With the crypto business struggling all through a record bear industry predicament, one particular asset that has polarized analysts is Coinbase stock, which has dropped to new lows.

Bitwise Spend Investment Director Matt Hougan think Coinbase stock is undervalued regardless of a substantial drop in 2022.

According to Hougan, Coinbase raised an $eight billion valuation in 2018. At the time, it had 22 million end users, created $520 million in income, and had $eleven billion in assets. on the platform.

Fast-forward to 2022, income is $three.three billion, has 101 million end users, and the platform’s assets are now $101 billion. Despite these clear indications of development, the corporation is trading at a $9 billion valuation.

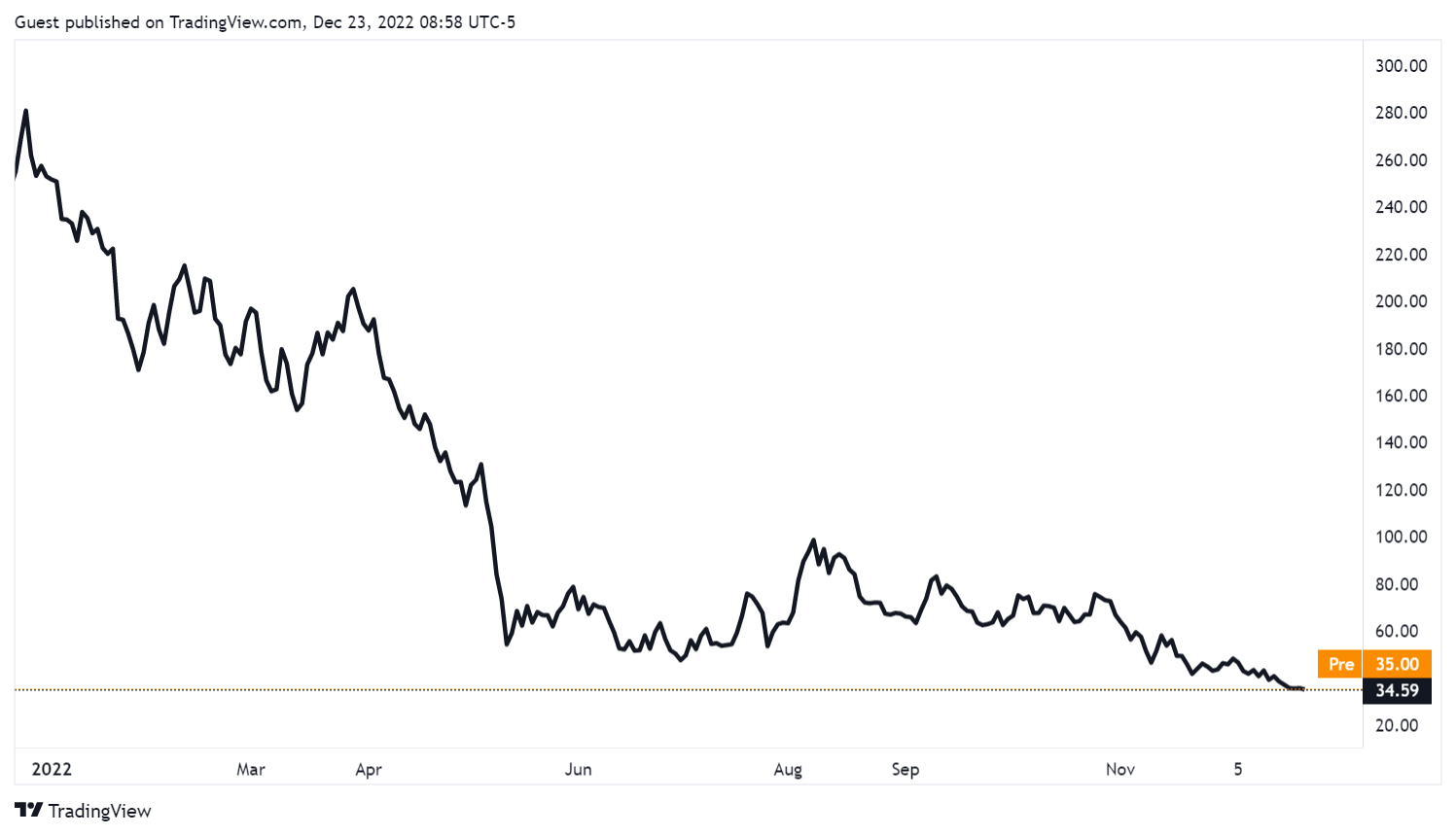

Coinbase Stocks at All-Time Low

Shares of Coinbase have been down considering the fact that the start off of the 12 months, trading close to $35 at press time. This represents a drop of a lot more than 86% in the 12 months-to-date figures.

After the share worth dropped, the exchange’s industry cap dropped to close to $eight billion, when Dogecoin’s industry capitalization even surpassed it at $ten billion. While this does not reflect the intrinsic worth of the exchange, it does present how present industry ailments have impacted it.

Analysts have attributed its stock decline to a amount of aspects, which include the present crypto winter and the reality that the exchange has been burning money at a record price. In the very first 3 quarters of 2022, the exchange recorded a reduction of a lot more than $two billion.

Coinbase’s major supply of income is transaction costs, and the present industry has impacted that. Although there are a lot more consumers, transaction costs are reduce due to the lower in the worth of crypto assets. Competitors like Binance.US have also experimented with to entice traders with new options like zero transaction fees for assets like Bitcoin (BTC).

CEO Brian Armstrong told Bloomberg that he expects the exchange’s income to drop by as considerably as 50% in the present 12 months.

business standpoint

Some have argued that Coinbase is overvalued, pointing to a money burn up, lack of substantial improvement in excess of the many years, and stock compensation for workers. Some industry analysts have downgraded the stock. Recently Mizuho low class underperformer, $thirty price tag target.

Previously, Bank of America has low class stock from Buy to Neutral, $50 price tag target. It mentioned that when the exchange is not the identical as FTX, a serious drop in the worth of Bitcoin will influence its shares.

Many in the crypto local community also share this see, noting that Coinbase was overvalued in 2018. Lazar Wolf tweeted that E*Trade offered for two.five% of assets below management, when JP Morgan was valued at close to ten% AUM.

Wolf additional that he is a Class C investor on the exchange and offered all of his shares final 12 months for $340.

Optimistic see stays

Meanwhile, regardless of the pessimism shared by some analysts, many others share Hougan’s see.

21.co CEO Hany Rashwan expressed belief that Coinbase stock is undervalued. According to him, though Coinbase has misplaced a whole lot this 12 months, it has doubled its share of the fiat exchange industry considering the fact that September.

Rashwan stated that everyone who believes in the prolonged-phrase probable of cryptocurrencies and appreciates Coinbase’s current development and industry share would think about bad industry ailments for a 12 months or two to be a error. He additional:

“They are losing a lot of money, yes. Obviously they should reduce these losses, but I still see a good underlying business.”

Meanwhile, Coinbase CEO Brian Armstrong asserts that the corporation will be close to for the subsequent two decades and believes that traders must invest in COIN shares just like they invest in crypto assets. Armstrong speak:

“We will also be the beneficiaries of increased regulation and diversify our revenue streams away from transaction fees.”