HBAR, the native cryptocurrency of the Hedera Hashgraph network, has seen a massive growth of over 180% in the past week. Currently, the price is trading at $0.13, a high price last observed in April 2024.

However, this escalation has pushed the token’s price into overbought territory. This overextension suggests that a price correction may be coming for the HBAR Token.

Trader Hedera overextends his price

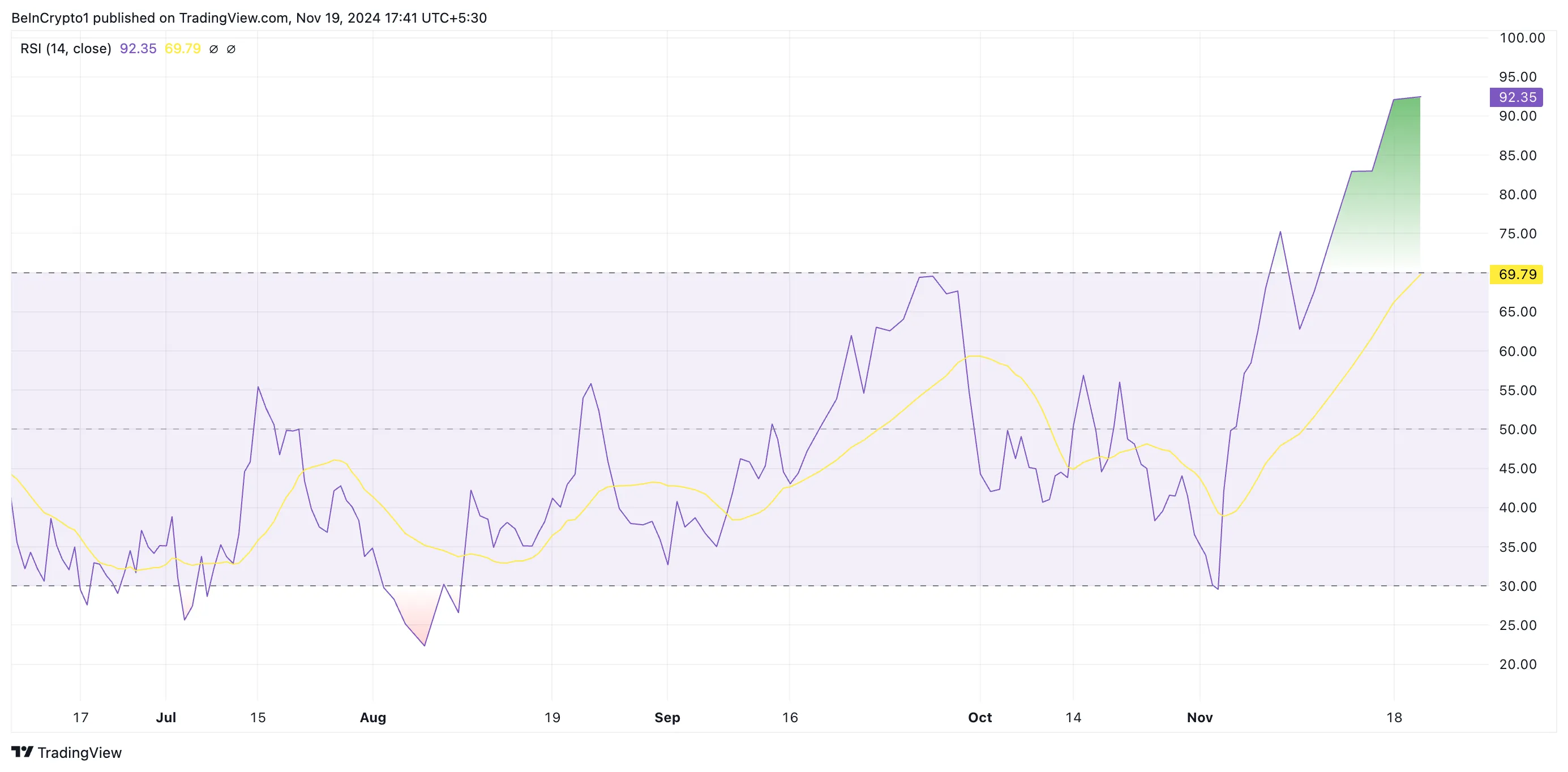

Indicators from HBAR’s Relative Strength Index (RSI) confirm that its markets are overcrowded. As of press time, the indicator stood at 92.35, its all-time high.

RSI measures overbought and oversold market conditions of an asset. It ranges from 0 to 100, with values above 70 indicating the asset is overbought and could decline. Conversely, values below 30 indicate the asset is oversold and could recover.

HBAR’s RSI of 92.35 shows that it is at extreme overbought levels. This shows that HBAR buyers have outpaced sellers, pushing prices to unsustainable levels. While asset prices may continue to rise in the short term, a high RSI often predicts a correction or pullback.

Additionally, HBAR price has crossed the upper boundary of its Bollinger Bands indicator, also confirming that it is overbought among market participants.

The Bollinger Bands indicator measures market volatility and identifies potential buy and sell signals. It consists of three main components: middle band, upper band and lower band.

The middle band is a 20-period moving average that acts as a baseline for price trends. The upper band is calculated as the middle band plus two standard deviations of the price, reflecting price fluctuations above the average. The lower band is the middle band minus two standard deviations of price, representing volatility below the average.

When the price trades above the upper band, it usually suggests that the asset is overbought, as it has moved much further from its average price. This could be a sign of a price pullback.

HBAR Price Prediction: A pullback is inevitable

As buyer fatigue sets in, the price of HBAR will experience a pullback. At its current value, it is trading above the support formed at $0.12. As the buying pressure subsides, it will test this price level. If it does not hold, the Token price could drop to $0.11 USD.

However, if the uptrend continues, the HBAR Token will reclaim its cycle peak at $0.15 and attempt to surpass it, thereby invalidating the previous bearish forecast. A successful break above this level would put HBAR on track to trade at year-to-date highs of $0.18.