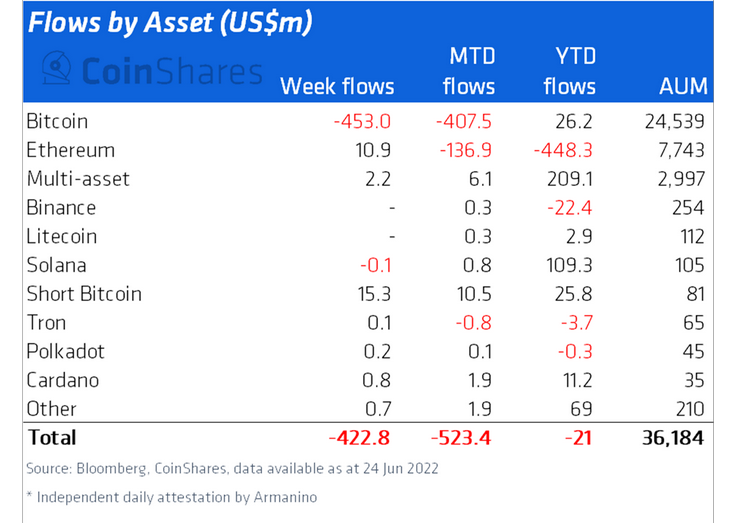

Up to $ 423 million in movement of institutional capital “out” from digital investment merchandise. Of these, most are Canadian investment units.

According to the weekly report of CoinSharesThere was in excess of $ 487.five in outflow of Canadian institutional capital from cryptocurrency investment merchandise from June twenty to June 24.

However, there have been $ 70 million in capital inflows to offset from other nations, of which the United States accounted for far more than half when it contributed $ 41 million. Germany and Switzerland join at $ eleven million and $ ten.four million just about every respectively. Brazil and Australia also contributed modestly with $ one.six million and $ one.four million.

Thus, a complete of $ 422.eight million of institutional capital has flowed out of the cryptocurrency marketplace, marking a record retracement given that the begin of the cryptocurrency marketplace. CoinShares begin publishing weekly reviews. Notably, which is far more than double the earlier record of $ 198 million announced earlier this 12 months.

On the other hand, there was $ 453 million in output from Bitcoin (BTC) merchandise, whilst Solana (SOL) only misplaced all-around $ one hundred,000. Ethereum (ETH) investment merchandise also created $ ten.9 million in inflows. However, Ether merchandise given that the starting of the 12 months have misplaced an inflow of $ 448.three million, building it the least favored investment channel for institutional traders this 12 months.

These not so constructive numbers are thought of quick to “understand” in the recent marketplace predicament, the sentiment of the crowd is commencing to get discouraged and investor self-confidence in the marketplace has also decreased somewhat.

However, investment merchandise that provide the capability to brief the BTC cost created the biggest inflow of the week at $ 15.three million. This contrarian signal It is mentioned to come primarily from the information that ProShares launched the initially “short” ETF on Bitcoin in the US on June 22.

Meanwhile, The biggest Bitcoin ETF in the globe has “evaporated” far more than 24,000 BTC in a single day. This is the most severe decline in background given that Purpose initially debuted on the Canadian stock exchange in April 2021. This indicates that the outflow of income from the fund equates to a forced sale of $ 500 million in BTC, which adds up to to the promoting strain on a marketplace that has previously fallen into economic downturn.

As Cointelegraph reported, 38% of significant money withdrew from the marketplace in May alone. Venture capital in cryptocurrencies virtually doubled from final 12 months, but not too long ago the figure dropped 38.two%.

Synthetic currency 68

Maybe you are interested: