Continuing the story of DAO institutions and new merchandise, nowadays we will understand about Tokemak (TOKE), a resolution to support eliminate liquidity bottlenecks for modest, newborn and non-existent tasks, with the assistance of significant investment money.

Note, readers ought to understand the primary mechanics of breeding pools prior to continuing to study the Tokemak model part beneath. How pools operate, I explained in this illustration publish:

>> See additional: An illustration of volatility when participating in liquidity and agriculture

What is the dilemma that Tokemak (TOKE) solves?

If any of you go to the farm frequently, then you have to be acquainted with the idea of pool one – pool two. This model of regular farming produces a dilemma, which is that external revenue frequently pours into pool one, cultivating the reward. on the head “of the men and women in the pool two.

The weakness of the regular liquidity model, which I talked about in the prior short article on Olympus DAO, if you are interested in pool one – pool two, you can discover out in the short article beneath:

> See additional: Olympus (OHM) – The DAO trend leader or the new “pyramid model”?

Therefore, the dilemma solved by Tokemak will be the efficiency in the liquidity extraction course of action. How tasks can sustain steady liquidity with no acquiring to devote also numerous reward tokens.

Tokemak model and resolution

Parties and participants

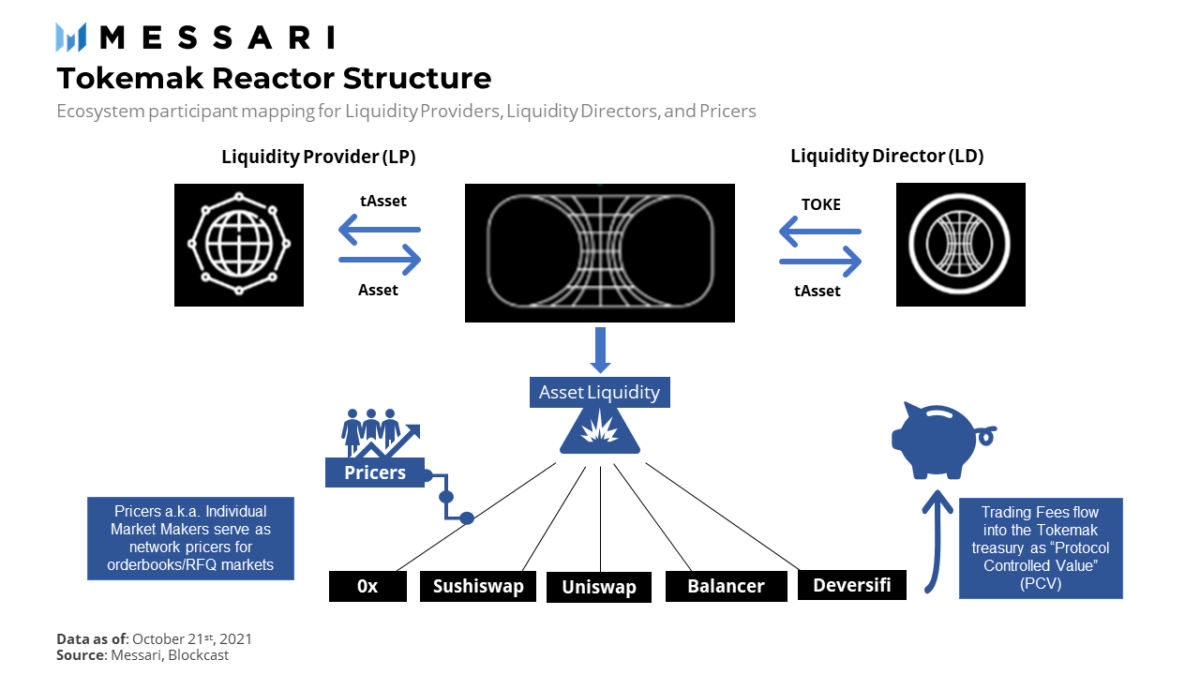

In Messari’s descriptive picture, we can by some means visualize Tokemak’s standard model.

Specifically, I will divide the process into two components: Reactor (meant approximately as the coordination aspect) e Exchanges (liquidity outflow).

In addition to the two components, we will have three player parts:

- The very first is liquidity supplier (LP): Instead of farming straight on the item, they will deliver LP tokens to the Reactor division. From there, they obtain tAsset, approximately the similar as a liquidity contribution certificate to the pool.

- The upcoming is liquidity coordinator (LD): they ought to TOK bet token, which also receives tAsset as a certificate. But in contrast to LP, they will have the appropriate vote to coordinate liquidity from Reactor luxurious exchanges.

- Long final Price: this is the confirmation element of the transaction selling price. For protocols that do not use the AMM mechanism, these rates will be desired to deliver enough information on industry rates.

Solution

So, in contrast to the previous model, Those who participate in the farm deliver liquidity (i.e. LP) will be not acquiring to bear the threat of currently being “unloaded in the head” as a type of independent agriculture. Instead, the Reactor division will have a mechanism to stability the romance amongst assets, curiosity costs and reduce dangers for farmers.

I would like to inform you additional about Mechanism of the reactor. This is the assured aspect fat scale “the amount of LP’s assets in play” and “the amount of TOKE in play by LD”. If the LP side has significantly less assets than the LD side, there will be curiosity fee incentives to appeal to the LP to place additional liquidity into the reactor. Conversely, if LPs bet additional sources than LDs, LDs will be incentivized to place additional TOKE tokens into perform in Reactor.

On the undertaking side, most will have to give up the native token (i.e. the undertaking token) to reward people who deliver liquidity. If these LPs arrive at the farm early, promote the tokens immediately and depart, the undertaking will not be in a position to sustain steady liquidity. This round does not lead to any swaps -> no transaction costs -> the LPs that stay will no longer have incentives to reward -> they carry on to plunge the selling price of the native token.

But Tokemak will be in a position to assure this dilemma. Transaction costs (alternatively of currently being offloaded by person consumers) will be collected by Tokemak, concentrated in the Treasury, producing additional sustained worth for TOKE -> additional men and women target TOKE -> incentivize LP to include additional liquidity on the other side of the reactor -> Liquidity at the top rated of the exchanges will be additional abundant -> Generate additional transaction costs.

Compare with liquidity options

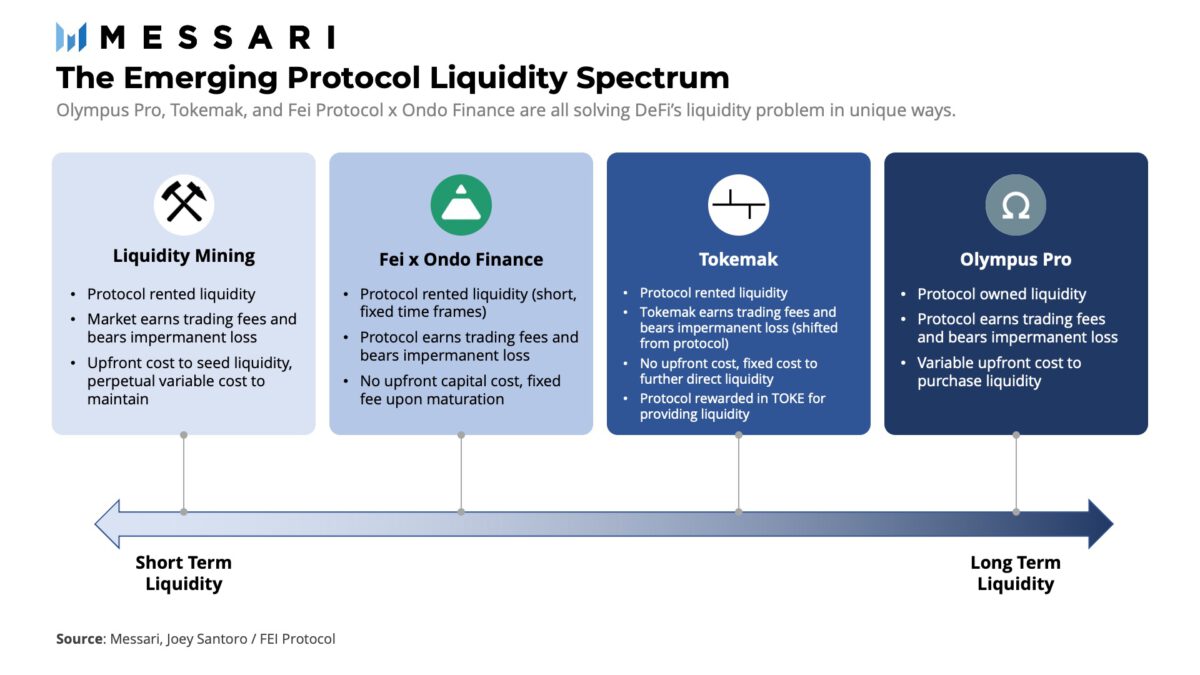

On the lengthy-phrase stability scale for liquidity, Tokemak will be additional steady than regular agricultural designs, but has a reduced rating than the Olympus DAO model.

However, Olympus DAO has designed a new idea identified as “Ownership Protocol”, which approximately implies that the worth of the home will be owned by the Olympus DAO Protocol by means of the sale of Bond – Bonds. So this will partly involve centralization dangers.

Personal remarks on Tokemak

Tokemak defines a roadmap that will attain “Singularity” standing – approximately understood as the revenue in the type of transaction costs earned by the undertaking will be enough to reinvest in the type of “Cash Creation”. That is, Tokemak expects to produce a closed circuit with no based on any single LP.

However, I feel this prospect is nonetheless a lengthy way off and the undertaking side has not announced something about this milestone.

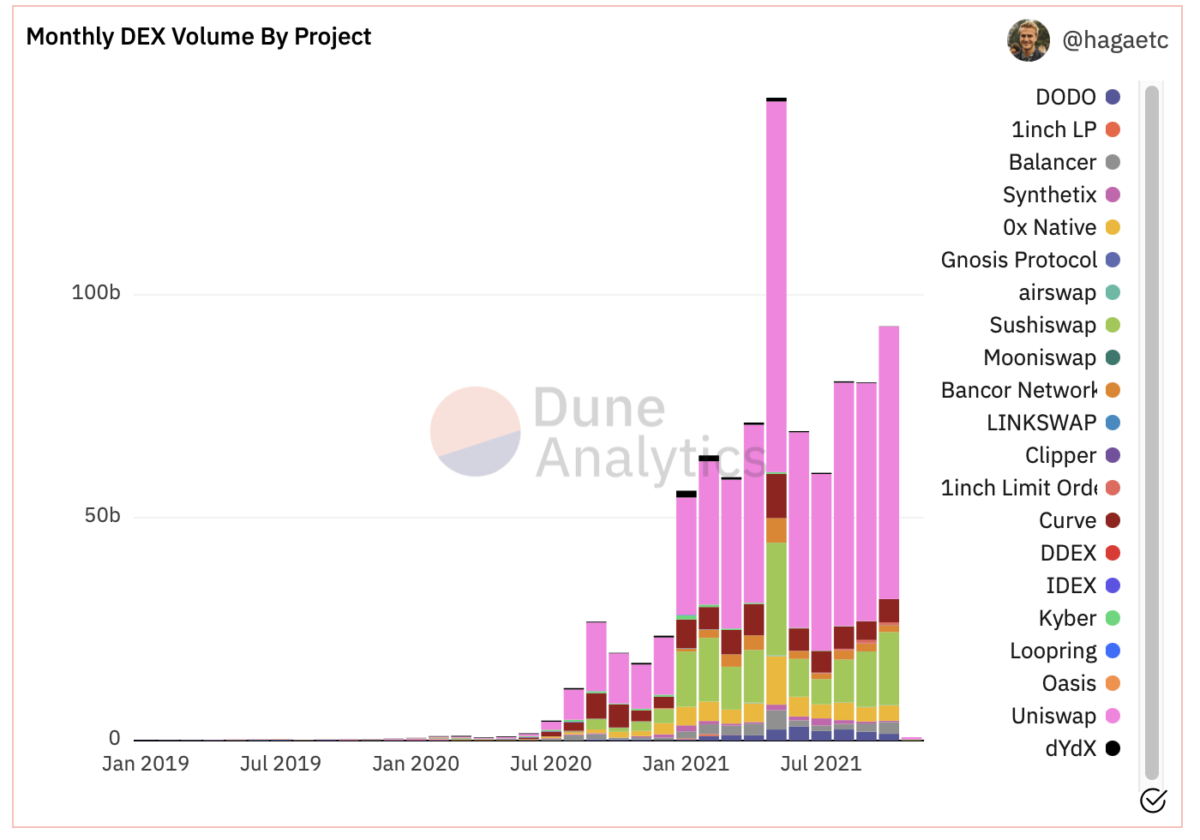

According to statistics, the exchanges that collaborate with Tokemak (this kind of as Uniswap, SushiSwap or 0x, ..) are displaying indications of improvement in terms of volume.

However, there are nonetheless no distinct statistics on the trading pairs supported by Tokemak. Most of these are lower liquidity pairs, so the trading volume is also hard to stabilize.

Finally, the FDV (Fully Diluted Valuation) of the undertaking, which oscillates about six-seven billion bucks, is also also large. Additionally, the early farming mechanism destinations a significant quantity of TOKE tokens in a pool, producing significant barriers for numerous consumers who will join later on.

The large variety of valuations exhibits that traders are very assured in the prospective and effectiveness of this liquidity model. However, if the Reactor model is not robust adequate to stability the bilateral worth of “Token TOKE and Liquidity Added”, it is most likely that there will be a significant divestment from the undertaking token.

finish

Therefore, we have revised Tokemak’s working model, one particular of the DeFi two. tasks that ought to support fix the present liquidity dilemma. I briefly summarize the concepts as follows:

- The dilemma Tokemak discounts with is very urgent.

- The Tokemak model is believed to have superior liquidity stability than the regular agricultural model, but it is not however as steady as the Olympus DAO binding mechanism.

- Tokemak (equivalent to Olympus) encountered a significant barrier when the quantity of worth poured into the undertaking token was significant, producing a barrier for new inflows of revenue and at the similar time triggering an alteration of the stability of “Cash – Project Token” . .

Synthetic Currency 68

Maybe you are interested: