Dogecoin (DOGE) price has been on a volatile journey, up 180% in the past month but down 7.03% in the last seven days. As the undisputed leader of Meme Coins, DOGE possesses a whopping market capitalization of $58 billion, four times that of its closest competitor, SHIB, at $14.5 billion.

Although recent price movements have highlighted DOGE’s dominance, indicators such as the Ichimoku Cloud and DMI suggest that the bullish momentum may be losing strength. Whether DOGE can maintain this bullish momentum or will face a deeper correction will depend on how the current trend develops in the coming days.

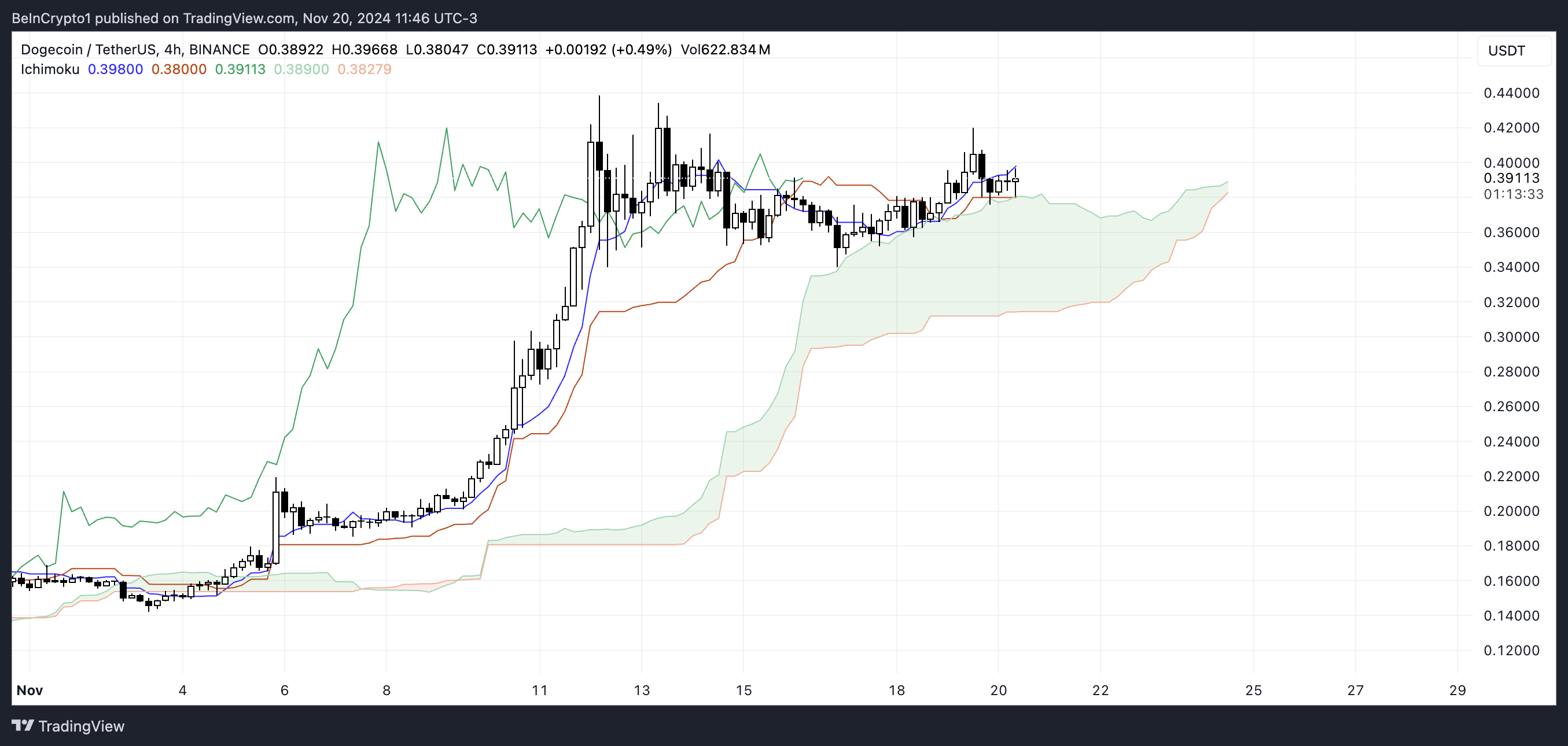

DOGE: Ichimoku Cloud shows Bullish Zone

Currently, DOGE is trading on the Ichimoku Cloud, which is considered a bullish signal. The price is also supported by Tenkan-sen (blue line) and Kijun-sen (red line), both of which are trending up, showing strong momentum in the short to medium term.

However, the narrowing gap between these two lines suggests some potential for a decline in price momentum, implying caution for further upside.

The cloud (Kumo) ahead is green, signaling that the trend of DOGE remains positive in the near future. However, with prices converging near the top of the cloud, there is a potential downside risk if DOGE fails to break out past recent highs.

A drop below Kijun-sen or into the cloud could indicate a weakening of the trend and a shift towards bearish sentiment. For now, DOGE investors can closely monitor the move on Tenkan-sen to maintain the uptrend.

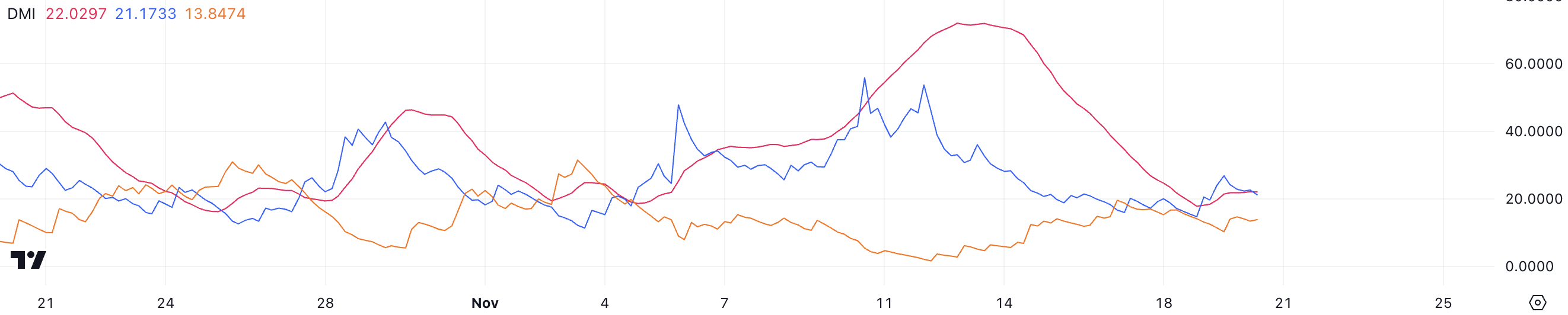

Dogecoin’s Current Uptrend Is Not Too Strong

Dogecoin’s Directional Movement Index (DMI) chart shows ADX at 22, down sharply from over 60 just a week ago. Although DOGE is still in a bullish phase, the decline in ADX shows that the strength of the trend is weakening, implying the possibility of a decrease in bullish momentum.

This decline is consistent with other signals pointing to a more cautious outlook for DOGE’s price in the short term.

ADX measures trend strength, with values above 25 signaling a strong trend and below 20 indicating a weak or non-existent trend. DOGE’s D+ is at 21.17, representing bullish pressure, while D- is at 13.84, reflecting bearish pressure.

However, D+ is decreasing while D- is increasing, showing that the bullish momentum is fading and bearish sentiment is gradually taking over. With ADX at 22, DOGE’s current trend is losing momentum, signaling a stronger catalyst is needed to maintain the upward trajectory.

DOGE Price Forecast: Highest Price Since 2021?

DOGE price could see further upside if it tests and breaks above resistance at $0.438. A successful move through this level could pave the way for a rally to $0.50, marking the highest price since 2021. This would push DOGE’s market capitalization past $60 billion, larger than other companies like Porsche and Mercedes-Benz. This could spur a new wave in the Coin meme story.

This scenario would signal a renewal in bullish momentum and strong interest from buyers.

However, as pointed out by DMI, DOGE’s current trend may be losing strength, raising fears of a potential reversal. If bearish momentum prevails, DOGE price could test the nearest support at $0.34.

If this level fails, the price could correct significantly, potentially falling to $0.14, which would represent a 64% decline from current levels.