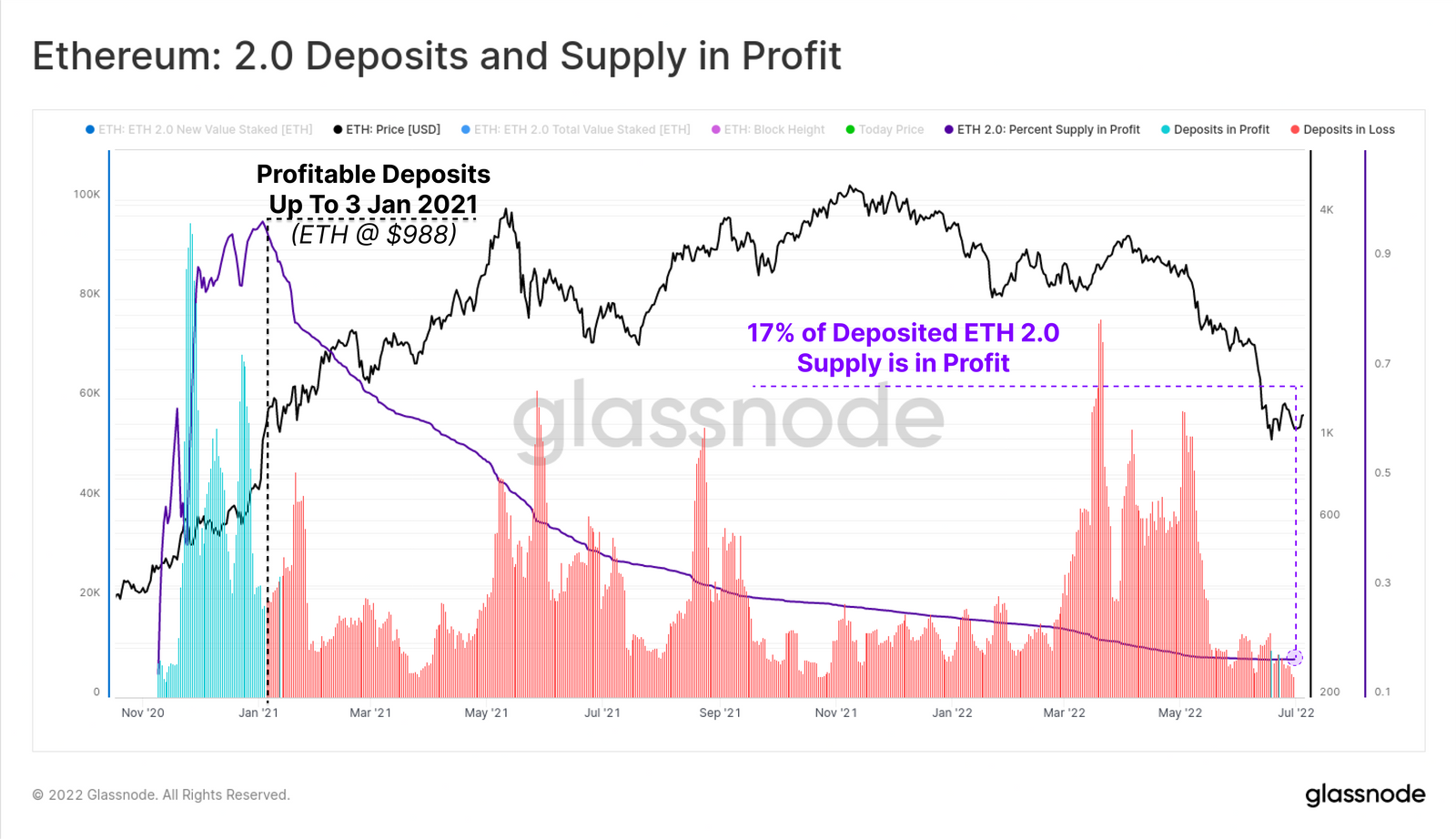

With a drop of a lot more than 78% from Ethereum’s November ATH to $ four,800, only about 17% of traders betting ETH on Beacon Chain contracts are at this time rewarding.

Staking in the Ethereum two. contract will primarily call for traders to lock their ETHs for a specific time period of time to act as validators supporting Ether in the course of the consolidation approach in direction of the consensus mechanism.

In the situation of Ethereum two., they have been demanded to wager a minimal of 32 ETH, which has viewed steady income movement expand more than the previous 12 months or so as ETH’s bullish self-assurance builds. There is also a different a lot more versatile staking option that does not need to have to meet the complete 32 ETH is by the Lido Finance (LDO) protocol.

Returning to the primary subject, in the course of its peak in the fourth quarter of 2021, the complete USD worth of ETH at stake grew to a whopping $ 39.seven billion, equal to 263,918 network validators.

However, immediately after hitting ATH at $ four,800 and continually plummeting in line with marketplace situations, the quantity of ETH in the Beacon Chain contract fell by $ 25.65 billion even with virtually five million a lot more ETH than they subsequently reversed, bringing the complete quantity of ETH frozen to a lot more than ten% of the complete excellent provide of ETH. The USD worth of ETH is at this time 65% below the rate of ATH at the time of going to press.

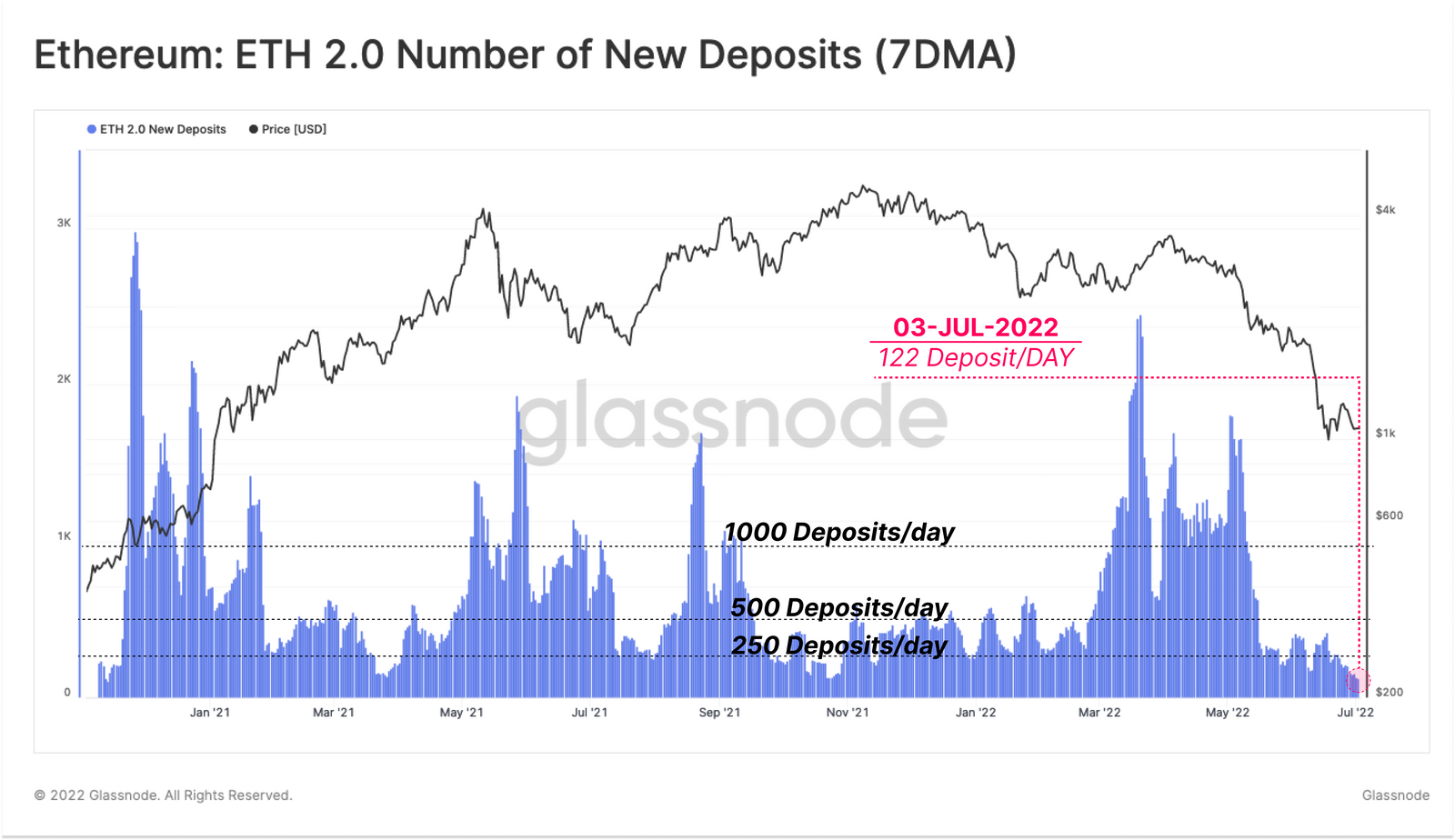

As a consequence, the approach of sending cash to ETH two. by traders has also slowed down very considerably. According to the newest Glassnode report, there had been 500-one,000 new deposits sending 32 ETH per day in 2020 and 2021. Even so, the downturn in the marketplace drove the common weekly variety of deposits down to 122 per day. , the lowest degree to date. Another issue that could be influencing the slowdown in the development charge is the bad charge of return that ETH traders encounter.

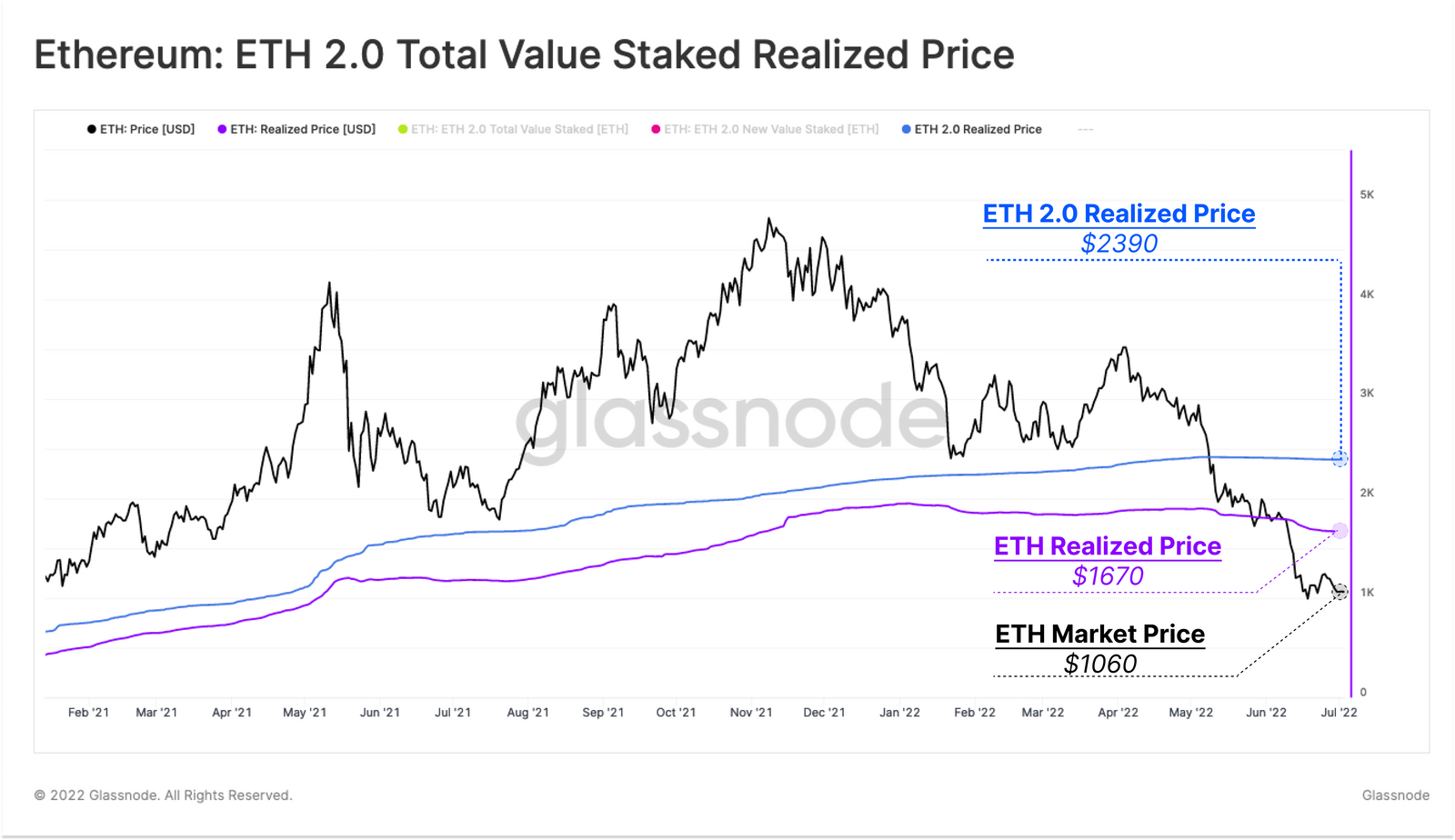

As traders are unable to withdraw ETH at this time, the real worth of ETH at the time of deposit in ETH2. has an common rate of 2390 USD. With Ether at this time trading about $ one,200, that signifies the common ETH two. investor is down -fifty five%. If we evaluate this to the real rate for the whole provide of ETH, they are creating a 36.five% better reduction than the Ethereum marketplace as a entire.

Furthermore, only 17% of deposited ETHs are rewarding. Combined with the ETH two. staking yield at this time about four.two%, the general rate of ETH drops to significantly less than fifty five% of the common stakeholder value base, which maybe explains the general general slowdown in staking. consumer deposit routines.

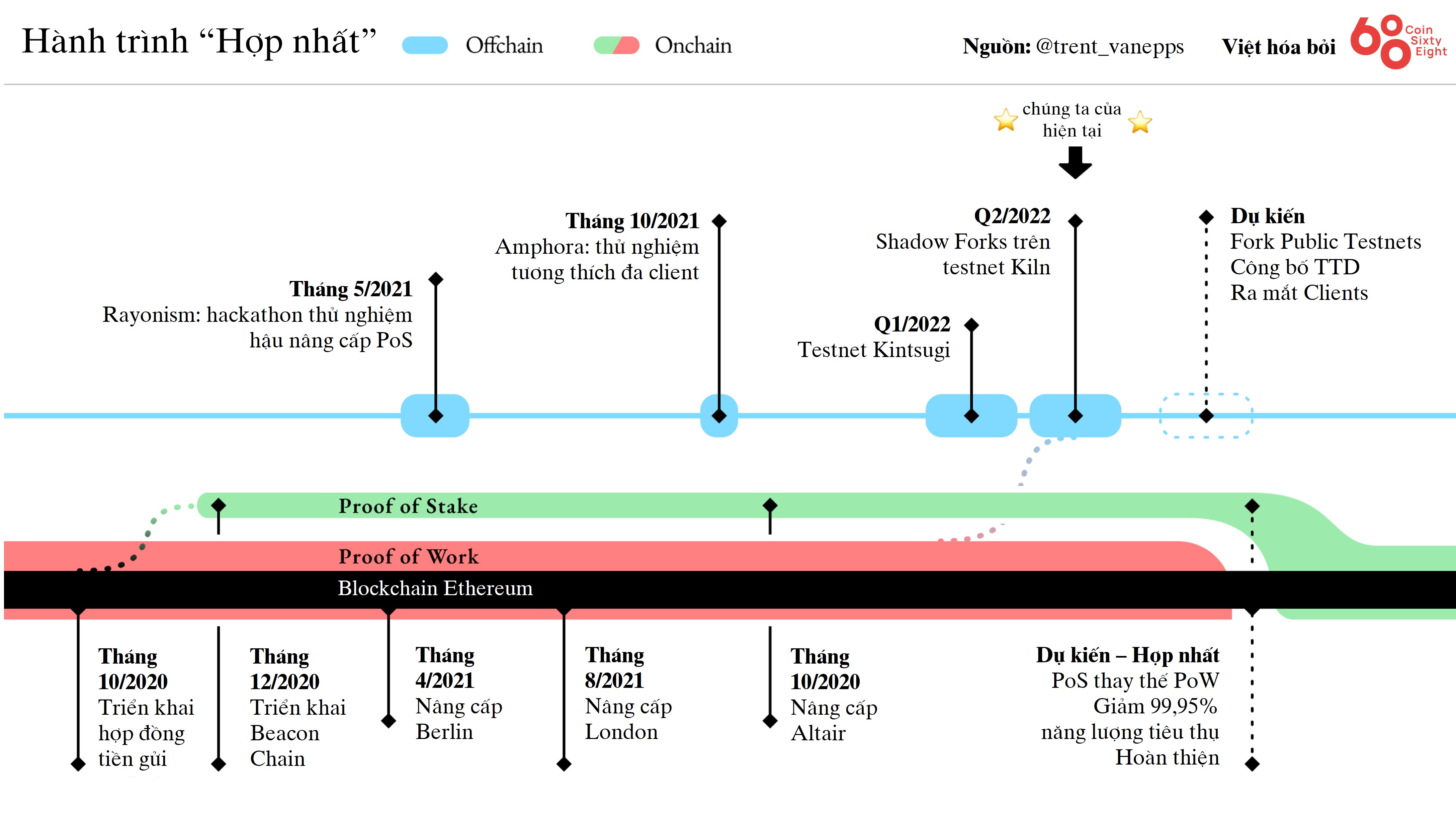

Among the quite a few relevant enhancements, also Ethereum’s most anticipated and anticipated transition from Proof-of-Work (PoW) consensus mechanism to Proof-of-Stake (PoS) by The Merge update.There had been no good indicators, when a series of technical troubles have occurred consecutively in the previous, creating from time to time a delay in the consolidation approach.

In reality, The Merge was supposed to consider area in June 2022 but was postponed in spite of ETH developers testing the PoS network by Kiln’s testnet and effectively launching the “Fork Shadow”. Not only that, Ethereum two.0’s mainnet Beacon Chain encountered really serious technical troubles, mixed with the Ropsten testnet network of the “The Merge” roadmap is also “harassed”, creating the local community to dread that The Merge will proceed to be impacted in the lengthy run. .

– See a lot more: Will the wave of competitors from the up coming generation of blockchains be sturdy sufficient to “overthrow” Ethereum?

But so far, with the commence of The Merge distribution on Sepolia, tesnet is thought of to be a single of the final ETH testnets with a PoS improve mainly because immediately after the merger Ethereum will “close” the Ropsten, Rinkeby and Ropsten and Rinkeby testnets. retaining only Goerli and Sepolia, along with the effective Gray Glacier difficult fork, there is nevertheless a likelihood that The Merge will be activated in August, in accordance to a statement from Ethereum improvement staff representative Preston Van Loon.

Synthetic currency 68

Maybe you are interested: