Recently, Ethereum has encountered a decline, dragging its price down to $3,300. Despite the price decline, this level appears to be consolidating as a base of support for ETH.

With strong investor interest and improving network activity, Ethereum could soon attempt to overcome key resistance and aim for $4,000.

Ethereum Owners Are Optimistic

Ethereum’s active address momentum is currently above the yearly average, indicating an increase in on-chain activity. This increase implies that network platforms are improving as more and more users interact with the blockchain. Rising usage is helping Ethereum maintain its position on the charts despite market volatility.

This continued activity reflects increased confidence in Ethereum’s recovery potential. As investor interest in the altcoin continues, its resilience is strengthening, keeping it from falling below key support levels. Expanding network usage is a positive sign for long-term growth.

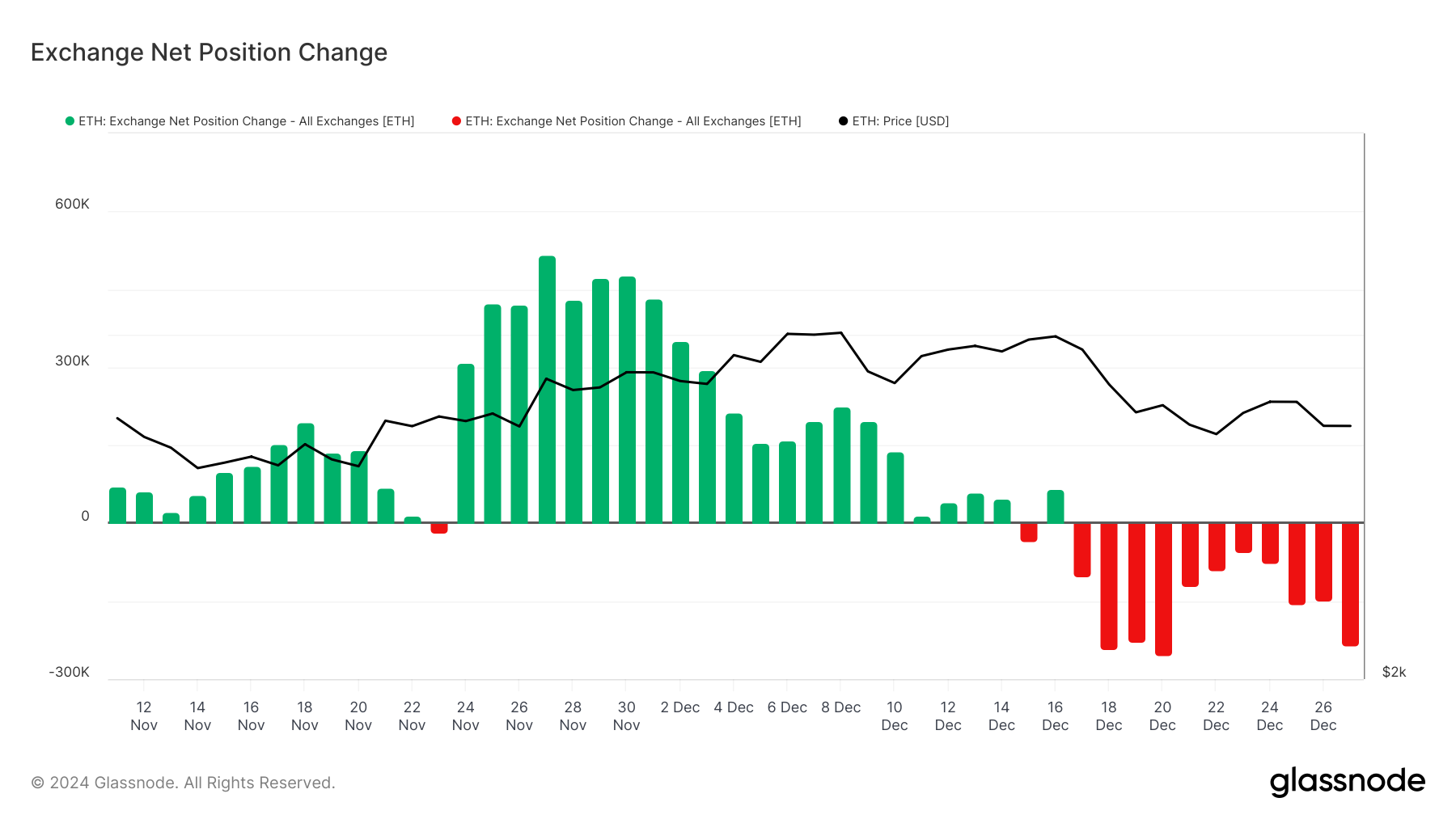

Ethereum’s macro momentum remains strong, supported by massive buying activity. In the past 24 hours, investors bought 87K ETH, worth approximately $300 million. This capital infusion is in line with heightened on-chain activity and demonstrates investor confidence in Ethereum’s recovery potential.

Net positions on exchanges support the idea of rising optimism. Investors are withdrawing Ethereum from exchanges, showing a preference for long-term holding instead of selling. This behavior hints at optimism about Ethereum’s price momentum in the coming weeks.

ETH Price Prediction: Aiming for the Peak

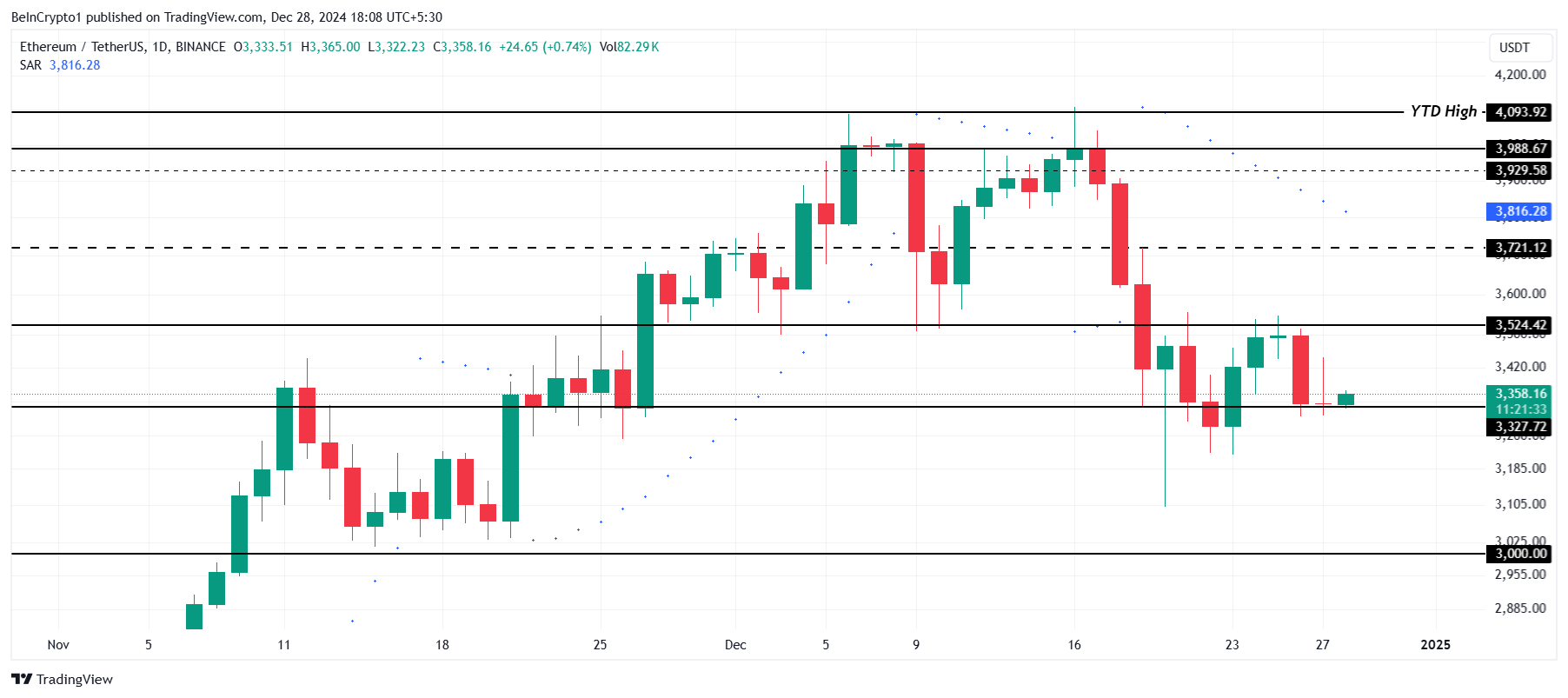

Currently, Ethereum is priced at $3,358, remaining above the critical support level at $3,327. However, the altcoin remains stuck below resistance at $3,524. Overcoming this barrier is necessary for ETH to move towards $3,721 and beyond, suggesting renewed bullish momentum.

If bullish sentiment continues to prevail, Ethereum could secure a path to $4,000. This price level represents a psychological milestone and will solidify ETH’s recovery, attracting more investor interest and increasing network activity.

On the other hand, if it loses support at $3,327, Ethereum could slide to $3,000. Such a decline would invalidate the current Bullish Forecast and signal the need for stronger support from the market to reverse the trend.