Decentralized infrastructure network (DePin) project Io.net has announced a strategic partnership with TARS Protocol, an artificial intelligence-based Web3 infrastructure platform.

This collaboration represents a major step forward in using decentralized resources to improve the process of training artificial intelligence models. In fact, this promises to reduce the cost of training AI models by up to 30%.

IO Token Price Struggles Despite New Partnership

Io.net, a leader in decentralized distributed computing, is aiming to revolutionize the scalability of machine learning. Through this partnership, Io.net integrates its vast network of over 11,000 distributed devices, including GPUs and CPUs, into the TARS AI Hub.

This integration promises to dramatically change the way AI models are trained, giving TARS users access to decentralized GPU clusters. The partnership also paves the way for a smooth transition from Web2 to the more secure, transparent, and efficient frameworks of Web3.

“Io.net and TARS Protocol are combining their strengths to develop cutting-edge tools and services for the AI and Web3 ecosystem. By working together, the two companies aim to seamlessly integrate artificial intelligence with blockchain technology, accelerating the transition from Web2 to Web3 for organizations and developers,” said an Io.net representative.

Over the next six months, Io.net and TARS Protocol have planned a series of joint marketing activities to highlight the collaborative initiatives. These efforts aim to attract over 1,000 developers and businesses, enriching the ecosystems of both platforms.

Despite technological advances and strategic partnerships, Io.net still faces challenges in market adoption and token performance. The IO Token, which is crucial for transactions in the Io.net ecosystem, is still down about 70% from its all-time high.

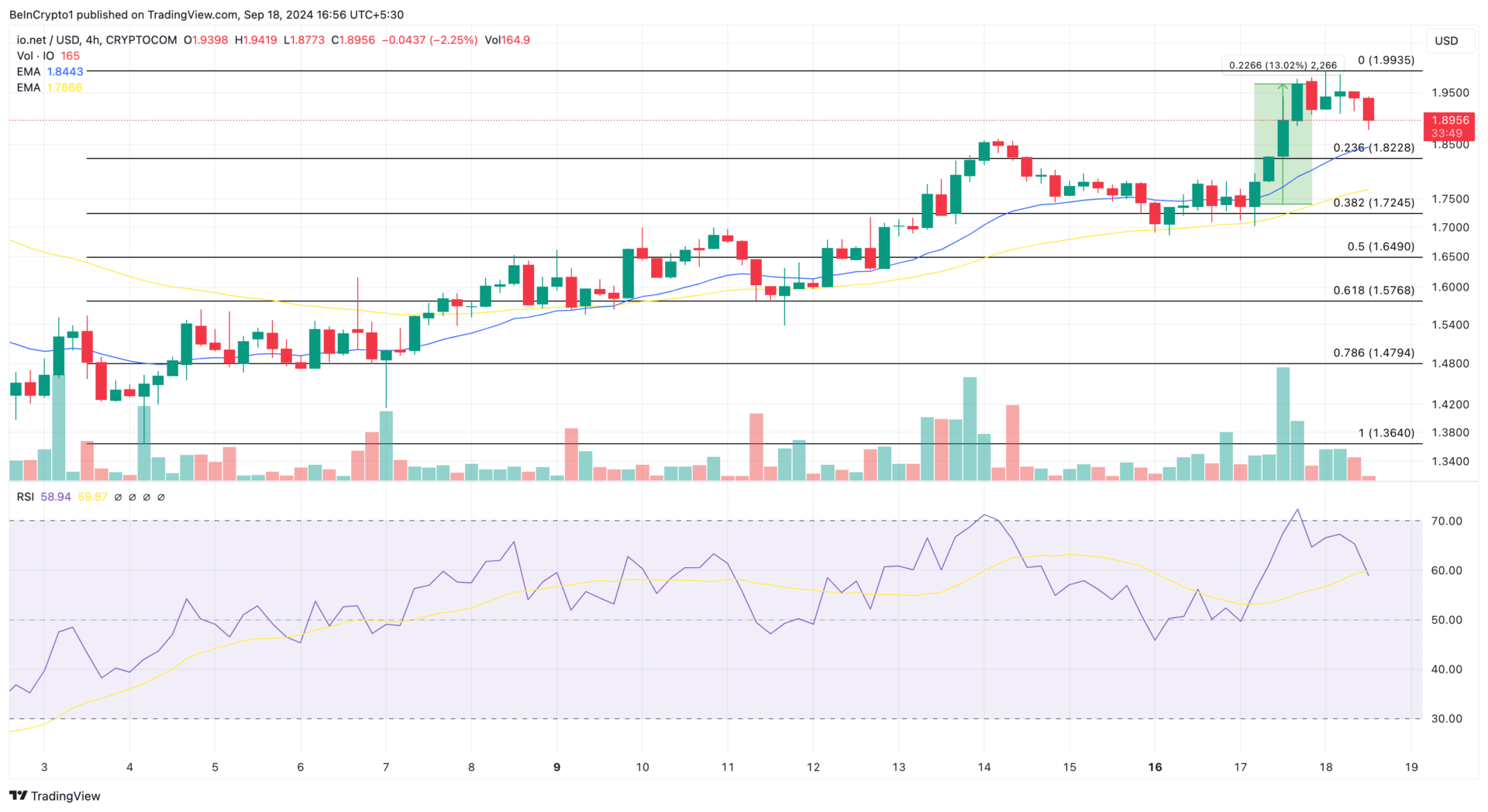

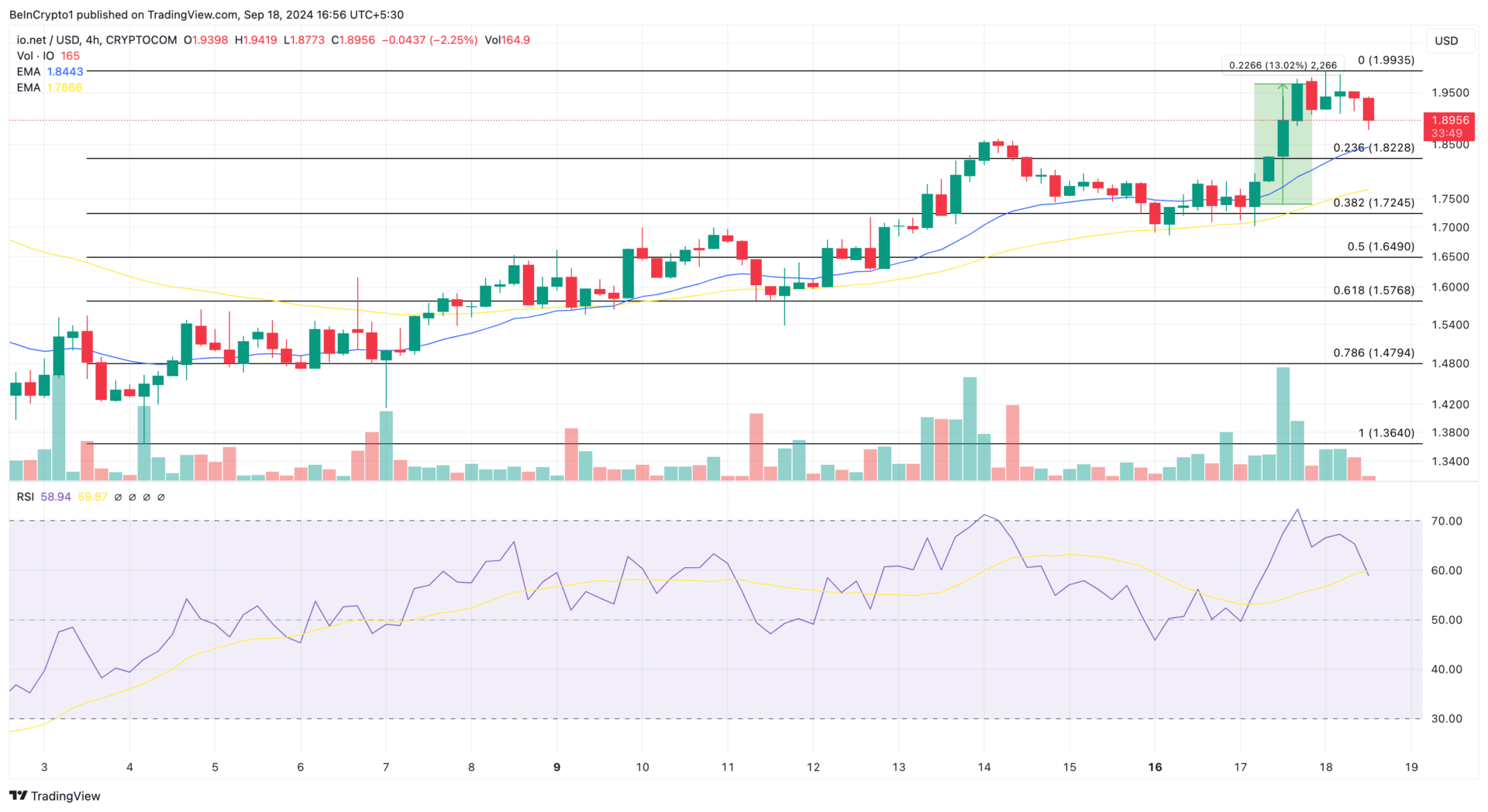

Recent trading data from September 17 shows market volatility, with IO Token experiencing a short-term 13% price spike, followed by a drop.

IO technical analysis shows a possible downtrend. Relative Strength Index (RSI) shows a decrease in momentum.

The analysis also suggests that the price could drop to $1.57, which corresponds to the 61.8% Fibonacci retracement level, before possibly recovering to around $1.99 as a potential recovery point.