[ad_1]

Institutional traders do not seem to have regained self confidence in the marketplace however, with the weekly volume of cryptocurrency investment goods falling to its lowest degree considering that October 2020.

According to CoinShares’ weekly report, $ one.58 billion really worth of crypto-asset goods was immediately modified from July 5th to 9th.

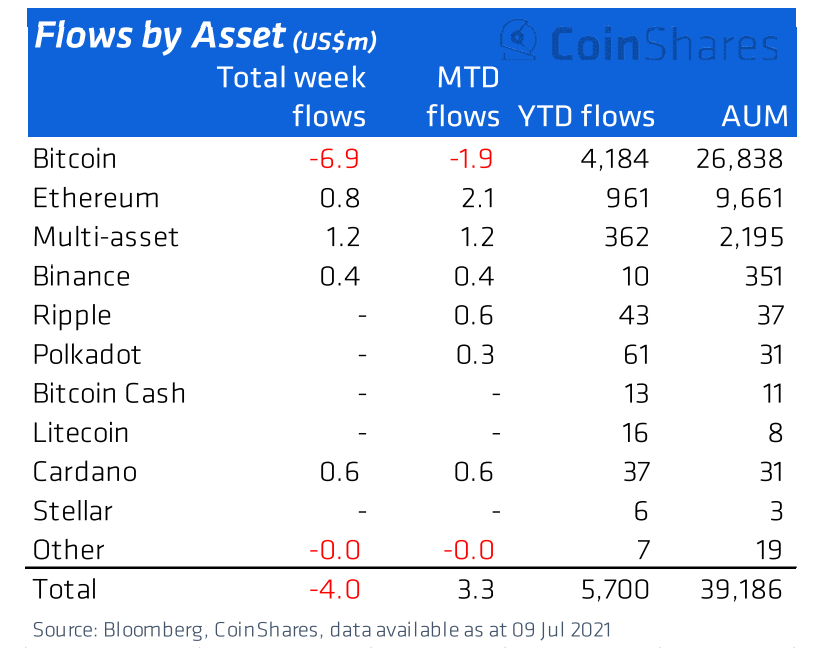

Investment goods noticed $ four million outflows for the week, with all over $ seven million coming from Bitcoin (BTC) mining goods.

However, European Bitcoin goods have usually noticed additional inflows, suggesting that some traders feel the worst bear marketplace of 2021 is coming to an finish. A favourable level is that Ethereum (ETH) goods had a smaller influx of $ 800,000 in the course of the week.

See additional: Whale wallets with above a hundred,000 Bitcoins peaked in 27 mesimonths

This exhibits that institutional traders are even now very calm following final week’s quick bullish rally. Outflows from Bitcoin goods have steadily misplaced eight of the previous 9 weeks. Exposure to Ethereum also declined final month, with a complete inflow of $ 64.three million from the week ending June six.

Bitcoin continues to accumulate as the value holds over $ thirty,000

While traders are cautious about BTC and ETH, other multi-asset goods proceed to see inflows as institutions spread their danger across the business with $ one.two million.

Multi-asset goods had a 12 months-on-12 months (YTD) inflow of $ 362 million and now signify sixteen.five% of the multi-asset fund’s assets below management (AUM).

Inflows are at this time even now fairly smaller in contrast to Bitcoin and Ethereum, but the information implies that traders are more and more seeking to diversify their holdings in cryptocurrencies.

Synthetic currency 68

Maybe you are interested:

.

[ad_2]