Not only have person traders suffered hefty losses due to the Earth and UST crashes, but the assets of the richest people today in the cryptocurrency sector also evaporated pretty immediately.

The collapsed “piece of Domino” named Terra-UST

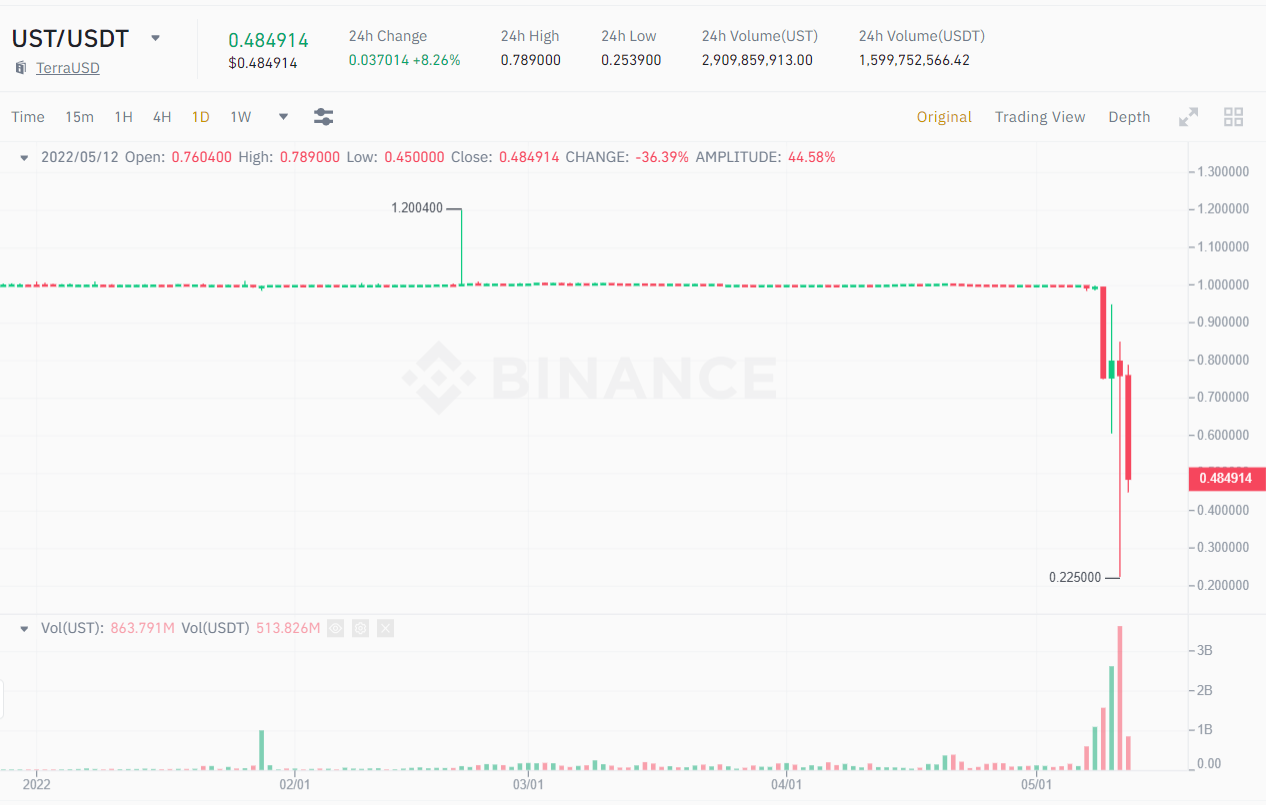

Such as Coinlive constantly up to date, regardless of some efforts as a result of CEO Do Kwon’s proposal declaring “sacrifice LUNA to save UST” and get rid of UST one.three billion from circulation in the previous 24 hrs, but LUNA and UST charges are steadily falling. While LUNA continues to fall under $ .04, UST has not however regained the peg and is trading at $ .48.

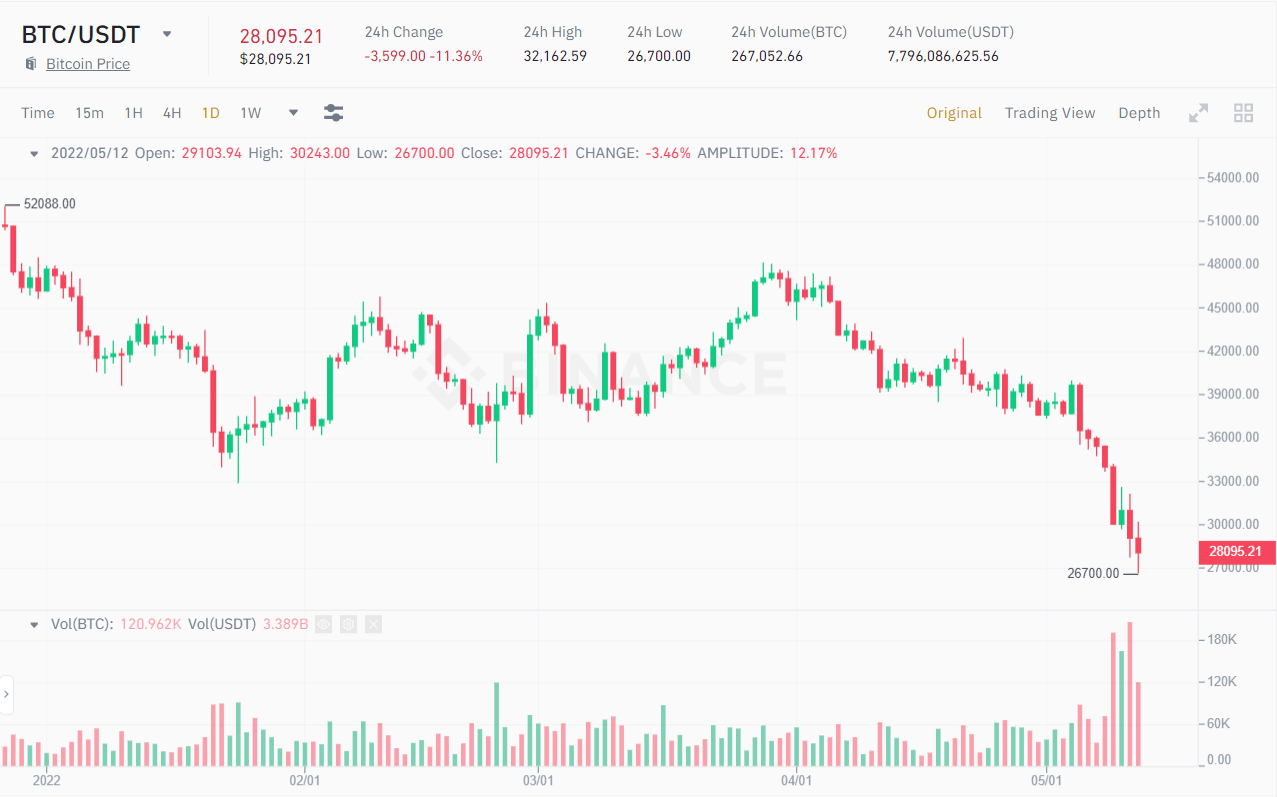

Worse nevertheless, when it was the collapse of the UST domino that induced lots of traders to panic, and started to set off horrible offering stress on the total marketplace, pushing down the price tag of Bitcoin, it dropped under the 27,000 mark. bucks, regardless of the context of lots of effectively-acknowledged marketplace money speaking to reassure the neighborhood on Earth.

This led to the simultaneous depreciation of a series of stablecoins in the afternoon of May twelve, specifically with the presence of the “king” Tether (USDT) and a series of other algorithmic stablecoins this kind of as Tron’s USDD or Near Protocol’s USN. .

To be in a position to grasp the most up-to-date overview particulars on this situation, study the particulars as a result of the series of content articles under:

Even the biggest fish in the marketplace are “stranded”.

And the complete asset worth of the leading richest billionaires in the cryptocurrency marketplace in 2022 is also “evaporating” at breakneck pace, reaching tens of billions of bucks.

The most severe is the situation of the marketplace-foremost billionaire, Binance CEO Changpeng Zhao. According to Forbes statistics, he misplaced about $ 37.six billion. It is understandable that he has repeatedly stated that he only holds Bitcoin (BTC) and Binance Coin (BNB). Also, for the duration of the LUNA crisis, lots of traders created big revenue as a result of LUNA quick orders, this is also the explanation why the Binance boss’s dollars was so “flying away” that Binance had to cancel the listing of trading pairs. LUNA futures.

Next up is FTX exchange founder and CEO Sam Bankman-Fried. Although he suffered a reduction of up to $ three billion, the CEO of FTX showed no shaky frame of mind. He also mentioned that although Terra’s situation is genuinely severe, it truly is not major ample to drag the total stablecoin array into a economic downturn.

Just as predicted by external see skeptics, a stablecoin exploded for the duration of a important marketplace move. Not just the stablecoin they had anticipated.

Which was to be anticipated, if I knew the particulars.

This is not a comment on great versus evil, but on how significant it is to know the particulars!

– SBF (@SBF_FTX) May 10, 2022

$ four.four billion is the consequence for Coinbase CEO Brian Armstrong. In addition to becoming impacted by the common marketplace problem, he has had to deal with the rather poor financial problem of the firm a short while ago. The Coinbase exchange misplaced $ 430 million in the to start with quarter of 2022, resulting in the COIN share price tag to drop constantly in April, and Brian Armstrong owns 19% of Coinbase shares.

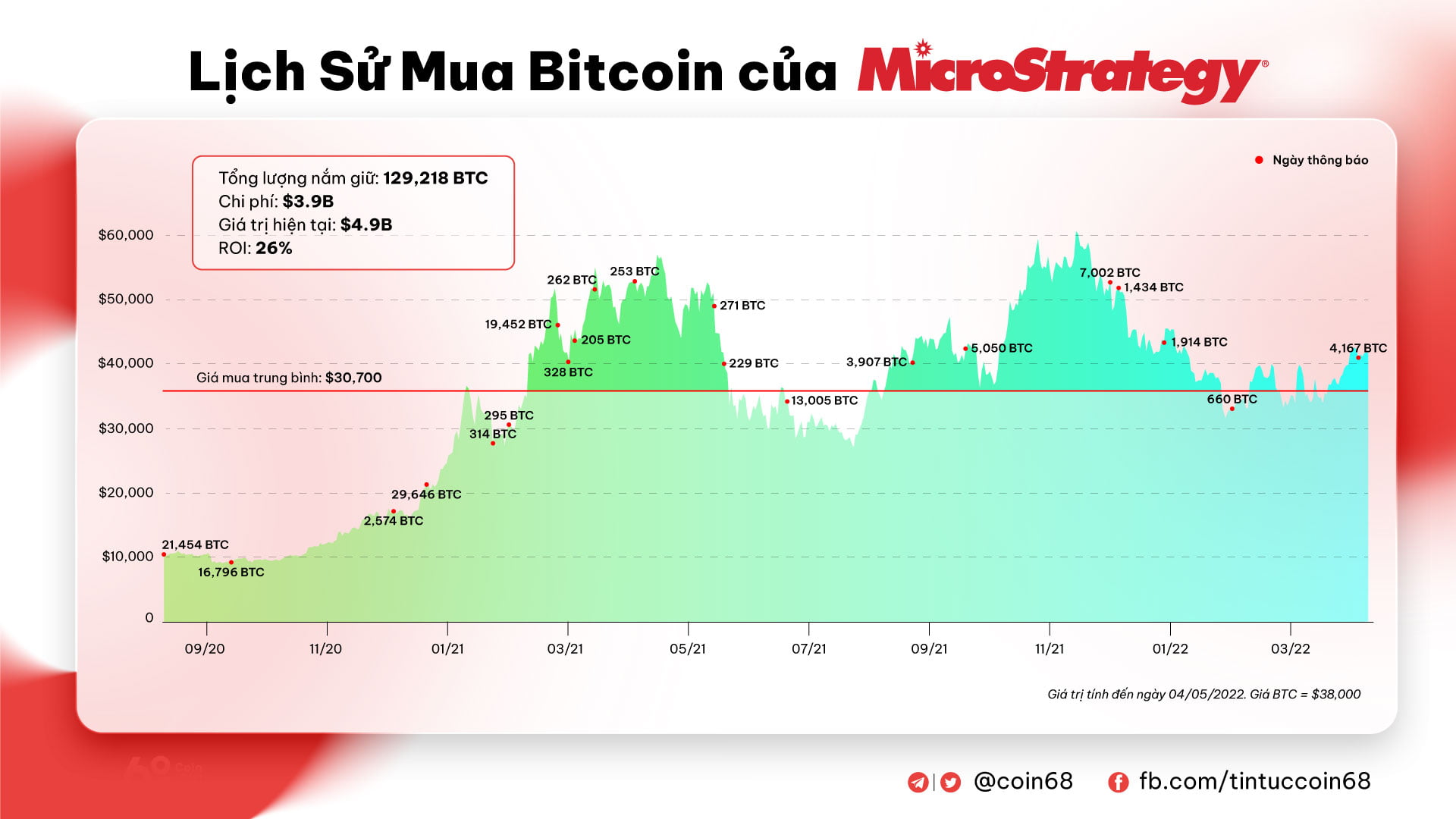

On the common side, the authentic whale Bitcoin MicroStrategy misplaced $ 694 million. Part of that comes from a shedding BTC investment. MicroStrategy at this time holds 129,218 Bitcoins with a complete obtain expense of $ three.97 billion and an regular obtain price tag of $ thirty,700 per BTC.

The rest is the damaging effectiveness of the company’s stock on the stock marketplace, which fell from practically $ 400 to $ 167 in just one week of May, not in contrast to the fluctuation in cryptocurrencies.

Even so, MicroStrategy nevertheless confidently stated that it will not promote any Bitcoin regardless of the threat of liquidating a $ 205 million BTC home loan loan from Silvergate Bank in March 2022 to purchase much more Bitcoin. Instead, Microstrategy will use other collateral to pledge if the worst situation situation is that Bitcoin’s worth falls under $ three,562 resulting in Microstrategy to run out of BTC to repay the loan.

MicroStrategy has a phrase loan of $ 205 million and need to hold $ 410 million as collateral. $ STR it has 115,109 BTC that it can pledge. If the price tag of #BTC drops under $ three,562, the firm could send other ensures. See slides eleven-twelve in the Q1 2022 Presentation. #HODLhttps://t.co/9WHsIB6Usx

– Michael Saylor⚡️ (@saylor) May 10, 2022

The rest of the over checklist are all prominent leaders from numerous exchanges and platforms, together with Gemini exchange CEO pair Cameron Winklevoss and Tyler Winklevoss ($ -300 million), Ripple founder Chris Larsen (-700 million bucks), venture capitalist Tim Draper (-270 million USD), and so on. Most of them very own a big quantity of cryptocurrencies, so their assets disappear immediately. That’s not even surprising.

Synthetic currency 68

Maybe you are interested: