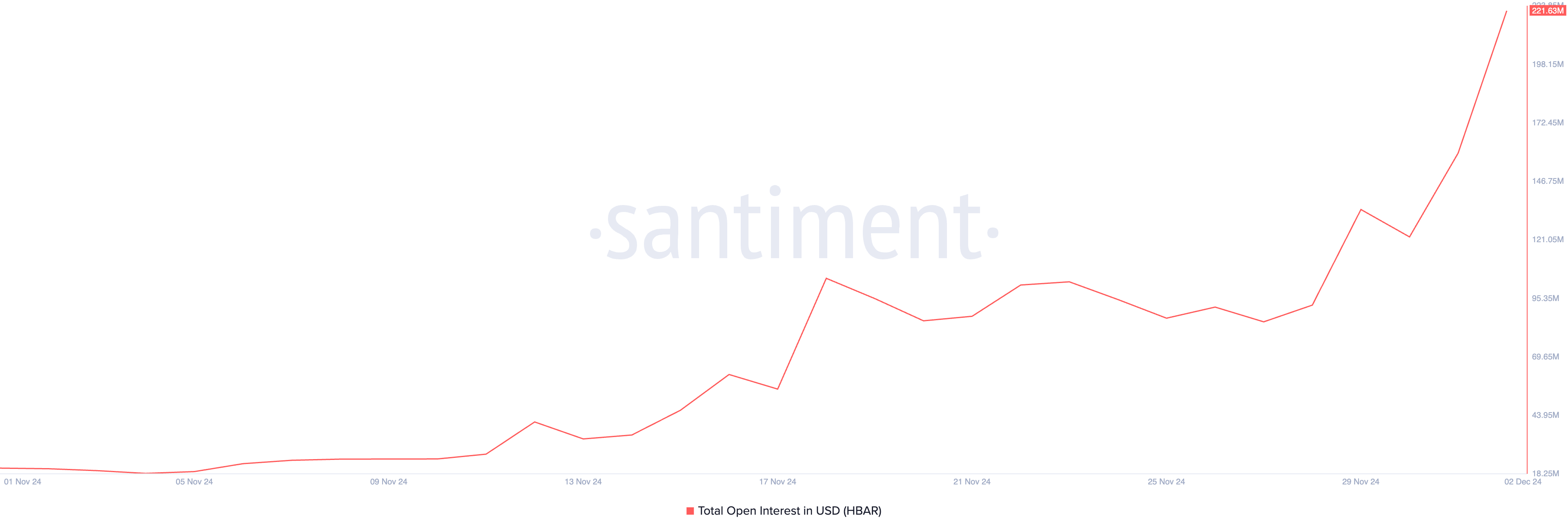

This double-digit price increase has led to an increase in its derivatives market activity, evidenced by soaring open interest, which is now at an all-time high.

Hedera: The center of attention

Recently, Hedera has created a buzz, attracting attention to its Token. The current price increase of HBAR Token is largely due to rumor about the possibility of cooperation between Ripple and Hedera to establish a global payment standard, as the former plans to expand its stablecoin RLUSD to this network.

Additionally, crypto investment firm Canary Capital has filed an application with the U.S. Securities and Exchange Commission (SEC) to open an exchange-traded fund (ETF) with direct access to the HBAR token for the first time. fairy. If passed, this would give institutional investors an opportunity for direct access.

These developments have attracted the market’s attention, as shown by the increase in HBAR’s open interest. At the time of writing, this number reached 222 million USD, and has increased more than 1,000% in the past 30 days.

Open interest refers to the total number of untraded contracts or positions of a particular asset, such as futures or options, that have not been liquidated. When open interest increases during a bull run, this shows that new positions are being opened, indicating strong participation and confidence in the continuation of the price increase.

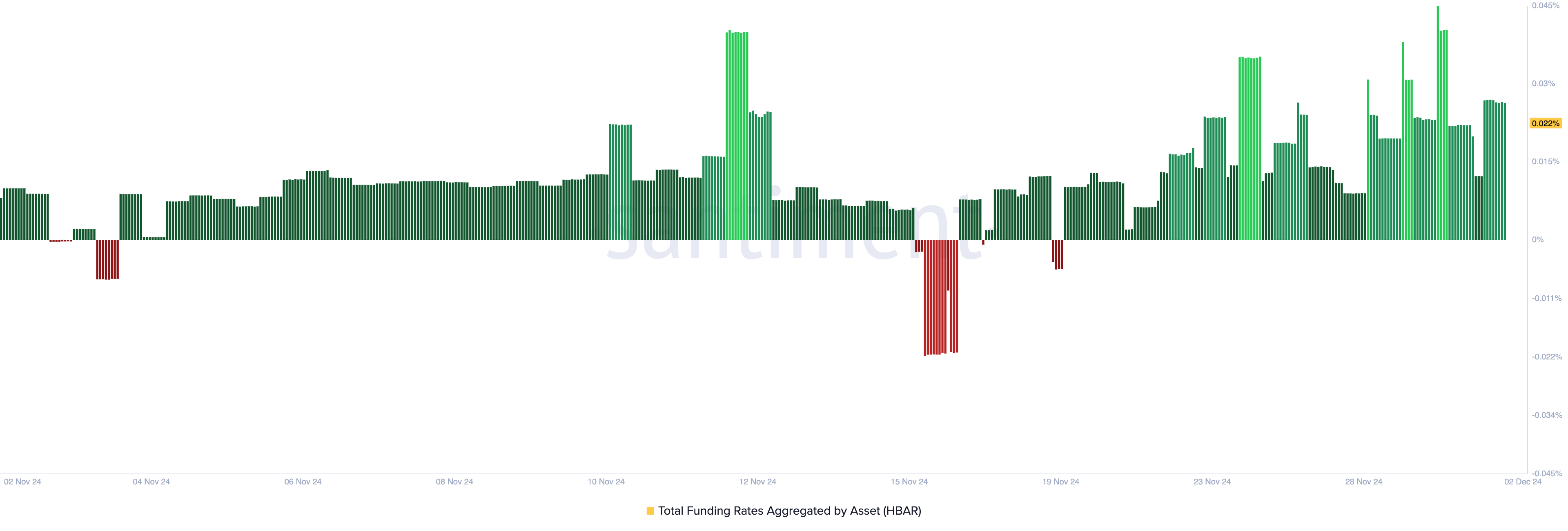

HBAR’s positive funding rate further reinforces its bullish bias, which currently stands at 0.022%.

Funding interest is a periodic fee exchanged between long and short positions in perpetual contracts, which helps keep the contract price close to the actual market price of the asset. Positive funding interest shows that long positions are paying for short positions, reflecting bullish sentiment as many traders expect that prices will rise.

HBAR price forecast: There are many growth opportunities

The HBAR Super Trend indicator on the one-day chart shows the possibility of an extended bull run. Currently, the price is above the indicator’s green line, reflecting upward price pressure.

The Super Trend Indicator tracks the direction and strength of a price trend, appearing as a line on the chart. Blue indicates an uptrend, while red indicates a downtrend. If this uptrend continues, HBAR price could reach $0.30.

However, if the positive momentum weakens, the price could drop to $0.15, invalidating this bullish forecast.

General Bitcoin News

[ad_2]