Once yet again, Arbitrum-associated bridges grew to become a “concern” for the neighborhood when a technical write-up was a short while ago shared, which uncovered some hidden vulnerabilities in this item.

Is the Arbitrum bridge definitely buggy?

Twitter account tincho a short while ago published a blog site publish, showcasing his private views on the vulnerability in the bridge among Arbitrum and Ethereum.

If you consider the @arbitrum bridge is protected, message traps will make you consider twice.

No want to fret even though. It’s all planned!https://t.co/MzbVIlpQv7

— tincho (@tinchoabbate) December 8, 2022

Before an in-depth evaluation of prospective vulnerabilities, the publish listed the vital phases of a bridge, exclusively:

- Data transfer from L2 to L1

- Waiting for an “Encouraged Relay” to obtain the information message and send it to L1.

- At layer one (i.e. Ethereum mainnet), the over information will be loaded into the Smart Contract for execution, hence assisting end users withdraw income from the other finish of the bridge.

Consequently, the three vulnerabilities highlighted by the write-up are in the final phase, i.e. information transmission and authentication to the recipient. At the similar time, the writer did not overlook to assess with how the Optimism bridge handles the over challenges and partly demonstrates the “support” frame of mind of the answer of this opponent.

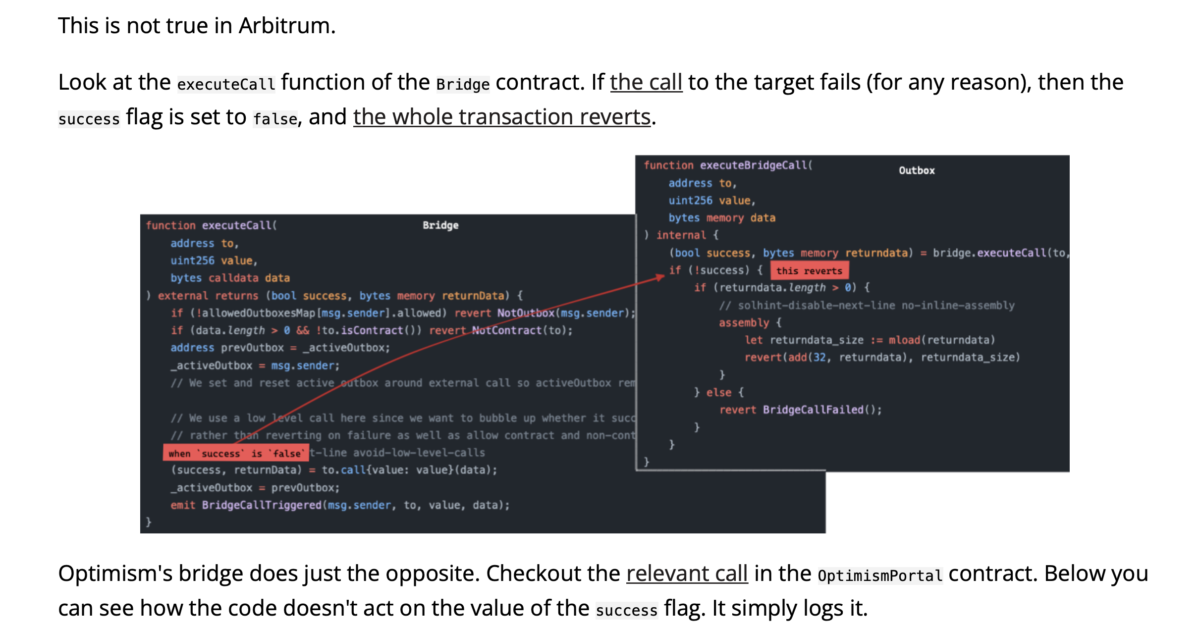

First flaw: The writer believes that the “true-false” worth registration stage of the Execute Call perform leaves an chance for the attacker. As a end result, the Relayer can actively pass “False (false)” information constantly to the perform, from which it can generate a loop right up until its authentic goal is pleased. The writer also factors out that information transmission from L2->L1 can truly be “reprovable”, which suggests repeated trial and error.

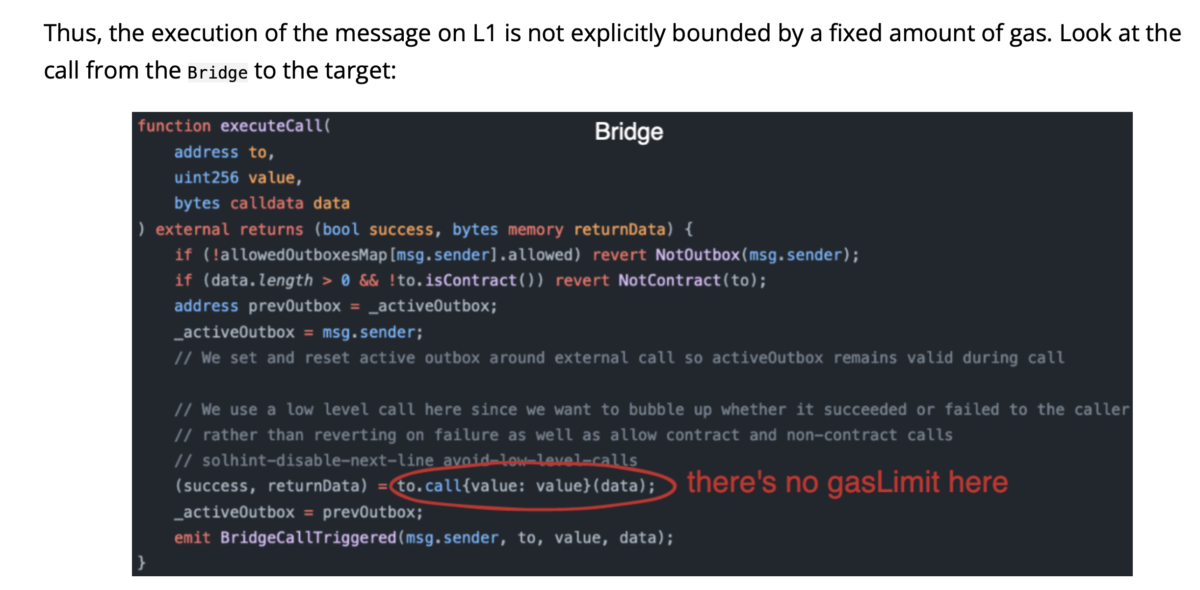

Second defect: The write-up claims that the information transfer perform from L2 -> L1 is not restricted by a distinct fuel degree. As a end result, there is no fuel cap that could trick an attacker into regularly prioritizing his information phone transaction and at the similar time purposefully and promptly sucking up Relayer’s income if anything goes incorrect.

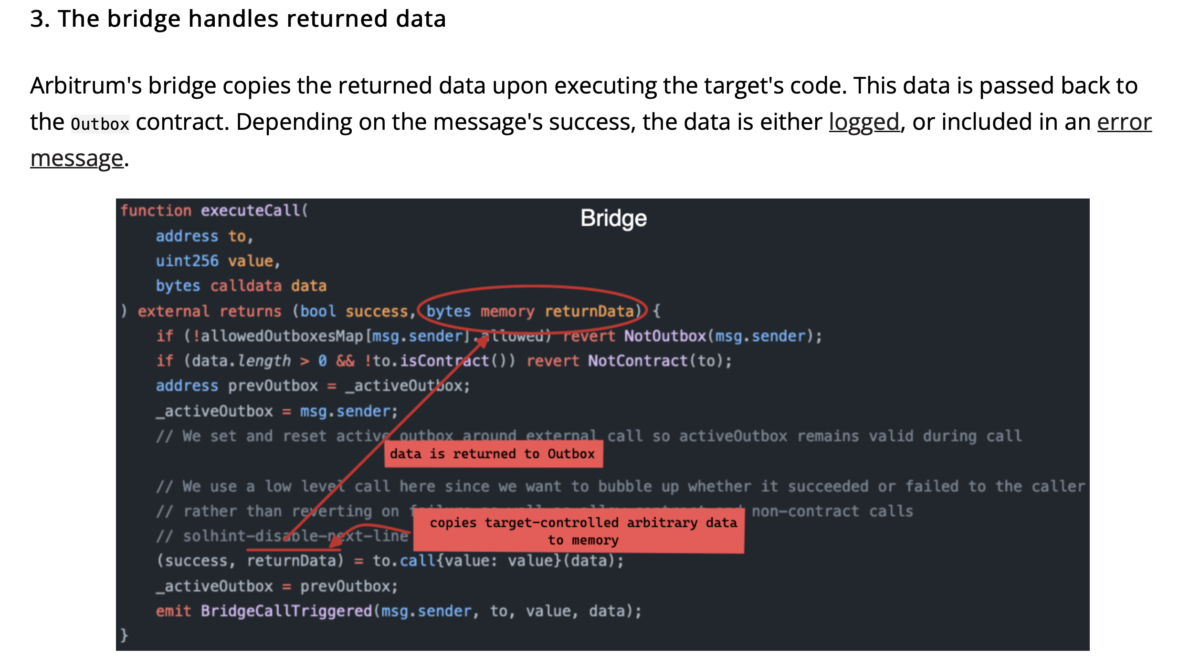

Third flaw: The writer believes that copying return_Data will generate stress on information storage in memory. Copying the worth into this return_Data variable can generate a loophole that lets an attacker to repeatedly keep the worth above and above yet again, triggering fuel expenditures to spiral uncontrollably.

Feedback from the Arbitrum staff

Shortly thereafter, Arbitrum founder and CTO Harry Kalodner also tweeted in response to these worries.

As for the worries about the forwarder getting a incorrect pattern and spam the worth in the Make Call characteristic. CTO Arbitrum mentioned:

Anyone who has switched from Arbitrum to Ethereum understands that we anticipate end users to redeem their Ethereum withdrawals following a week.

After a week, the consumer himself “claims” his withdrawal. There are no third-get together repeaters, both in style or in practice.

— Harry Kalodner (💙,💙) (@hkalodner) December 11, 2022

“Everyone working with the Arbitrum -> Ethereum bridge understands that we anticipate men and women to withdraw from Ethereum inside of one week. After one week, end users can request this withdrawal volume by themselves. No third get together relayers interfere with the style or execution.

Talking about the cause for limitless fuel tariffs all through information transfer on Layertwo, this CTO explains that this is a stage in the direction of finish end users:

If a fuel restrict desires to be set to L2 a week just before a transaction is executed (author’s preferred style), there is each and every chance that the transaction may well no longer be legitimate, leaving the user’s money trapped permanently . This hazardous habits is fully prevented in our style.

— Harry Kalodner (💙,💙) (@hkalodner) December 11, 2022

“If the fuel degree is capped at L2 one week just before the transaction is produced, there is a chance that the over transaction will develop into invalid, leaving users’ money locked up permanently. The over phenomenon will be entirely prevented by our style.

Summarizing his total response, Harry Kalodner mentioned that the writer of the over write-up had speculated about an assault on “Relayer” – an object that isn’t going to even exist in this item procedure. At the similar time, CTO Arbitrum mentioned that if you go in the course of the author’s suggestion, it will be like defending the Relayer (a non-existent drive), but it will get the finish consumer into pointless difficulty.

Side stories

After tonight’s “hustle” an account that commonly shares facts on blockchain engineering, Polynya, also has suggestions for end users when bridging L2-L1.

Given that Arbitrum One comes in third area in some vital financial exercise metrics, now behind only Ethereum and BSC, I advise towards working with it – it can be the weakest website link (quick upgradability with an opaque four out of six multi-sig) lo tends to make it exceptionally higher dangerhttps://t.co/pBrQJune1F

— polynya (@apolynya) December 11, 2022

“Since Arbitrum One ranks 3rd in terms of assets locked (behind Ethereum and BSC), I consider you need to be cautious when working with it. The weakest website link that poses a massive danger is that urgent modify updates will only want four/six multi-sig signatures to get authorized.

Previously, a technical researcher, bartek.eth, was also constantly posting content material revolving all around the background of information transmission among L1 and L2. If you are interested, you can read through this author’s thread yet again to get a new standpoint on the connection among blockchain networks!

The total message exchange mechanism L2 –> L1 can be summarized in this diagram /14 pic.twitter.com/RkPDcwRknC

— bartek.eth (@bkiepuszewski) December 9, 2022

Returning to the story of the Arbitrum bridge, in September Arbitrum Nitro (an up to date model of Arbitrum One) identified a flaw in the Layer-one Ethereum connection. Fortunately, the system was expedited and the aforementioned white hat hacker was credited.

Synthetic currency68

Maybe you are interested: