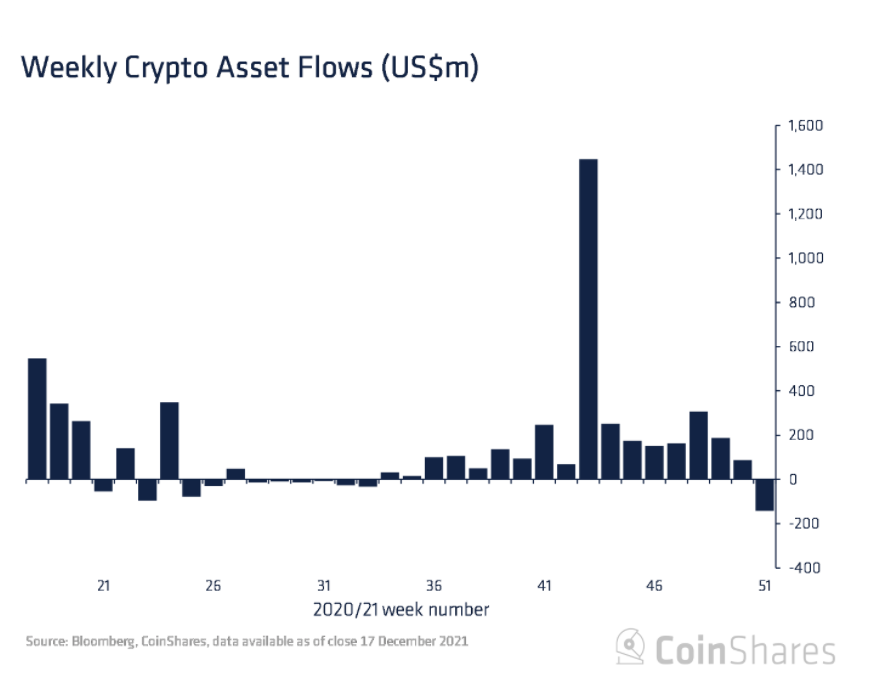

With the worldwide cryptocurrency marketplace in decline, institutional cryptocurrency investment solutions have skilled record weekly retracement inflows.

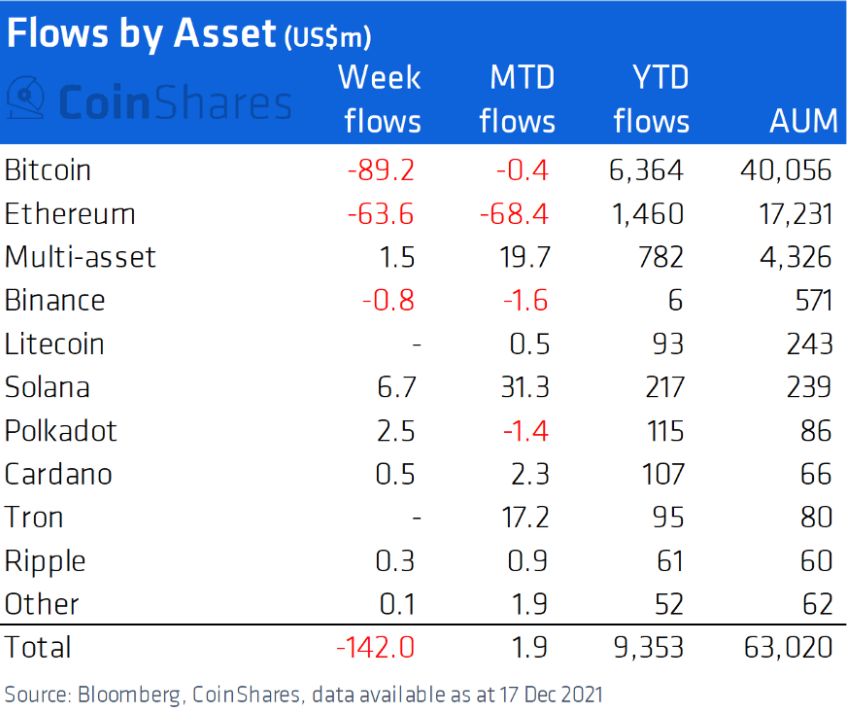

According to a report by CoinShares, outflows from crypto money totaled $ 142 million final week. The biggest variety had previously been recorded in early June, hitting $ 97 million.

Bitcoin (BTC) posted a “loss” of up to $ 89 million. However, the variety is substantially much less than the $ 150 million recorded in June, and Ethereum (ETH) is definitely in crisis with $ 63.six million coming out of its solutions.

Most altcoins eased the shock of Bitcoin (BTC) and Ethereum (ETH) this week with two common representatives, Solana (SOL), Polkadot (DOT) possessing a complete inflow of six. $ .seven million and $ respectively. two.five million.

While the signal that capital is “bleeding” seems alarming, there are some factors to look at. First, the move comes at a time of major outflows on all assets following the Fed’s latest announcement that it will accelerate charge hikes in 2022. But the Fed chairman stated he does not see cryptocurrencies as a risk to ” break “the US money program. program.

Second, outflows signify only .23% of complete assets below management (AUM) and from a historical viewpoint they are modest in contrast to early 2018, exactly where weekly outflows accounted for one.six% of AUM. . Ultimately, capital flows into the marketplace at press time hit an yearly record of $ 9.five billion, up from $ six.seven billion in 2020.

In basic, when crowd sentiment is getting to be as well unfavorable, it is crucial that institutional traders get action to defend their place in the marketplace. Although the variety of BTC withdrawn from the exchange has improved considerably in spite of 90% of the BTC provide becoming mined, Bitcoin does not but have sturdy determination to set up an uptrend, even PlanB will have to “apply” for permission. Christmas Magic for a hundred,000 for BTC target.

Coin Summary 68

Maybe you are interested: