Hedera (HBAR) price has maintained stability over the past few weeks with little upside momentum. However, traders still maintain an optimistic outlook, expecting a significant price increase.

In contrast to typical accumulation periods that often lead to sell-offs, the HBAR community appears optimistic about the possibility of a break higher.

HBAR Trader Optimistic

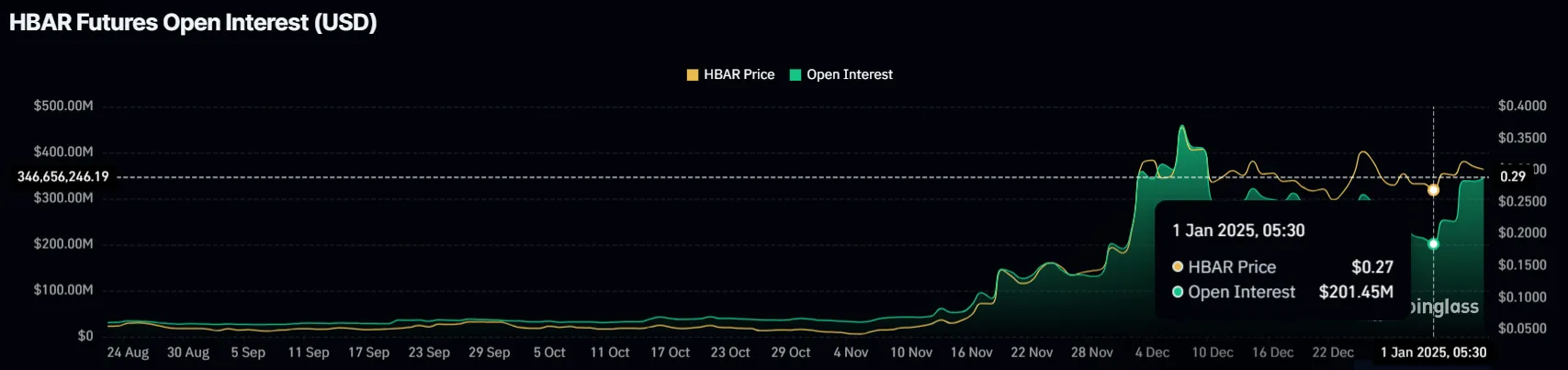

HBAR’s Open Interest (OI) increased by 144 million USD in the past week, bringing the total OI to 344 million USD. This strong increase shows that traders are actively returning to HBAR, expected to gain from the expected uptrend. The increase in open interest is also supported by a positive funding ratio, which shows that most Futures positions are long, reflecting bullish confidence.

The increase in market participation is in line with traders’ expectations that HBAR will overcome key resistance levels. The capital flows into this asset represent optimism as investors expect a change in momentum. The combination of funding rate and increase in open interest provides a strong basis for bullish activity in the near term.

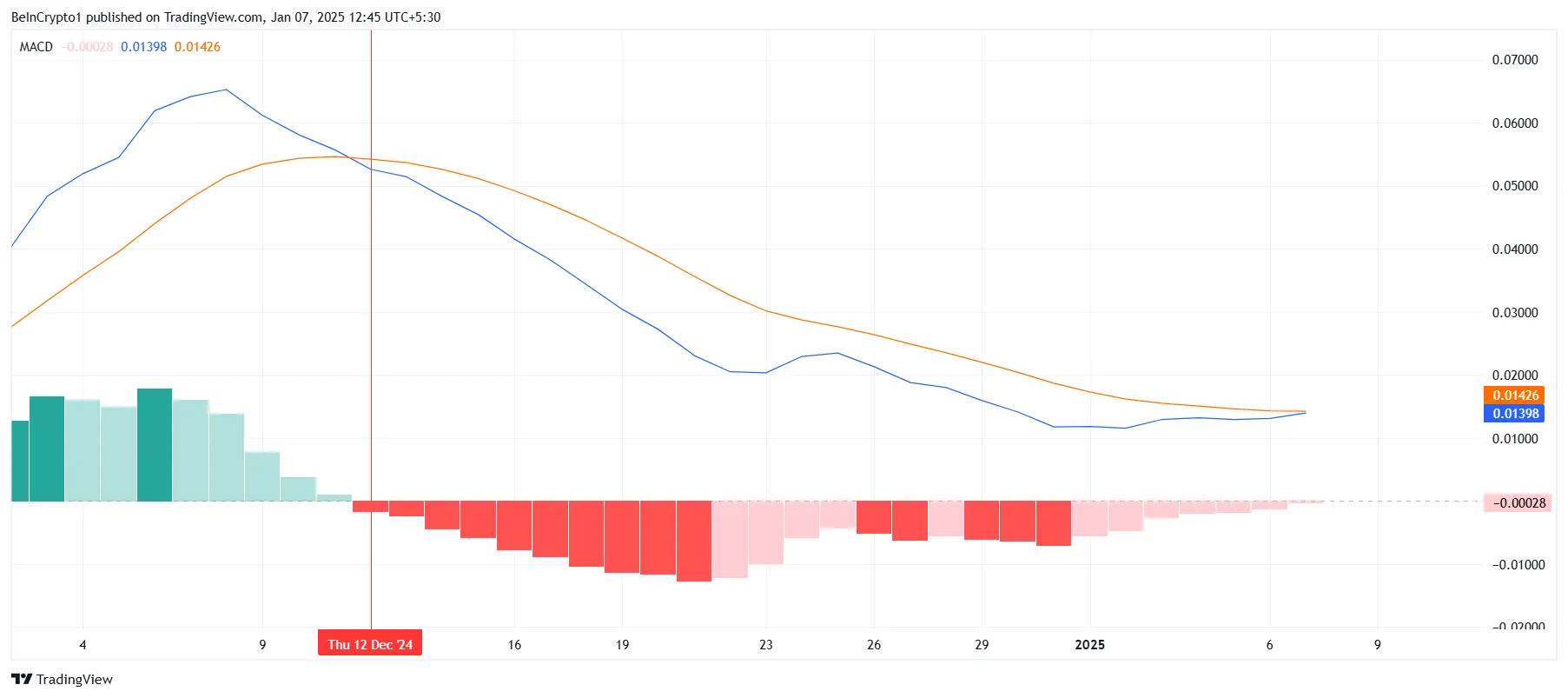

HBAR’s macro dynamics are showing signs of improvement, as the Moving Average Convergence Divergence (MACD) indicator shows that downward pressure is ending. The MACD line is approaching the point of intersection with the signal line, signaling the possibility of a price explosion. Such a change would mark the beginning of an uptrend, supported by positive signs from the market.

The upcoming bullish crossover point on the MACD line reflects the market’s growing optimism, setting the stage for a price recovery. The combination of technical indicators with rising open interest and positive funding rates further strengthens the case for HBAR achieving a breakout. These factors together suggest a shift in investor sentiment towards optimism.

HBAR Price Prediction: Look for a Boom

HBAR is stuck in an accumulation phase over the past month, trading between $0.33 and $0.25. This price stagnation has limited investor profits.

However, the market signs mentioned point to a possible boom. If successful, HBAR could rise to $0.39, reach 2024 highs, and even $0.40.

The breakout scenario depends on HBAR breaking through and turning $0.33 into support, which would confirm a sustained uptrend. Such a move would increase market confidence, attracting more capital to the asset. Conversely, failure to overcome $0.33 could prolong the accumulation phase, leading to selling pressure.

A sell-off due to an extended accumulation phase could push HBAR below the $0.25 support. This scenario will invalidate the optimistic view, leading to a decline in prices and reducing investor optimism.