Bitcoin (BTC) led the bull market place by breaking via the $ 50,000 resistance and restoring a market place cap of $ one trillion. According to JPMorgan, the Bitcoin breakout is getting led by big institutional traders.

JPMorgan mentioned that Bitcoin’s latest rate hike has been largely driven by the influx of money from institutional traders. JPMorgan analysts say the resurgence of inflation worries has renewed curiosity in applying Bitcoin as a hedge towards the dilemma.

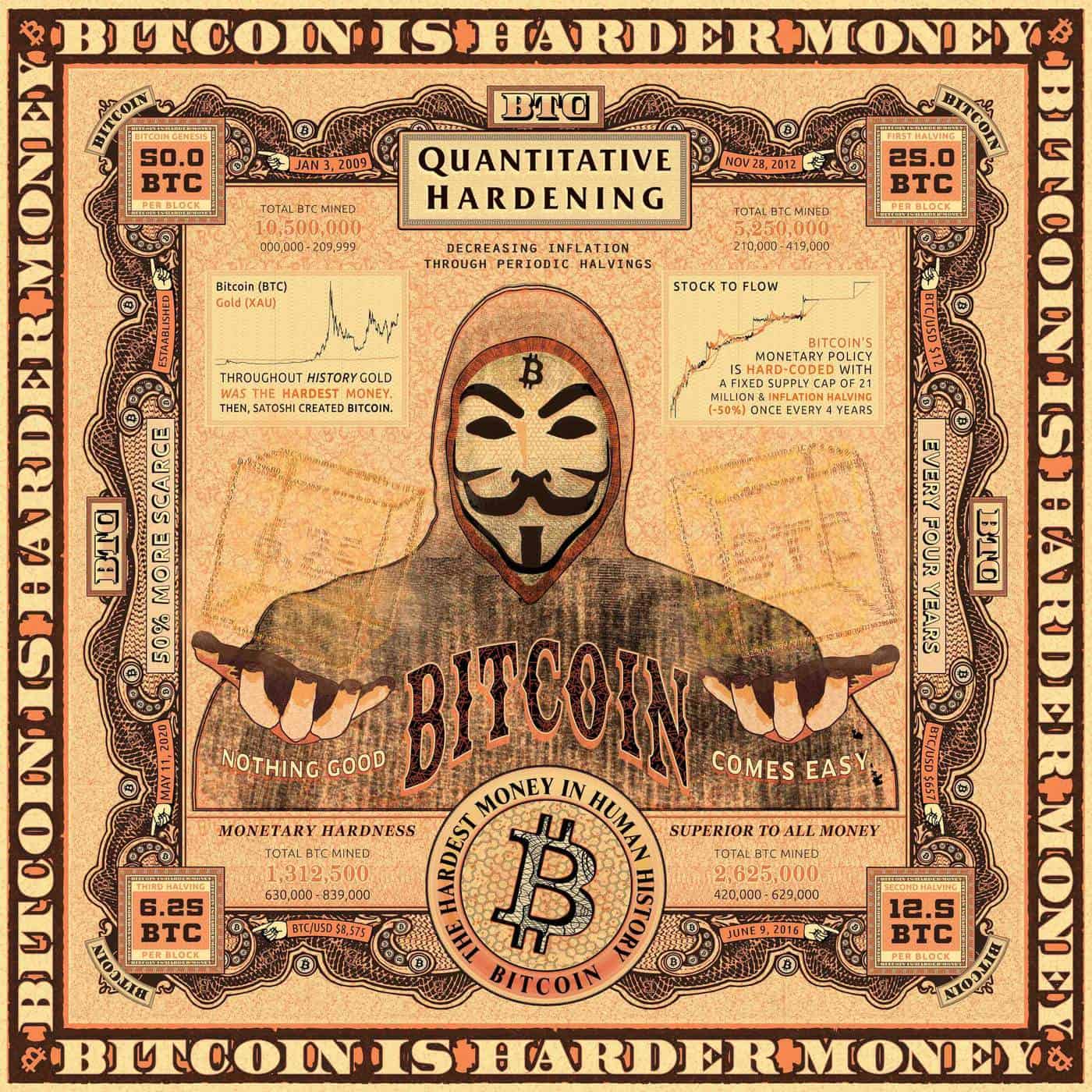

Institutional traders seem to be returning to Bitcoin probably seeing BTC as a greater hedge towards inflation than gold.

– See extra: Bank of America reveals twenty “big” US businesses that invest “silently” in cryptocurrencies

Among them is Shark Tank star Kevin O’Leary, who exposed earlier this week that he is allocating extra cryptocurrency investments than gold. The momentum for Bitcoin stands in stark contrast to a May JPMorgan report, which stated that main traders at the time had been shifting from Bitcoin to regular gold.

MicroStrategy CEO Michael Saylor also posted his views on his individual webpage ahead of JPMorgan’s most current report. He is “optimistic” about the existing problem of Bitcoin and the common market place towards gold.

Implicit approval of Bitcoin by main banking institutions and regulators will accelerate the collapse of #Gold and the rise of #Bitcoin as a favored keep of worth for each institutional and retail traders.https://t.co/7os1ojenHs

– Michael Saylor⚡️ (@michael_saylor) October 7, 2021

The implicit approval of Bitcoin by main banking institutions and regulators will accelerate the demise of gold and the rise of Bitcoin as a favored keep of worth for each institutional and retail traders.

Beyond that, JPMorgan has also supplied two other aspects that they feel are the driving force behind the Bitcoin boom. Such are the latest assurances from US politicians that they do not intend to stick to China’s lead in banning the use or mining of cryptocurrencies and the cutting-edge remedies that come with it.

The latest emergence of Lightning Network and Layer two payment remedies has assisted El Salvador adopt Bitcoin.

– See extra: The explanation why Bitcoin 1st returned to the $ 50,000 mark considering that the July 9th drop

Although some components of JPMorgan have expressed a increasing curiosity in crypto assets and blockchain initiatives. However, PMorgan CEO Jamie Dimon stays opposed to Bitcoin, stating in an October 22 interview that he stays skeptical of BTC and has even in contrast Bitcoin to “just some kind of thing”. stupid gold “.

Synthetic Currency 68

Maybe you are interested: