[ad_1]

Helium (HNT) price has increased more than 8% in the past 24 hours, attracting attention as it tries to regain its recent momentum. Despite short-term gains, technical indicators show mixed signals about its future trend.

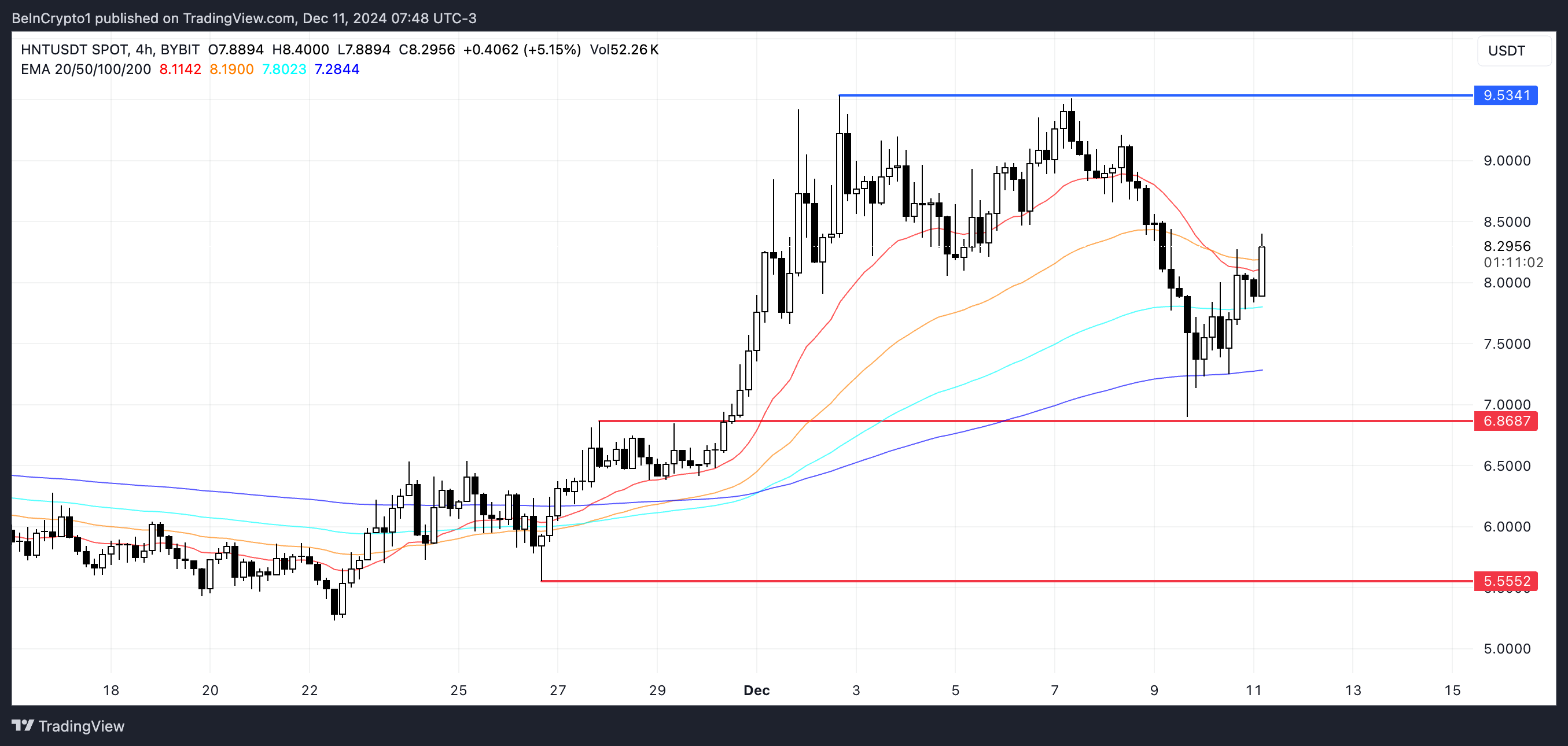

The ADX index points to weakening trend strength, while the RSI is in the neutral zone. With the EMAs showing the potential for a positive crossover, HNT is facing a decisive moment that could determine whether it breaks out towards the $9.53 mark or tests key support levels near $6.86.

HNT’s Current Trend Is Losing Momentum

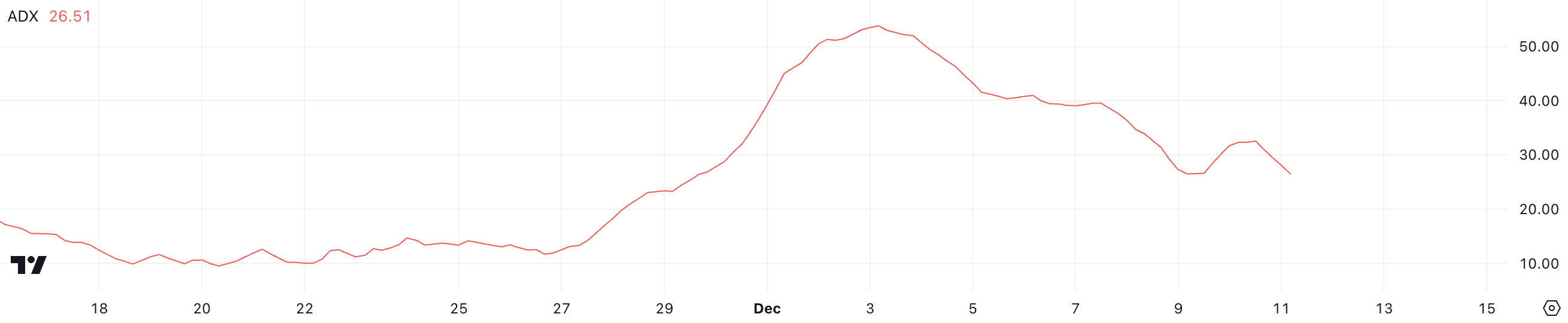

The Helium Directional Average (ADX) is currently at 26.5, down significantly from levels above 50 just a week ago. At that time, its price reached above $9, marking the first time it had reached those heights since March 2024.

The ADX decline reflects a loss in strength of the recent uptrend, which could signal a pause or slowdown in momentum.

ADX measures the strength of a trend but not its direction. Values above 25 indicate a strong trend, while readings below 20 indicate a weak or no trend.

At 26.5, HNT’s ADX hovers just above the strong trend threshold, suggesting that although the trend remains in place, it is weakening. If HNT price wants to restore its uptrend, ADX must rise higher, signaling new development momentum and stronger purchasing power.

Helium’s RSI Is Currently Neutral

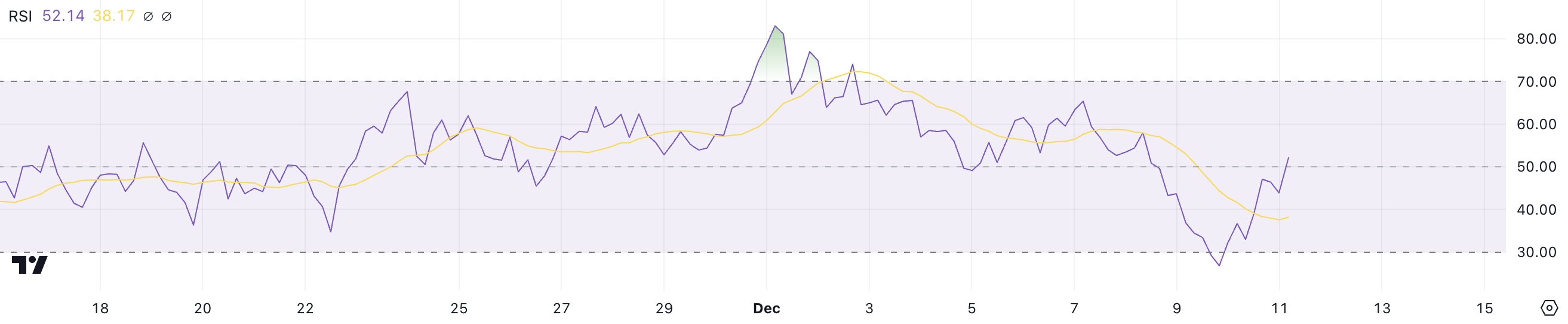

HNT’s Relative Strength Index (RSI) currently stands at 52, down from over 70 in early December when prices surged. This decrease shows that buying momentum has decreased compared to previous overbought conditions.

While the RSI remains in neutral territory, it reflects a cooling in market enthusiasm following the recent rally. It is also worth noting that HNT’s RSI reached 28 on December 10, suggesting that buying pressure may be returning.

RSI measures the speed and magnitude of price changes, ranging from 0 to 100. Values above 70 indicate overbought conditions, often signaling a potential reversal or correction. Readings below 30 indicate oversold conditions where prices could recover.

With RSI at 52, HNT price is neither overbought nor oversold, showing it is consolidating. To continue the uptrend, RSI needs to increase, reflecting new buying power. Conversely, a drop below 50 could suggest further weakening momentum.

HNT Price Prediction: Will It Reach $9 Again?

Helium’s Moving Averages (EMA) are showing mixed signals. Recently, the shortest EMA crossed below the other line, signaling bearish momentum.

However, the shortest EMA has started to increase again. If it breaks above the upper line, this could point to renewed bullish momentum and potentially trigger a rally as the DePin (Decentralized Physical Infrastructure) story tries to continue to gain momentum. suck.

If a bullish crossover occurs, Helium price could retest the resistance around $9.53. However, the weakening trend highlighted by ADX suggests caution. If a downtrend develops instead, HNT price could test support at $6.86.

If that mark fails to hold, the price could fall further to $5.55, representing a potential 33% drop.

General Bitcoin News

[ad_2]