The Hedera (HBAR) price has shown impressive growth, up 21.43% in the past seven days and a notable 172.58% in the last month. This breakout is supported by an uptrend in the EMAs, with the short-term lines above the long-term lines, suggesting sustained growth momentum.

However, caution is needed as both the Ichimoku Cloud and DMI charts show signs of a possible trend reversal. If bearish momentum prevails, HBAR could face a major correction, testing key support levels at $0.117 and potentially falling as low as $0.053.

HBAR’s Uptrend Remains Strong

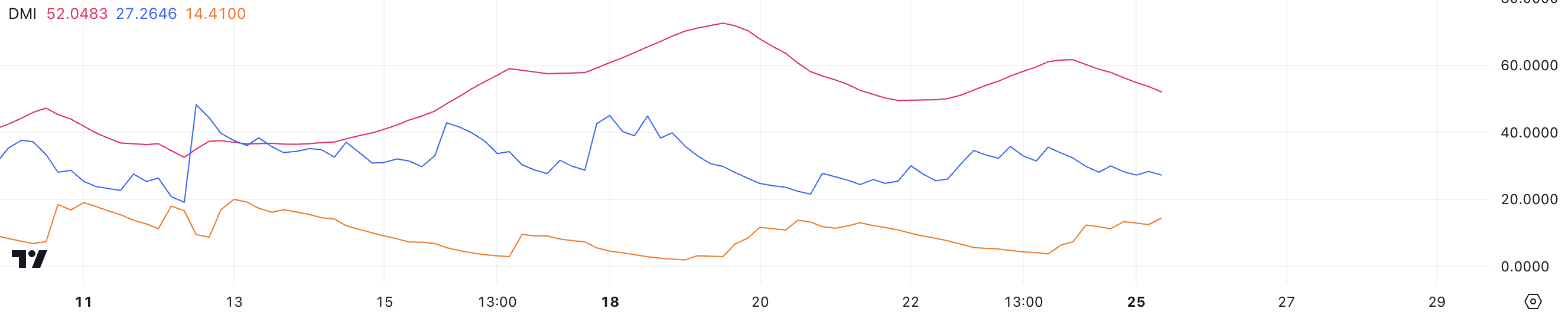

Hedera’s DMI chart highlights an ADX value reaching 52, signaling a strong market trend. ADX, or average directional index, measures the strength of a trend, with values above 25 indicating a significant trend and values above 40 indicating an extremely strong trend.

ADX at 52 suggests that the current trend, whether bullish or bearish, is well established and is unlikely to weaken in the near future. Importantly, this value has remained above 40 since November 14, indicating sustained market momentum.

Currently, HBAR’s D+ is at 27.2, D- is at 14.4, reflecting the current upward trend. However, the decrease in D+ along with the strong increase in D- shows the possibility of the uptrend weakening. This divergence suggests increased selling pressure, which could challenge bulls’ dominance if it continues.

While the trend remains strong for now, the interaction between D+ and D- highlights a critical period for Hedera, where market sentiment could change if bearish momentum continues to increase.

Ichimoku Cloud Chart Shows Caution Is Necessary

Based on the Ichimoku Cloud chart for HBAR, the price is trading near Kijun-Sen (orange line) and Tenkan-Sen (blue line), indicating a consolidation phase. The flat nature of the Kijun-Sen suggests a lack of strong directional momentum, while the cloud (Senkou Span A and B) below the price acts as an area of support.

The green cloud in the chart shows positive sentiment in the medium term, but the price’s difficulty holding above the Kijun-Sen represents uncertainty.

If HBAR price maintains support above the cloud, it could stage a bullish reversal. The next resistance will be around the Tenkan-Sen line and the recent high.

However, a decline through the cloud could signal bearish momentum, targeting lower levels. The cloud thinning towards the end of the chart also suggests a weakening of support, making this a decisive period for the direction of the HBAR trend.

HBAR Price Forecast: 62% Correction After Recent Strong Increase?

HBAR’s EMA shows a bullish price trend, with short-term lines placed above long-term lines, indicating strong bullish momentum.

The token is up 21.43% in the past seven days. If the uptrend sustains, it could challenge the resistance levels at $0.157 and $0.1711. This positive sentiment reflects sustained buying pressure, keeping prices on an upward trajectory.

However, indicators such as Ichimoku Cloud and DMI suggest a possible trend reversal. If the trend turns bearish, HBAR price could test support at $0.117, a key level to maintain momentum.

If this support fails to hold, the price could fall to $0.053, marking a significant 62% correction.