- IMF lowers 2025 global economic growth forecast.

- Crypto markets react with a downturn.

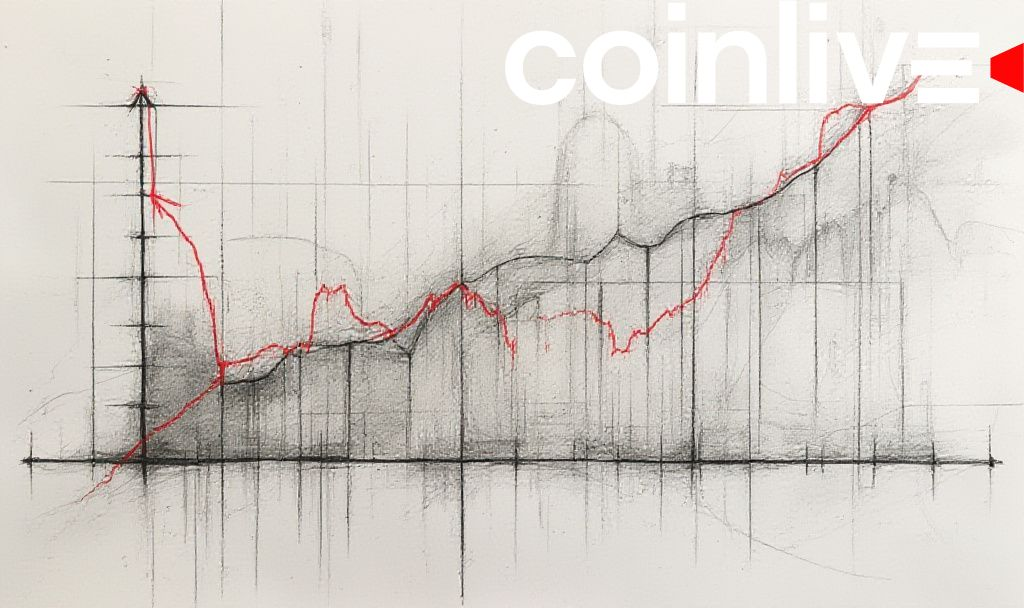

- Increased market volatility amid economic uncertainty.

The report’s downgrades are crucial for economic policy, influencing global financial markets, including a noticeable reaction in cryptocurrency valuations.

Global Economic Outlook Impact

The IMF released its latest World Economic Outlook on April 22, 2025, with a key focus on lowering the global economic growth forecast for the year. IMF leaders, including Chief Economist Pierre-Olivier Gourinchas, emphasized heightened risks due to trade tensions. Gourinchas stated the probability of a U.S. recession is now at 40%, up from the previous forecast.

Crypto markets reacted swiftly, with Bitcoin dropping from $60,400 to $58,300 and Ethereum decreasing from $3,110 to $2,980. Total Value Locked (TVL) in major DeFi protocols fell by approximately 2%, reflecting a risk-off sentiment in response to economic uncertainties.

These changes highlight the increased susceptibility of digital assets to macroeconomic forecasts. Historical data suggests that similar IMF reports have led to crypto market volatility, typically resulting in short-term downturns before potential stabilization.

Developers and industry experts are discussing strategies to manage risks, focusing on stablecoin products and decentralized finance adaptations to counter economic shifts.

Insights suggest that the current economic environment may lead to deeper correlations between crypto and broader financial markets. Economic trends emphasize the evolving relationship between digital assets and institutional actions, underlying the significance of global policy shifts. Pierre-Olivier Gourinchas stated, “Recession risks have risen sharply, with the probability of a U.S. recession now at 40%, up from 25% in October 2024.” IMF Press Briefing