Faced with a huge promote-off in the cryptocurrency marketplace, numerous traders consider refuge in stablecoins, but not all of them are picked.

Stablecoins are also topic to arbitrage

During the morning and afternoon of May twelve, the cryptocurrency marketplace continued to record a new correction. Bitcoin plunged to a new reduced of 2022 at $ 26,700, the lowest worth due to the fact December 2020, or 17 months in the past.

Many important altcoins are also hitting the bottom of 2022, maybe even breaking the bottom of 2021.

Faced with the existing chaotic predicament, the move of numerous traders is to transfer assets to important stablecoins on the marketplace this kind of as Tether (USDT), Circle (USDC) and Binance USD (BUSD).

However, it is unusual that the exchange costs involving these stablecoins have a massive variation, specially USDC and BUSD are priced increased than USDT.

The BUSD / USDT exchange price on the afternoon of May twelve hit $ one,025 at one particular level, even though the USDC / USDT pair climbed to $ three. CoinMarketCap’s cost statistics web page also reviews that the typical USDT cost across all exchanges is USD .98, deviating from the USD one mark even though USDC and BUSD nonetheless hold the one USD mark.

According to Coinlive, the purpose USDT is “fud” at the second stems from the collateral nature of this stablecoin.

Why is the USDT “criticized”?

Despite getting the biggest stablecoin in the cryptocurrency marketplace by marketplace capitalization, Tether has prolonged been viewed as a “slow-blast bomb”. The purpose is that, in essence, USDT is “partially guaranteed” rather than entirely denominated in USD.

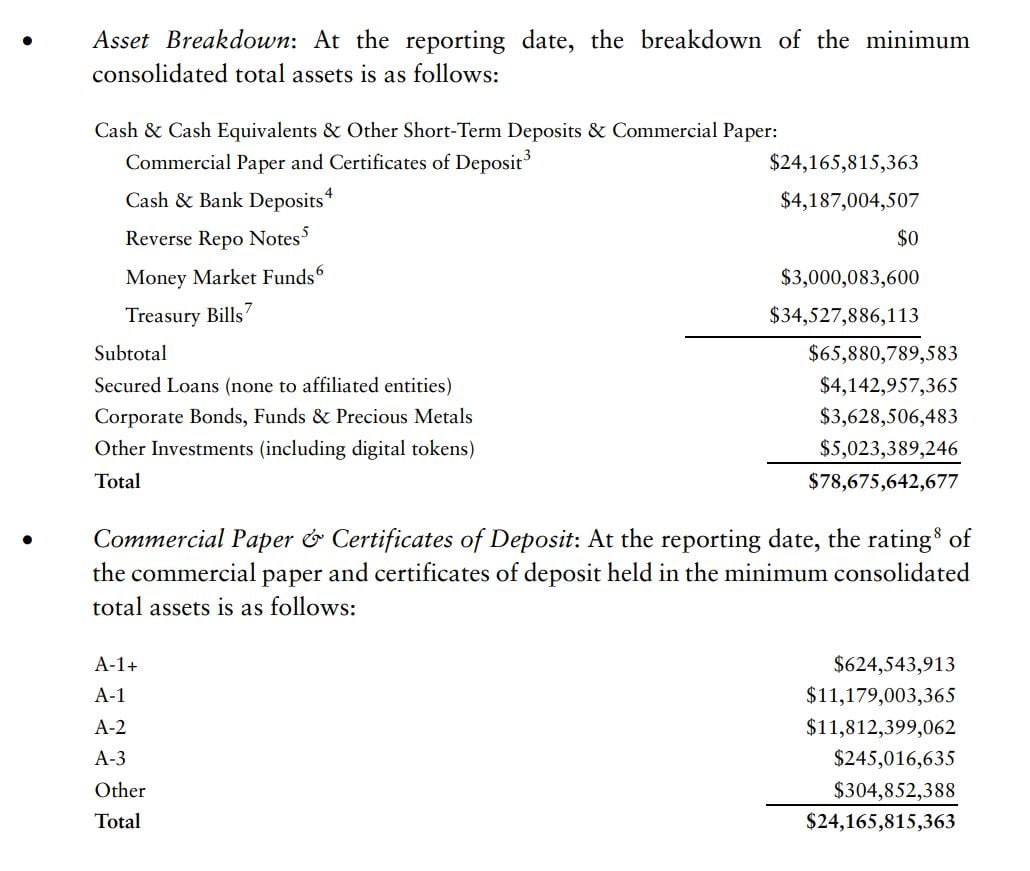

In The most recent balance sheet as of December 31, 2021, Tether says the company’s assets are $ 78.six billion utilized to “support” USDT. However, in actuality, only $ four.one billion of that is money, the rest was invested by the corporation in corporate bonds, government bonds and outgoing loans.

Many men and women dread that Tether will not have adequate sources to assistance the USDT in the occasion that stablecoin holders “run away” en masse mainly because the company’s assets are illiquid (bonds, payments). It does not halt there, the collapse of the US stock marketplace in the previous following the Fed curiosity price hikes has also impacted the routines of numerous businesses, threatening the well being of businesses.

Not to mention, Tether is a quarter behind in its reporting time period of Q1 2022, as requested by the New York Attorney General when the corporation settles the situation with the state government in 2021. Bloomberg in October 2021 published an investigative report, claiming that Tether’s money movement could not be traced.

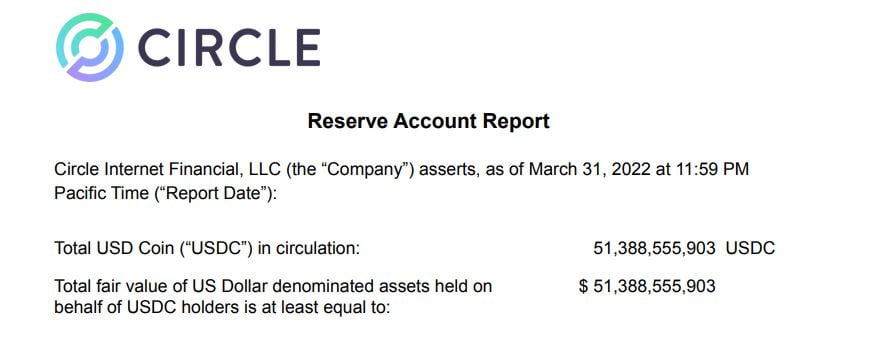

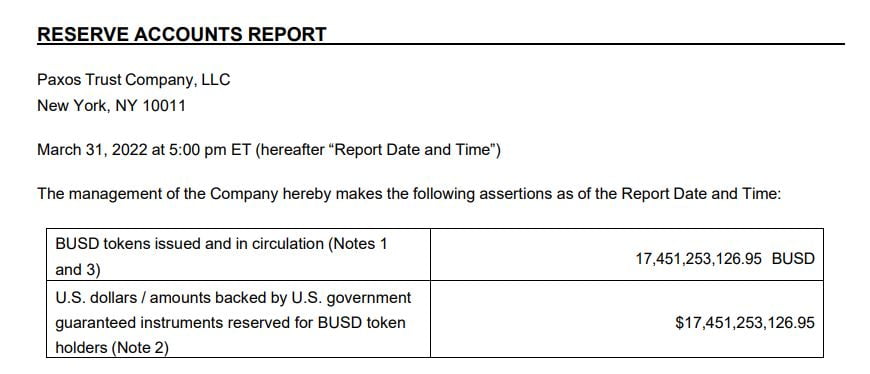

On the other hand, in the stability sheets published month-to-month by Circle (the issuer of USDC) and Paxos (the issuer of BUSD), by the finish of March 2022, these two businesses have stated that the plaintiff holds an sum of USD equal to the quantity of stablecoins issued on the marketplace, ie “full margin” in USD or one: one margin.

Specifically, Circle is holding US $ 51.3 billion to keep the price at US $ 51.3 billion produced by them, even though this Paxos figure is $ 17.4 billion for $ 17.4 billion.

This is specifically why USDC and BUSD are trusted far more than USDT, as they are assured to hold genuine USD charges and have minor connection to the stock marketplace.

Another purpose the marketplace is very frightened of securitized stablecoins is in portion due to the latest collapse of LUNA – UST.

Synthetic currency 68

Maybe you are interested: