[ad_1]

With the market shifting sideways and investor sentiment exhibiting no indicators of slowing, institutional demand, a vastly vital issue behind Bitcoin’s development, seems to be slowing.

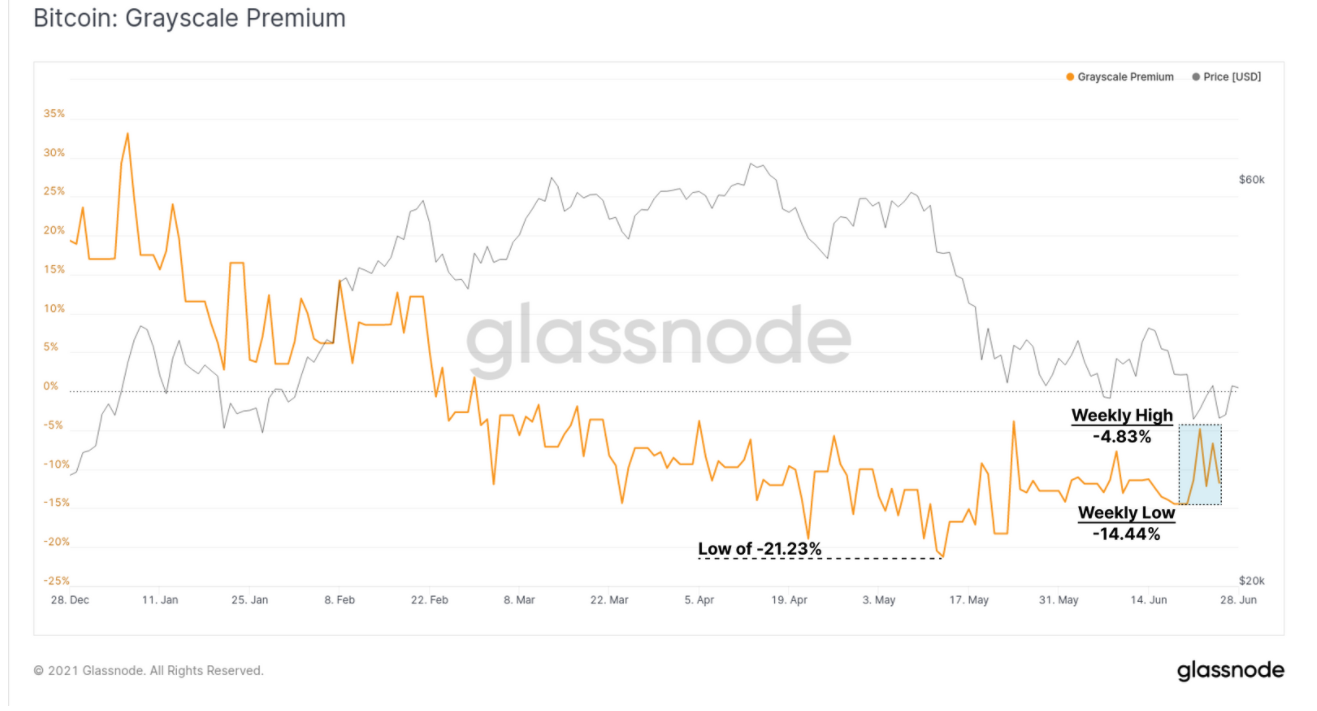

A Glassnode report reveals that institutional buyers are slowly dropping curiosity in Bitcoin. Evidence of this may be discovered by monitoring the exercise of the Grayscale Bitcoin Trust (GBTC).

The major driver of the rise in Bitcoin costs in 2020 and 2021 is the robust efficient demand from massive establishments. One of the largest components resulting in that is the inflow to Grayscale’s GBTC belief, the excessive premium unfold noticed in 2020 and early 2021.

As of February 2021, the GBTC product reversed to be trading at a continuing low cost to the online asset worth (NAV), reaching the deepest low cost of -21.23% in mid-May. GBTC low cost started to rise, trading this week between a low of -14.44% and a excessive of -4.83% in opposition to the NAV.

The largest GBTC share launch to be launched in July is a significant occasion. There are two opposing views that needs to be famous, whether or not Bitcoin can repeat historical past with Grayscale’s largest set off of the yr as of February or whether or not it’s going to drop on to $ 25,000 from the monetary large’s perspective. JP Morgan himself? We must comply with up subsequent time.

See extra: Bitcoin has entered a bear market, however when will it cease?

Another key indicator is Grayscale’s GBTC belief which at present holds over 651,500 BTC, a whopping 3.475% of Bitcoin’s circulating provide.

The subsequent are the most important Bitcoin ETFs. There are two main Bitcoin ETFs in Canada:

- The Bitcoin ETF goal

- 3iQ QBTC ETFs

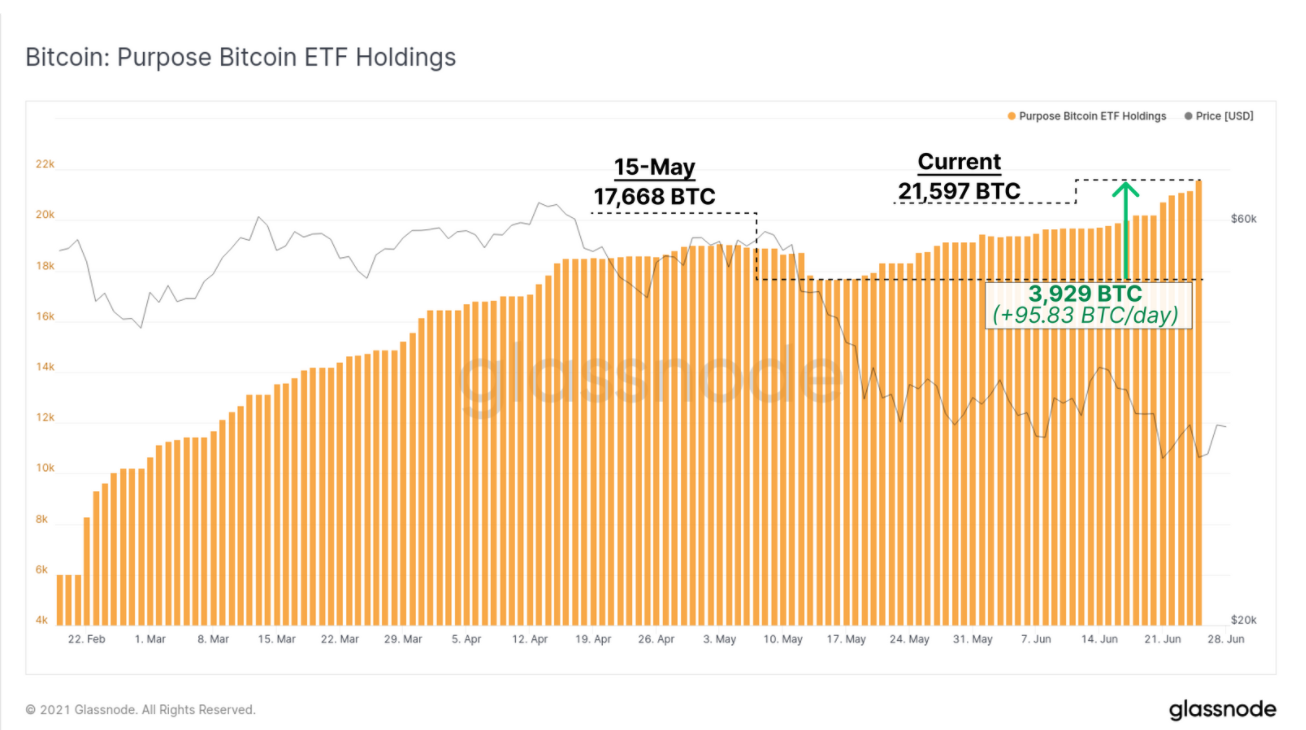

These two funds continued to develop quickly in complete BTC below administration. With a web influx of three,929 BTC as of May fifteenth. This represents a day by day influx of 95.83 BTC / day and brings complete ETF holdings to 21,597 BTC.

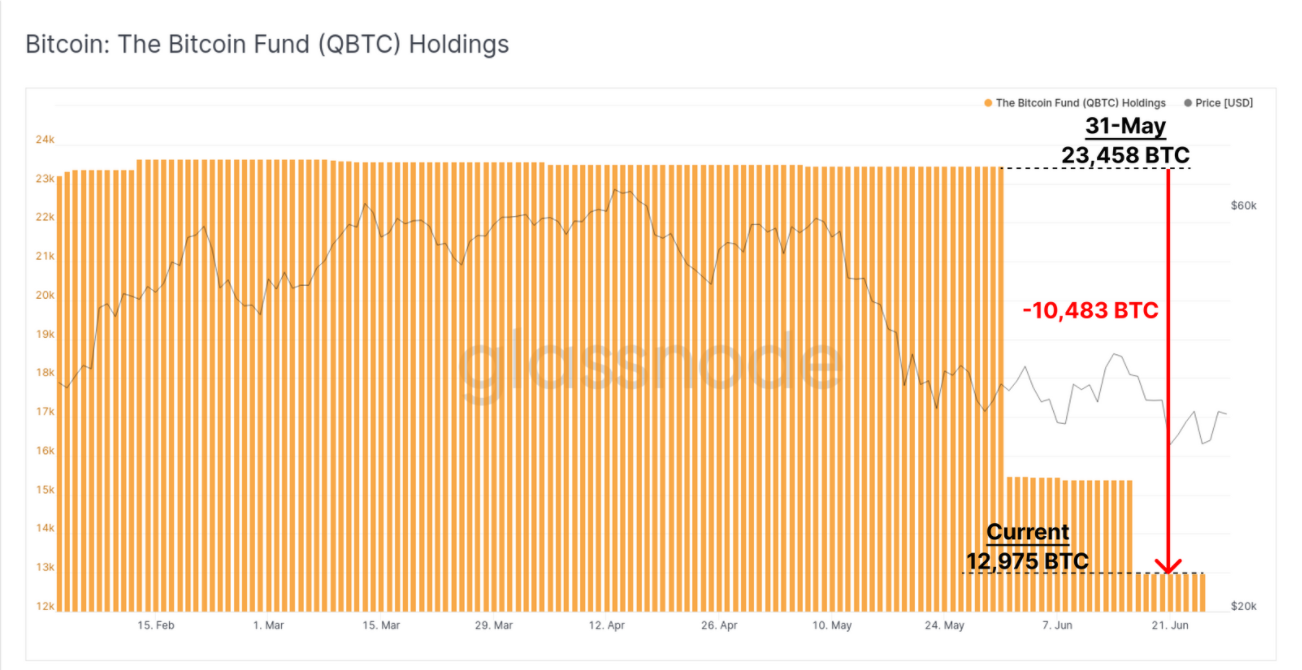

The QBTC ETF has skilled vital web outflows over the previous two months. Total BTC holdings have fallen over the previous two months by a complete of 10,483 BTC particularly.

This brings the present holdings in BTC to 12,975 BTC. Therefore, the aim of the ETF is to “help” the QBTC ETF within the complete quantity below administration. However, when combining the online outflows for each ETFs over the previous month, a complete of 8,037 BTC got here out of those ETF merchandise.

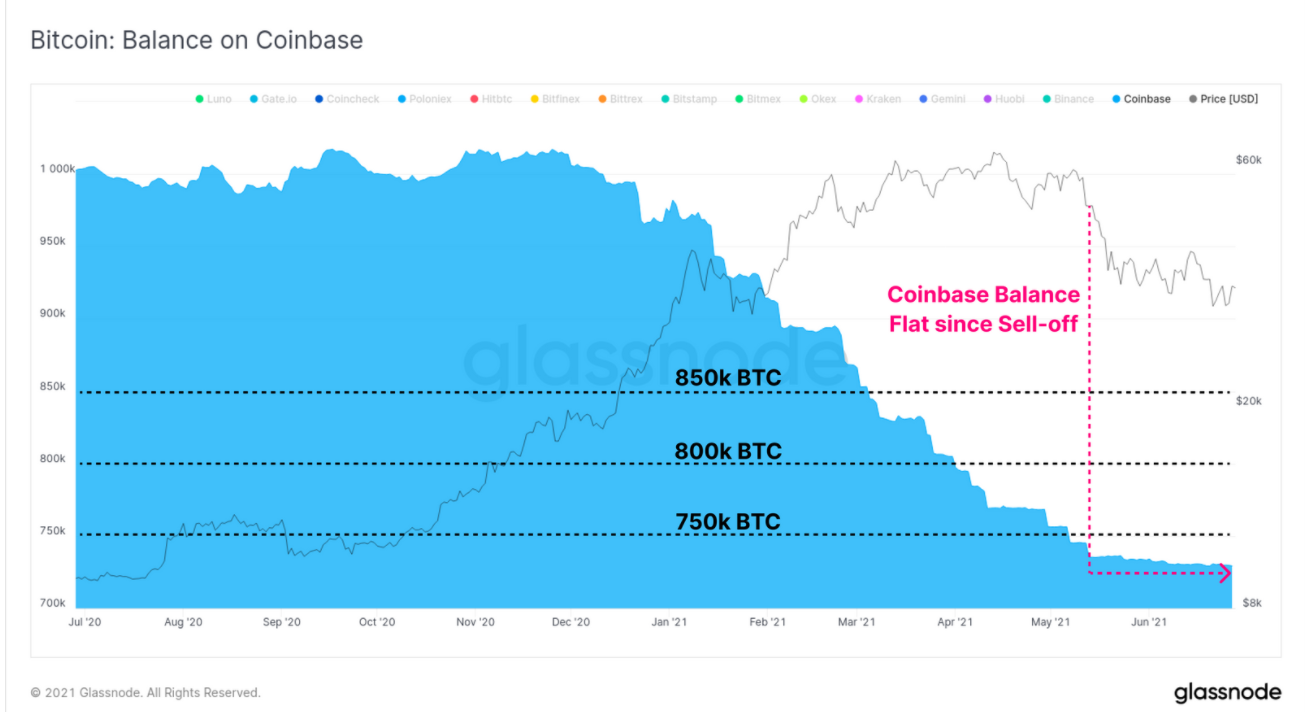

Finally, let’s check out the online change on Coinbase, a favourite spot for US establishments through the bull market. After an extended interval of web money circulation since December 2020, the change in Coinbase’s stability has considerably decreased.

Above all, the information reveals that the wants of huge organizations nonetheless appear a bit weak. From there, it may be concluded that the market wants a powerful shock from this issue to finish the present “cold” interval and begin a brand new development cycle.

Synthetic forex 68

Maybe you have an interest:

.

[ad_2]