[ad_1]

Technical indicators primarily based on Glassnode information demonstrate that prolonged-phrase traders have started off accumulating Bitcoin in spite of the coin’s latest downtrend.

Bitcoin (BTC) price tag remained reasonably peaceful more than the weekend, inching closer to $34,000 on July 11th. However, it need to be remembered that the BTC/USD trading pair is down virtually 50% from its highs. all-time higher, nearing $65,000 in mid-April. But the substantial downside move did not prevent traders from betting on the coin’s prolonged-phrase bullish outlook.

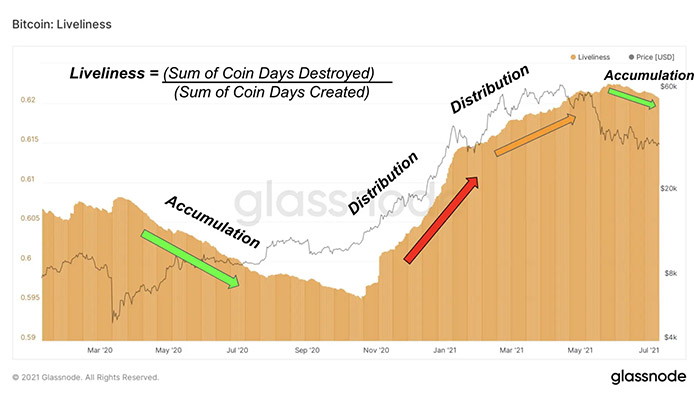

According to 1 of Glassnode’s metrics, identified as Liveliness, the Bitcoin market place has proven a shift in the “macro selling behavior” of prolonged-phrase traders. To fully grasp this Liveliness metric, you need to have to fully grasp two metrics: Coin Days Destroyed – which is a metric that emphasizes the fat of coins that have not been applied for a prolonged time, and Sum of Coin Days Created – the amount of coins. coin age.

“Liveliness is the ratio of Coin Days Destroyed divided by Coin Days Created. This number varies from 0 to 1, with 0 representing the highest percentage of the Bitcoin supply that is inactive, i.e. from mining to computation the coin has never been moved. The chart is showing that the market is in a strong consolidation phase.”

However, a greater degree of distribution does not always predict a bearish cycle. For illustration, from November 2020 to April 2021, the Liveliness Ratio elevated along with the Bitcoin price tag, displaying that in spite of the decrease HODLing index, the Bitcoin market place did not enter a bearish phase.

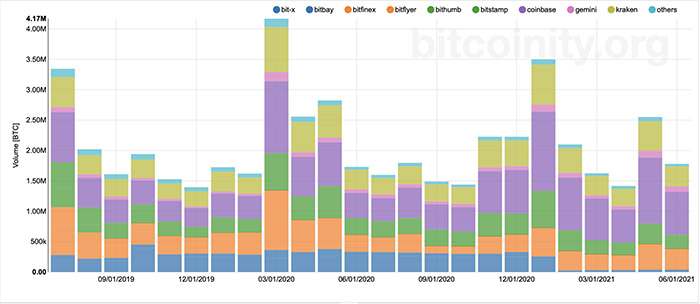

That could be due to a spike in trading volume earlier this 12 months. In the initially quarter, all round Bitcoin trading exercise skyrocketed to more than $six trillion, in contrast with $one.14 trillion in Q4 2020, in accordance to information obtained by Bitcoinity.

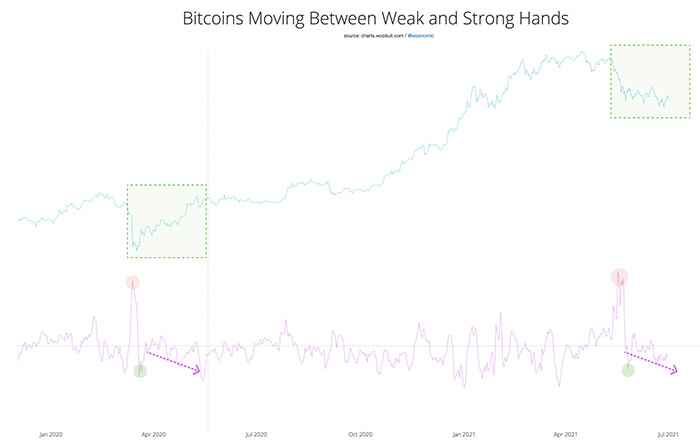

Thus, when prolonged-phrase holders started to dump Bitcoin from November 2020 to April 2021, greater trading volumes across all crypto exchanges indicate that retail demand has soak up offering stress. But by April, as analyst Willy Woo notes, offering had outstripped bull market place investors’ capability to invest in back:

“It is clear to see that long-term holders are buying back speculative coins at a strong rate. Now a game of patience until this is reflected in price behavior, the data confidently indicates that an accumulation bottom is forming.”

Bitcoin holds the $thirty,000 mark

A spike in Bitcoin accumulation sentiment comes as the coin continues to keep an uptrend over the strongly-motivated $thirty,000 assistance.

The BTC/USD trading pair dropped to $thirty,000 for the initially time on May 19, bringing with it the collapse of the total crypto market place. Since then, the pair has examined the floor at least 4 occasions, only to see a sturdy rebound afterward. That has created $thirty,000 a psychological assistance that, if broken to the lows, threatens to push Bitcoin price tag as reduced as $twenty,000 – which was the former peak.

Joel Kruger, an investment method advisor at LMAX, mentioned earlier this week that Bitcoin could return to $twenty,000, as the coin is even now underneath stress from damaging market place sentiment. Global. This analyst refers to the most recent stock market place crisis, induced by worries linked to the spread of the Delta variant of Covid-19.

“It would be foolish to rule out a drop back below the June low and we think there is a risk in that case that Bitcoin price could return to its old highs around $20,000,” he explained. a lot more.

“But at that stage, we believe the market will be strongly supported.”

Maybe you are interested:

Join our channel to update the most beneficial information and understanding at:

According to Coinlive

Compiled by ToiYeuBitcoin

.

[ad_2]