[ad_1]

Hyperliquid (HYPE) price has skyrocketed 60% following a multi-billion dollar airdrop, distributing 310 million HYPE Tokens to users. This growth came after a brief overbought period, when its RSI crossed the 70 mark.

However, the momentum quickly weakened, and the RSI fell to 44.8, indicating a neutral or slightly negative sentiment. Despite fluctuating net cash flows, reaching a record high of $181 million on November 29, HYPE’s price remains under pressure with recent declines in both net cash flows and price levels.

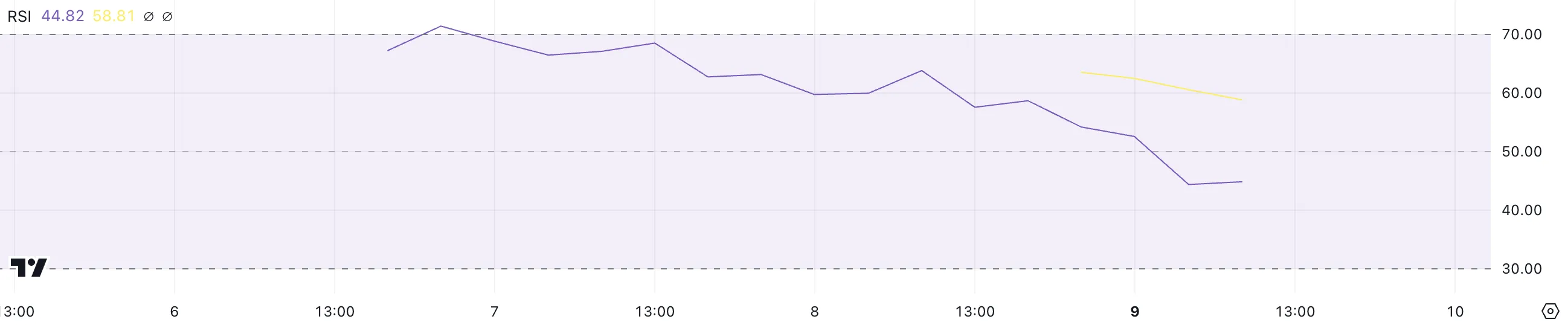

HYPE’s RSI Is Currently Neutral

After the airdrop, HYPE’s RSI quickly crossed the 70 mark, indicating that the asset is overbought.

However, this momentum did not last, and RSI has started to decline. Currently, the index is standing at 44.8, indicating neutral or slightly negative market sentiment.

RSI, or relative strength index, is a momentum oscillator that measures the speed and variability of price movements. It ranges from 0 to 100.

An RSI above 70 is considered overbought, while below 30 indicates oversold conditions. RSI at 44.8 suggests that HYPE is neither overbought nor oversold. In the short term, this could suggest that HYPE’s price may remain stable or come under slight downward pressure if momentum continues to weaken.

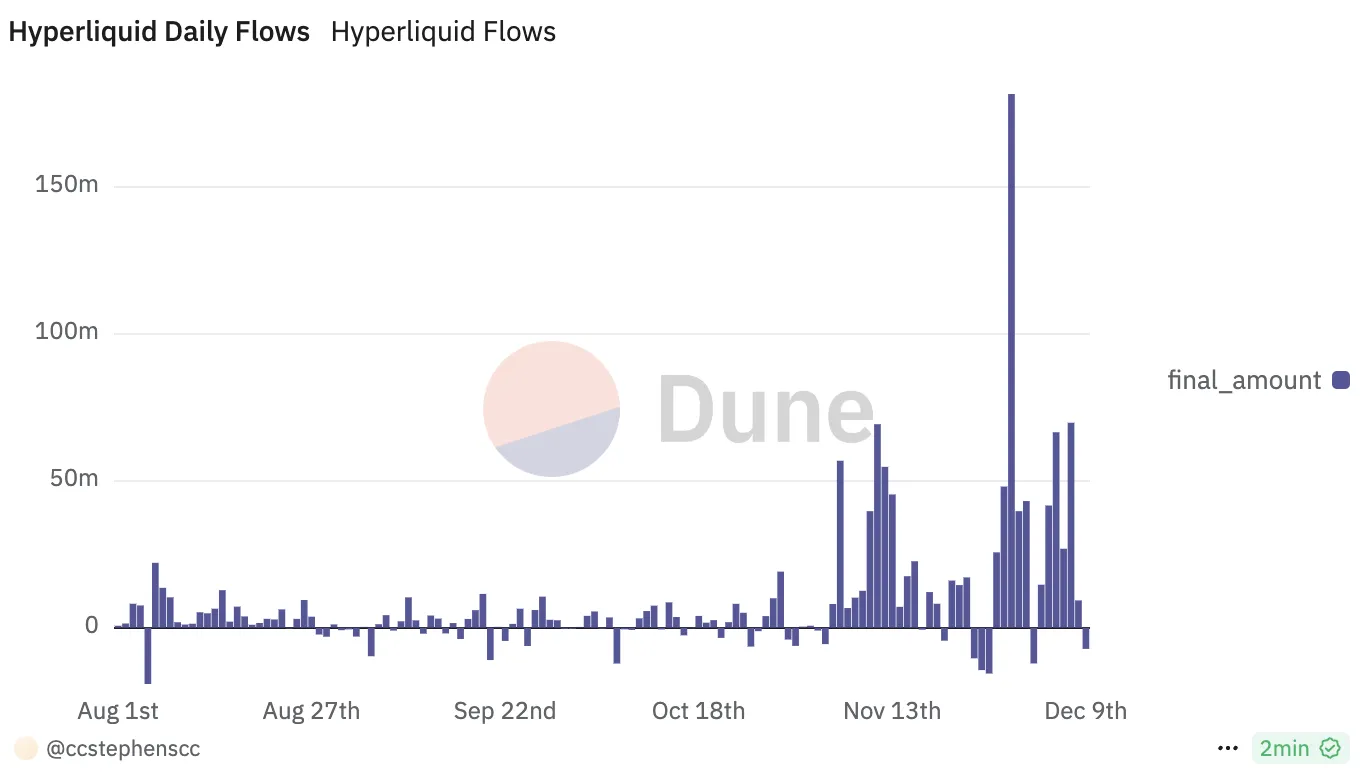

Hyperliquid Flow Peaked on November 29th

Hyperliquid’s net cash flow chart shows a significant increase, reaching a record above $181 million on November 29. It then dropped to $66 million on December 5, then increased slightly to 69 million USD on December 7.

However, on December 8, net cash flow plummeted to $9 million, and is currently around -$7 million.

Net cash flow is the difference between the total cash inflows and outflows of an asset or investment over a given period of time. A positive net cash flow indicates that more money is flowing in than out, while a negative net cash flow indicates the opposite.

While there are still more inflows than outflows overall, a sharp decline in negative net cash flows could indicate a loss of investor confidence or a change in market sentiment. . This could signal potential price instability or short-term downward pressure, as outflows exceed inflows, signaling a possible reversal in market sentiment.

HYPE Price Forecast: Can HYPE Drop Below 10 USD In December?

Following the airdrop, the HYPE price increased sharply, reaching a high of $14.99 on December 7. This growth was accompanied by an accumulation phase, when the price stabilized before starting to gradually decline.

The market appears to be in a state of uncertainty, with a slight downtrend gaining the upper hand.

If HYPE can restore its previous bullish momentum, it could continue to rise and challenge resistance levels near $15. This could pave the way for a rally higher, with the next target at $16, as perpetual DEX platforms continue to attract attention.

Conversely, if the current downtrend continues to strengthen, HYPE price could test the first major support level at $11.29. If this support weakens, the price could continue to decline, possibly down to $10.44, indicating a deeper downtrend.

General Bitcoin News

[ad_2]