Injective joins the ranks of blockchains that have lately announced Ethereum-compatible layer-two options with inEVM.

Injective is a layer two implementation that supports Ethereum applications

Injective is a layer two implementation that supports Ethereum applications

Injective Protocol, a layer one blockchain created on the Cosmos platform, announced on the evening of September 19 that it had implemented a testnet for its layer two inEVM option, enabling Ethereum applications to run seamlessly right here.

inEVM was jointly formulated by Injective with Caldera, the developer of the customized rollup option.

one/ Injective nowadays presents the launch of inEVM, the initially Ethereum virtual machine capable of reaching genuine composability via @cosmos AND @solana.https://t.co/WJcrW6REiT

— Iniettiva 🥷 (@Iniettiva_) September 19, 2023

With help for Ethereum Virtual Machine (EVM), inEVM makes it possible for dapp developers on Ethereum to conveniently connect and deploy their applications on this layer two, therefore opening up new possibilities for Injective.

Unlike other layer-one EVM options like Close to Protocol’s Aurora or Solana’s Neon, inEVM is a rollup right linked to Injective, which assists it leverage the protection of the mother or father blockchain.

The launch of inEVM is portion of Injective’s method to produce an “Electro Chain” network, expanding the layer-two ecosystem and the skill to connect to other blockchains.

The injective representative shared:

“Electro Chain is a network of multiple rollups with private virtual machine environments, meeting the development needs of many different teams, while still providing scalability and security.”

After today’s testnet occasion, inEVM aims to launch mainnet in Q4 2023.

The cost of the INJ token did not fluctuate substantially right after the announcement of Injective’s implementation of its inEVM layer-two option.

1h chart of the INJ/USDT pair on Binance at 21:00 on September 19, 2023

1h chart of the INJ/USDT pair on Binance at 21:00 on September 19, 2023

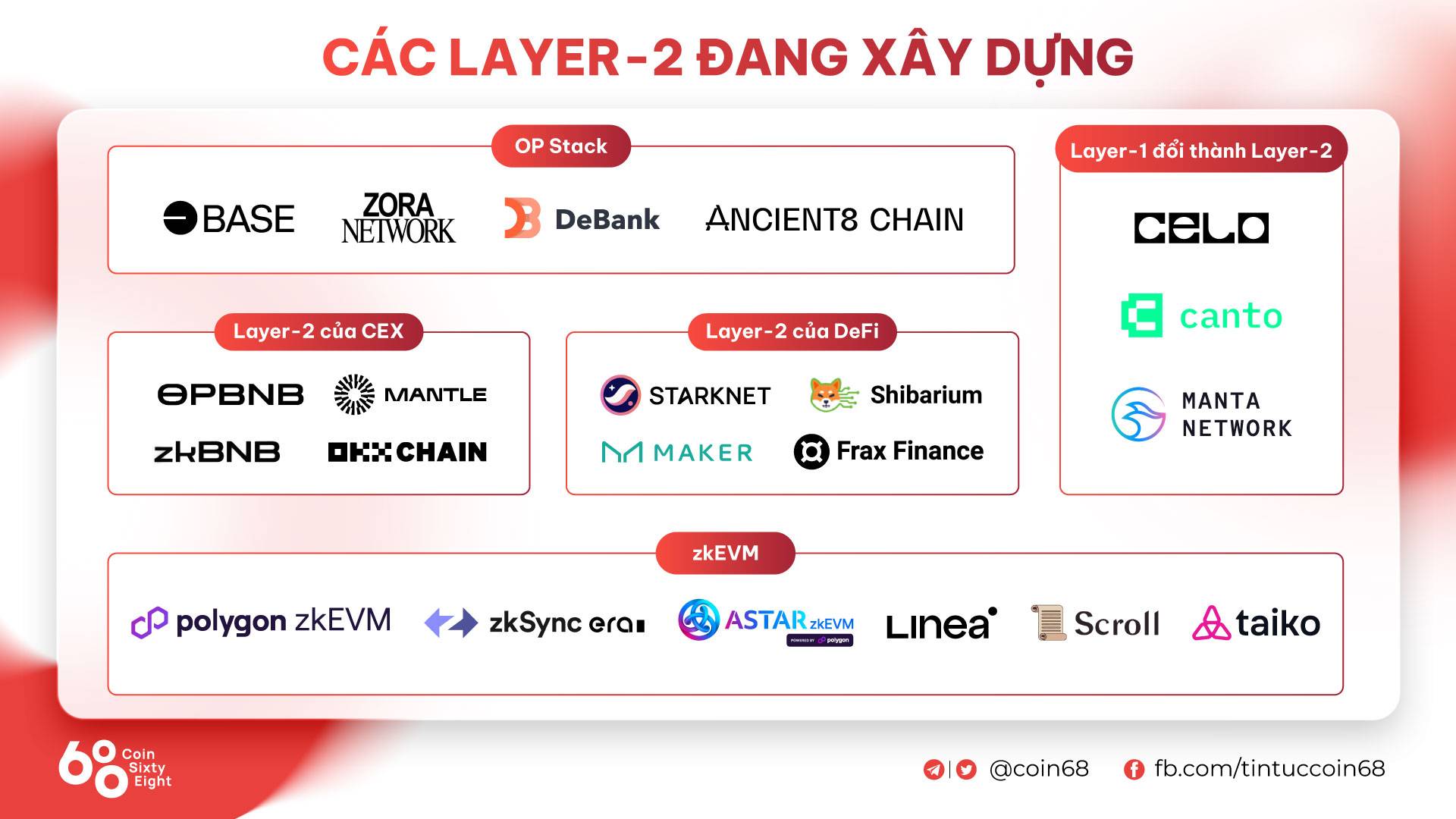

The trend of layer two development continues to spread across the cryptocurrency market. In September alone, the marketplace witnessed the emergence of 2nd-layer scaling options which include opBNB, Manta Pacific, Astar zkEVM, Ancient8 Chain, and Canto.

Coinlive compiled

Join the discussion on the hottest challenges in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!