While Justin Sun has repeatedly denied purchasing Huobi, the move to exchange the HUSD stablecoin with USDD displays otherwise.

As reported by Coinlive on October eight, cryptocurrency exchange Huobi lately announced that it has modified hands. As a end result, the founder of the exchange, Leon Li, reached an agreement to transfer somewhere around 60% of the shares of Huobi to the About Capital Management investment fund based mostly in Hong Kong. This produced About Capital the vast majority shareholder of Huobi and basically the new proprietor of the exchange.

Nonetheless, the deal brought about fairly a stir when About Capital named Justin Sun – founder of the blockchain platform TRON, proprietor of the Poloniex exchange and a notorious figure in the cryptocurrency field – as an advisor to the corporation. Mr. Sun also immediately up to date facts about Huobi on his social media accounts, foremost to substantially speculation that this particular person is basically the new proprietor of Huobi, conducting the acquisition through About Capital to prevent conflicts of curiosity.

However, the interview The blockJustin Sun denied the facts that he was the particular person who purchased Huobi, but rather he was just an “advisor”.

However, Huobi’s hottest move signifies otherwise. On the evening of October ten, Huobi announced that he would take away all trading pairs containing Huobi USD (HUSD), the stablecoin issued by the exchange itself, leaving only a USDT / HUSD pair. The quantity of HUSD trading pairs canceled by Huobi is up to 21. The explanation offered by the exchange is “to provide a better trading experience”. HUSD was depeged in August 2022 due to an imbalance in the Curve pool, forcing FTX to take away the stablecoin from its currency basket.

Huobi Global announced the delisting of 21 HUSD associated trading pairs, like USDC / HUSD, BTC / HUSD, ETH / HUSD, HT / HUSD, and so on. HUSD is a secure BUSD-like currency issued by Huobi, which it launched not prolonged in the past.https://t.co/9EeyWBhpQK

– Wu Blockchain (@WuBlockchain) October 10, 2022

So, give an interview CoinDesk On the evening of October eleven, Mr. Justin Sun stated that Huobi requirements a “springboard” from stablecoins to compete in the worldwide arena. That’s why the exchange has determined to exchange HUSD with USDD, the algorithmic stablecoin of the TRON network, the blockchain venture initiated by Justin Sun. USDD is declared by Justin Sun as the “most decentralized” stablecoin and is frequently protected by the depeg.

Mr. Sun explained:

“In the next 3 months, we will likely create USDD trading pairs for all coins listed on Huobi.”

“In the next three months, we will probably list all cryptocurrency against USDD on Huobi,” he says @trondao Founder @justinsuntronwho was lately appointed worldwide advisor following About Capital’s acquisition of Huobi.

More on his strategies with $ USDD: https://t.co/lQ7ywaMGck pic.twitter.com/VV2U6At4C3

– CoinDesk (@CoinDesk) 11 October 2022

Additionally, Huobi’s advisor is optimistic that Huobi could return to operations in China, the exchange’s most significant industry prior to the Chinese cryptocurrency ban in September 2021. Mr. Sun commented:

“Crypto is a around the world trend and are unable to be isolated. This is why China will come to be a main player in the blockchain field, even as it faces regulatory hurdles in the quick phrase. But in the prolonged run, I’m really optimistic. “

Mr. Sun also stated that he might get Huobi in the long term but not now, yet another statement suggesting that this controversial figure is the “real” proprietor behind Huobi.

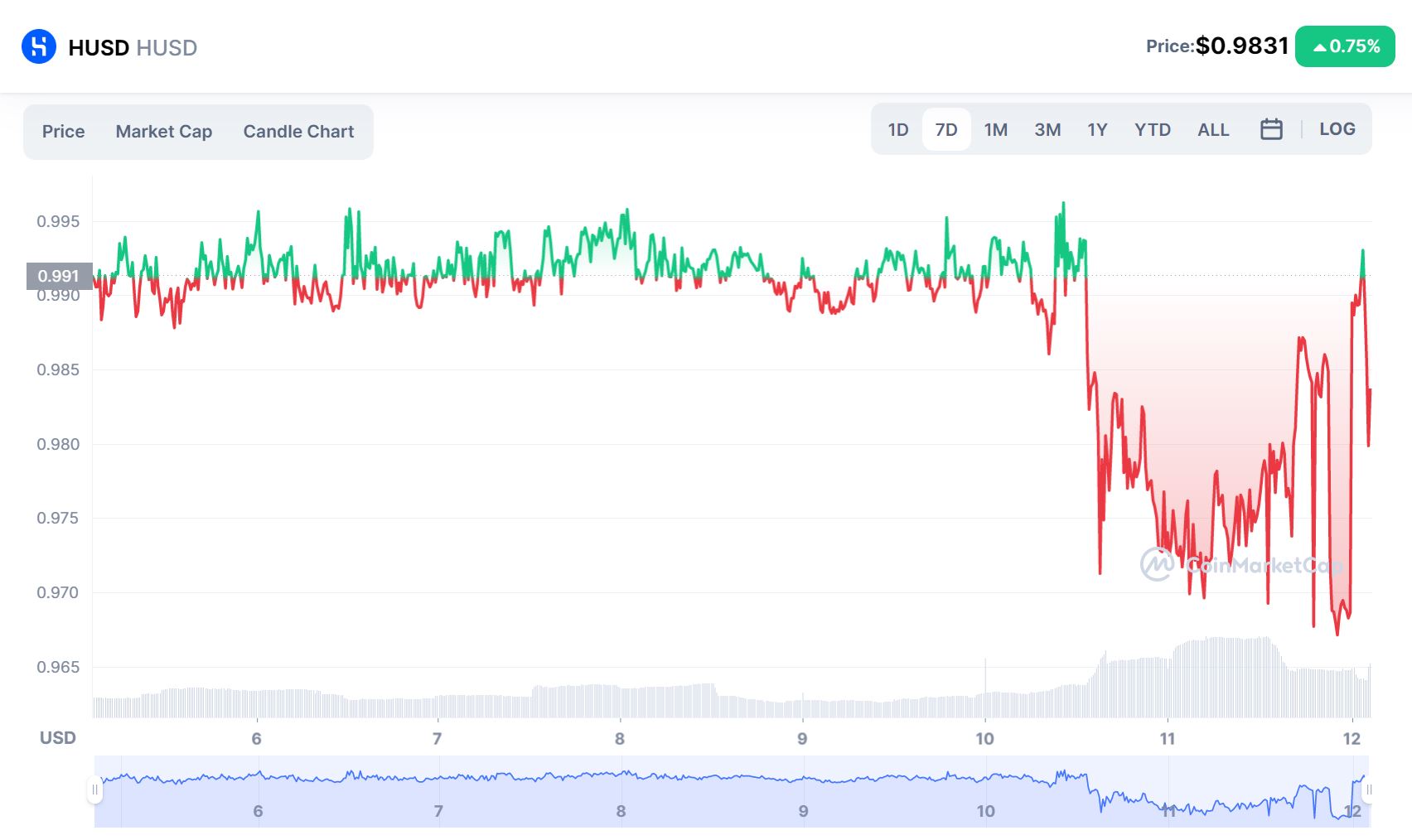

The cost of the HUSD stablecoin at a single level dropped sharply and hit $ one following remaining unlisted by Huobi.

In the opposite course, the cost of Huobi’s HT token has continued to rise impressively above the previous number of days. Coins in the TRON program all enhanced at the similar time Huobi announced the adjust of hands.

Meanwhile, the stablecoin battle in the midst of the bearish trend continues with the emergence of numerous new gamers, regardless of the collapse of the LUNA-UST model in May. New stablecoins that appeared this yr involve USN Close to Protocol, TRON’s USDD, Aave’s GHO and Coin98’s CUSD. Furthermore, Curve is explained to be producing stablecoins as effectively, even though Binance has produced the controversial determination to consolidate the stability of all stablecoins except USDT into BUSD, the stablecoin issued by the exchange, and increase BUSD to much more techniques, the new blockchain ecology. .

Synthetic currency 68

Maybe you are interested: