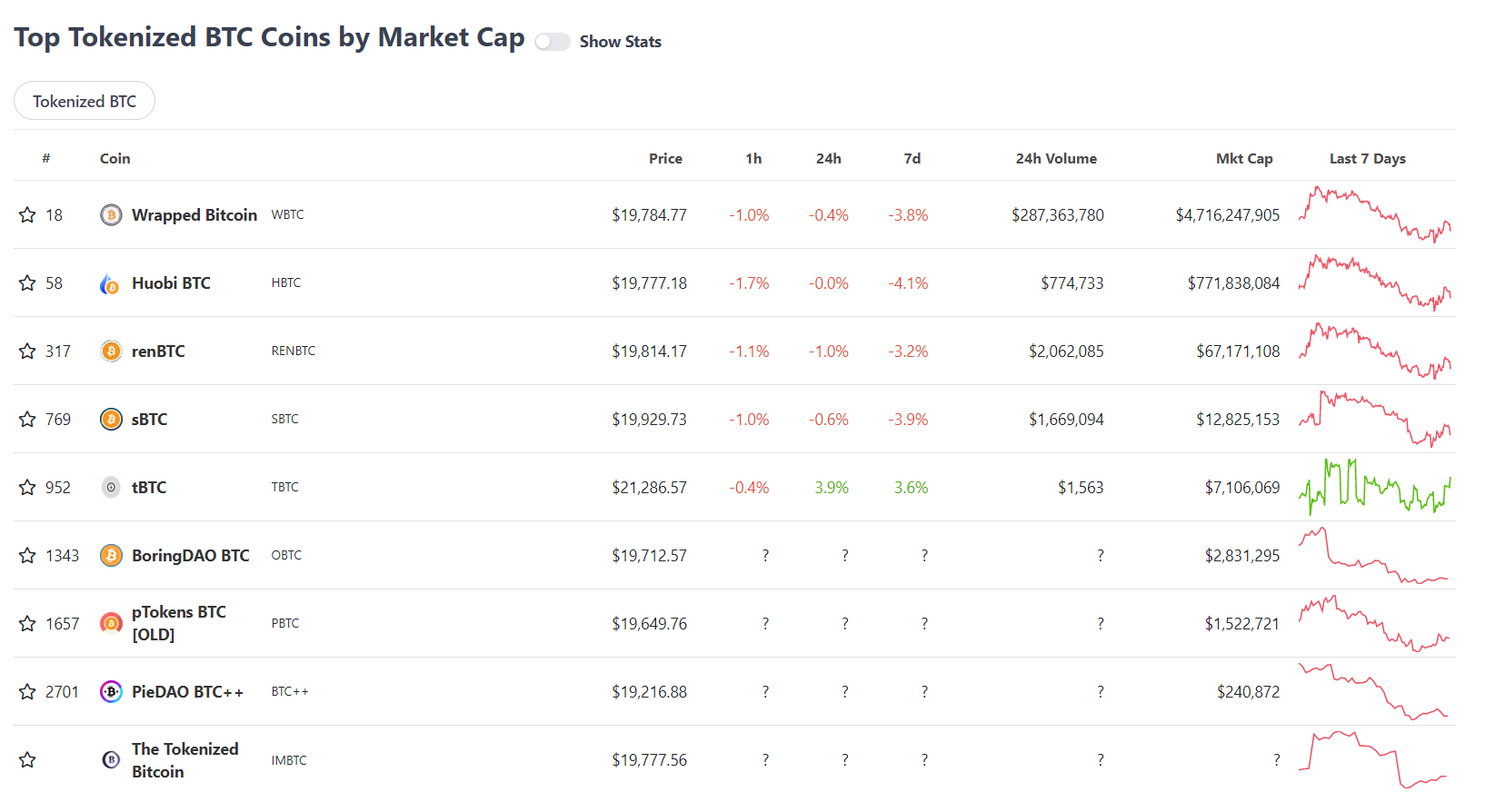

Huobi’s “Tokenized Bitcoin” coin, HBTC, was identified to be non-transparent in its collateral assets. So what took place?

What is Huobi BTC (HBTC)?

As analyzed in post no. five by Kyros Kompass: Bitcoin vs DeFi – What’s the results for each of them ?, the issue with Bitcoin is that there are also couple of use circumstances. BTC owners, if they participate in DeFi, typically have to exchange BTC for ETH, the basic currency of the whole DeFi ecosystem, and then switch to ERC20 coins to use.

The resolution to this issue are tokens which signify one: one for BTC on the Ethereum chain. From there, BTC holders can convert one: one to BTC tokens in the kind of ERC20 to be utilised for DeFi transactions.

The most renowned coin in this section is Wrapped Bitcoin (wBTC). And the truth proved that this approach is pretty useful, when one% of the provide of Bitcoin is locked in the WBTC protocol.

WBTC is normal of the model custodyi.e. the minting and use of WBTC are topic to monitoring by third events to stay away from fraud. Of program, quite a few other events also want to share the pie in this section, so there have been quite a few forms of “wrapped” BTCs that are overseen by other third events.

One of them is Huobi BTC (HBTC), a one: one pegged token with BTC issued and utilised on the Huobi exchange.

Question mark on transparency

Huobi designed HBTC in February 2020, as a one: one representation of BTC on the Ethereum blockchain.

At that minute, the representative of the Huobi exchange confirmed that the asset will be obviously displayed on the Bitcoin and Ethereum blockchains:

“HBTC is completely transparent and anyone can verify it.”

At initially, this was unquestionably proper. As of early August 2021, there are about 31,000 HBTC, and two Huobi exchange wallets also hold about 39,7000 BTC.

From August twenty-26, 2021, Huobi started moving BTC in these two portfolios to quite a few other smaller portfolios. And each and every time in this way, the first volume of BTC is split, not “collected” in some wallets. Therefore, BTC’s reserves are starting up to be tough to track.

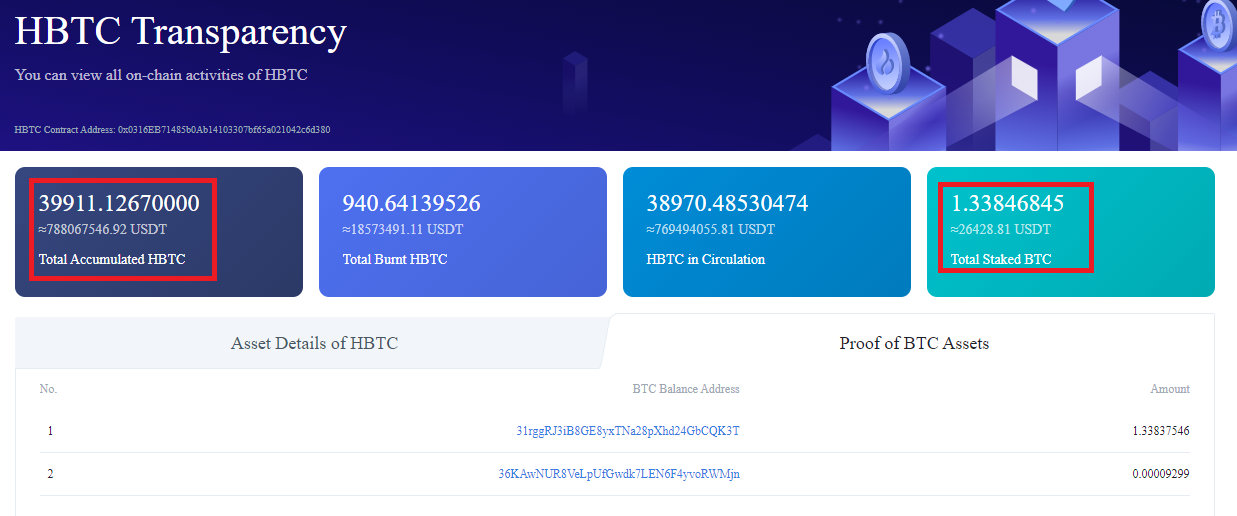

Gift, Web page HBTC’s transparency demonstration displays:

– Total supply of HBTC: nearly forty,000 HBTC, for an nearly worth 800 million bucks (at the time reported by Coinlive)

– BTC asset reserve: one.34 BTC, equivalent $ thirty,000

finish

In actuality, this scenario is only evidence that HBTC are unable to ensure “transparency” as promised.

But at present, there are no indicators of wrongdoing, or “de-bugs” like the circumstances of stablecoins with inadequate ensures.

However, I assume Huobi need to obviously disclose the exchange’s BTC wallets. Since then, HBTC customers and exchange customers are also safer and extra assured.

Giovanna

Maybe you are interested: