Institutional traders have flocked to Solana (SOL) as the inflow of Solana-associated investment merchandise accounted for 86.six% of complete market place inflows in excess of the previous week. This is occurring amid a decline in institutional demand for Ether (ETH) and Bitcoin (BTC).

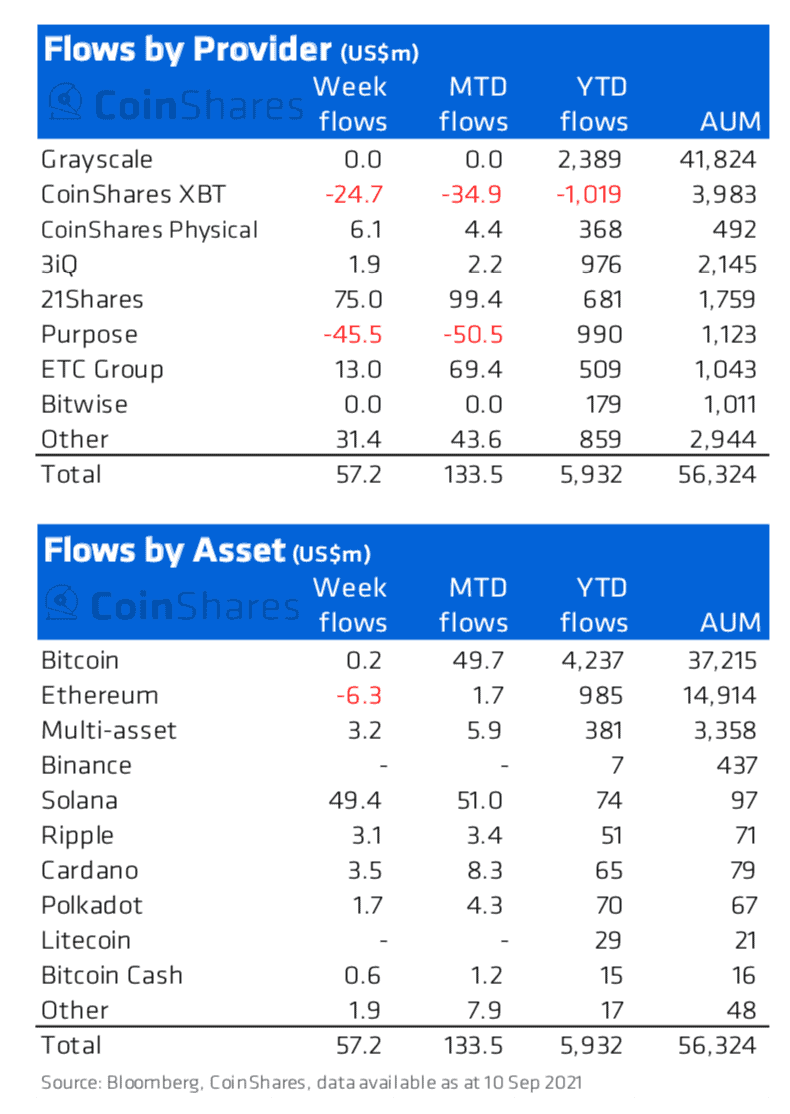

According to a publication published by CoinShares on Sept. 14 to report “weekly inflows into digital asset funds,” Solana (SOL) investment merchandise noticed an inflow of 49%. , four million bucks. Additionally, Solana’s complete capital final week reached $ 57 million, an raise of 275% in excess of the similar time period.

At the similar time, income movement in Solana investment merchandise also accounted for 86.six% of the complete market place capital movement. Unexpectedly, the sharp rise in income movement in Solana associated merchandise was also the time when SOL broke out and hit a new ATH at $ 216.five.

See additional: SOL continues to do ATH soon after Steve Harvey joins the NFT globe on Solana

“The combination of price appreciation and capital inflows has now brought Solana’s assets under management to $ 97 million, the fifth largest value of all investment products.”

Digital asset merchandise have witnessed inflows for the fourth straight week. In individual, the demand for altcoins improved appreciably, when the want for Bitcoin also fell additional or much less when BTC only registered a minimal inflow of $ 200,000.

Ether (ETH) recorded a unfavorable inflow of $ six.three million. The purpose is that the value of this cryptocurrency has dropped by up to ten% in the final week. Despite the a lot anticipated launch of the Cardano sensible contract (ADA) on September 13, institutional income movement monitoring merchandise for ADA had been down 46% from final week.

The multi-asset products, Ripple (XRP), Polkadot (DOT) and Bitcoin Cash (BCH) also recorded income movement development of $ three.two million respectively three.one million bucks $ one.seven million and $ 600,000.

According to CoinShares estimates, institutional wealth managers now account for a complete AUM of $ 56.three billion. This amount marks a 9% drop from final week, when the total cryptocurrency market place “collapsed” soon after Bitcoin’s “bleeding”.

Cash flows had been mixed involving asset managers, with CoinShares XBT and Purpose money dropping $ 24.seven million and $ 45.five million respectively. Meanwhile, 21Shares, And so on Group and CoinShares recorded inflows of $ 75 million, $ 13 million and $ six.one million, respectively. Grayscale, a leader in institutional investment, nonetheless dominates, accounting for 74% with a complete worth of $ 41.eight billion.

Additionally, on September 13, Grayscale announced a partnership with alternate fintech resource supplier iCapital Network. The agreement will allow iCapital advisors to supply higher net well worth consumers with entry to Grayscales’ digital asset companies by means of a diversified investment approach by market place capitalization.

Synthetic Currency 68

Maybe you care