Institutional cryptocurrency investments are returning amazingly positively, to a 3-month higher, signaling indicators that a correction and industry skepticism has come to an finish.

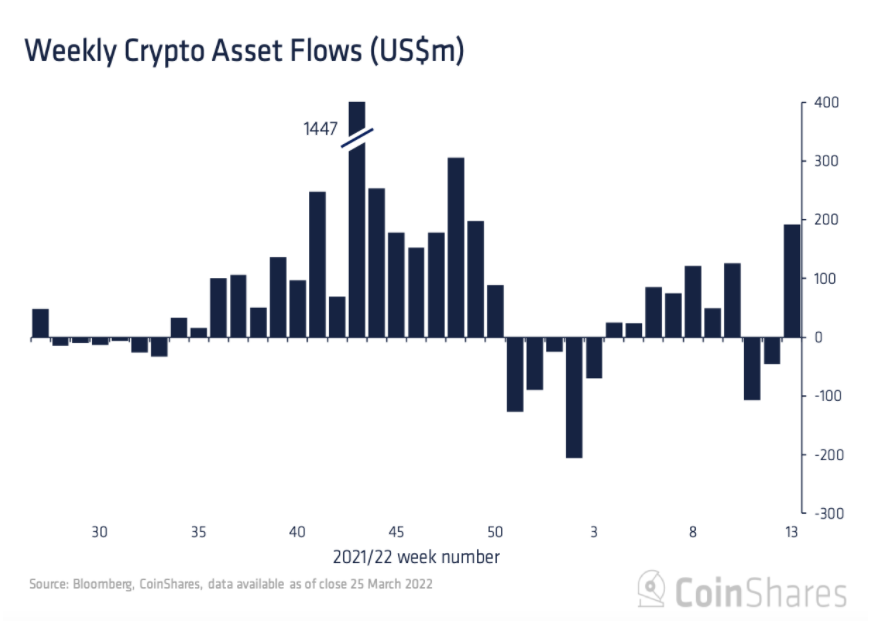

According to CoinShares’ weekly report, most cryptocurrency investment items noticed a complete inflow of $ 193 million final week, a milestone not observed because early December 2021, coinciding with the truth that Bitcoin has established development in extra of $ 47,650. The final time the degree of investments approached the existing figure was on December three, with a capital of 184 million bucks.

The impetus for this breakthrough comes from the occasion the place Luna Foundation Guard purchased far more than 15,000 BTC in five days, holding far more than $ one.one billion in BTC, plus lots of proof that Russia will accept it. and promote power.

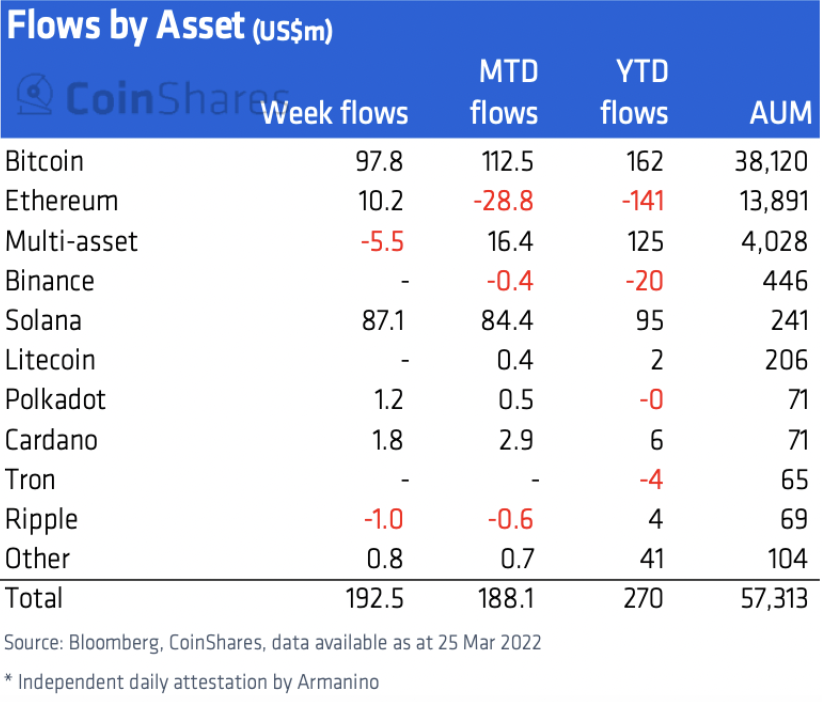

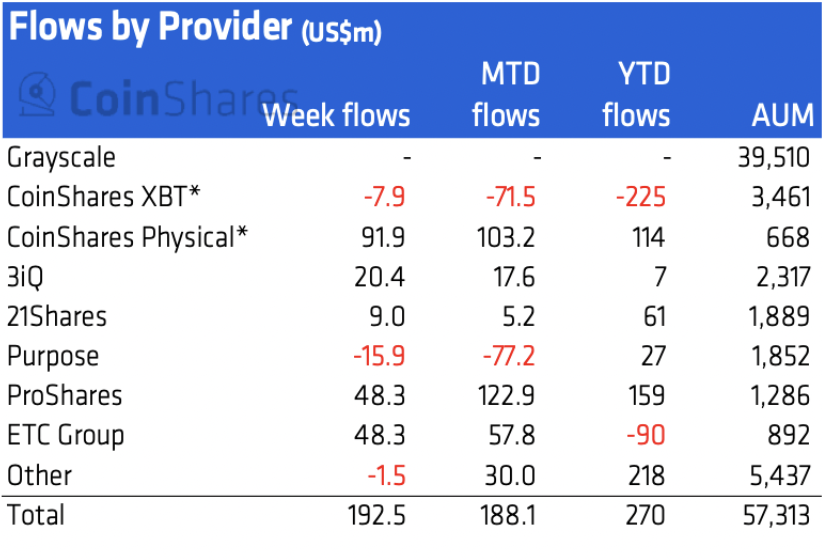

Capital flows are nevertheless largely concentrated in Bitcoin (BTC), with more than 50% flowing into BTC-primarily based items, with a complete investment of $ 98 million. A shock came when Solana (SOL) grew to become the 2nd biggest coin with $ 87 million. SOL-primarily based money at this time account for 36% of assets managed by institutional organizations, building them the biggest altcoin soon after Ethereum (ETH).

Europe contributes substantially, apparently supported by the information that the Proof-of-Work (PoW) bill has not been accredited. As a end result, 76% of investment flows, or all around $ 147 million, came from the EU final week.

On the other hand, the figures present that $ 49.four million has been withdrawn in BTC and ETH by most North American organizations with issues about far more regulation, regardless of the president’s executive buy. Biden was announced in February as professional-cryptocurrency. Additionally, US Treasury Secretary Janet Yellen has also been outspoken about the positive aspects of cryptocurrencies.

However, institutional investor action is a single of the vital signals to decide Bitcoin’s up coming course and form the general industry to come, as demonstrated in quite a few phases of the previous. For illustration, in October 2021 alone, institutional gamers paid up to $ two billion to purchase Bitcoin, pushing their BTC investment to a record $ 9 billion and BTC’s end result right away exploded, reaching ATH a $ 69,000.

However, till the finish of December, with a relatively stagnant industry predicament, regardless of the truth that the quantity of BTC withdrawn from the exchange has enhanced substantially regardless of 90% of the BTC provide getting extracted, the movement of institutional capital has strongly withdrawn, major Bitcoin to no longer have any solid determination to sustain the uptrend, even even though at a single stage BTC dropped to the $ 33,000 bottom.

Summary of Coinlive

Maybe you are interested: