Despite worries surrounding Bitcoin’s power consumption, US multinational investment financial institution Morgan Stanley could be one particular stage closer to turning out to be the biggest Bitcoin holder in the planet this 12 months.

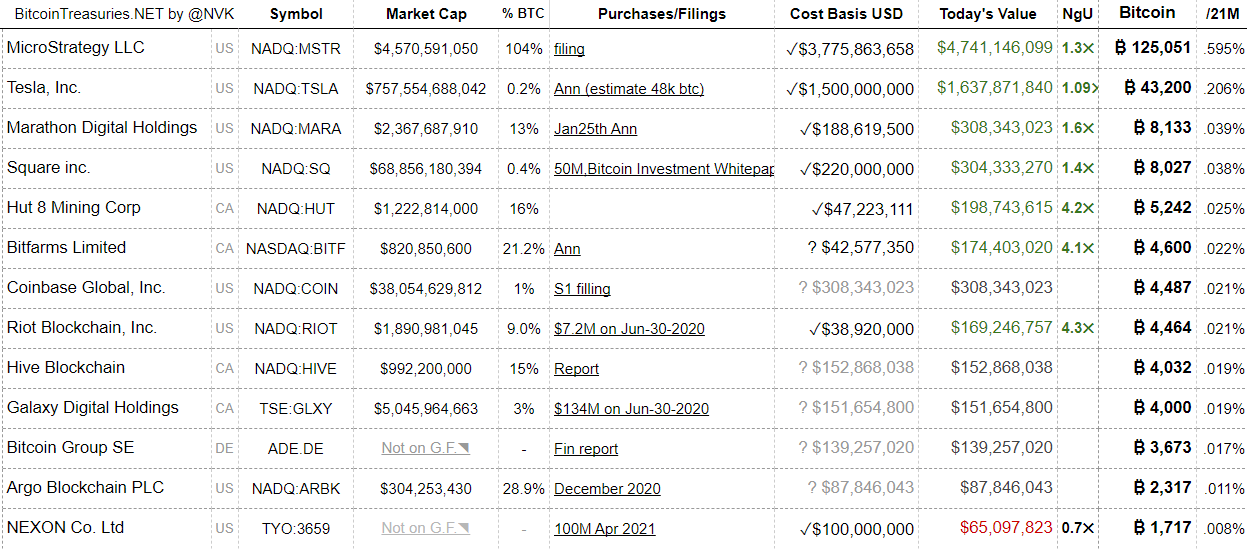

2021 is a wonderful time for Bitcoin as institutional funds flows into the marketplace at breakneck velocity, for illustration, prominent providers this kind of as Microstrategy, Tesla, Galaxy Digital Holdings, Square (now renamed Block) or Coinbase, have invested hundreds, even billions of bucks on the want to accumulate BTC.

However, possibly Morgan Stanley’s “silent” action created the neighborhood fail to remember about its marketplace presence. 28, the MacroScope analyst pointed out that in 2021 the wealth management giant with more than $ four trillion purchased hundreds of thousands of shares of the Grayscale Bitcoin Trust (GBTC). In distinct, GBTC is one particular of the major reputable resources to support big conventional banking institutions like Morgan Stanley accessibility Bitcoin.

Morgan Stanley’s asset management arm purchased hundreds of thousands of shares of Grayscale BTC in 2021.

Morgan is just a important raise in ownership on a big amount of its institutional money. These are typically double-digit percentage increases, up to 26% at the major finish.

– MacroScope (@ MacroScope17) February 28, 2022

The analyst also hints at a substantial raise in Morgan Stanley ownership in quite a few of the bank’s subsidiary money. According to the stability sheet, the major revenue that Morgan Stanley is creating fluctuates in double digits, with a development charge of up to 26%. Based on information as of December 31, 2021, the bank’s portfolio in the Growth Portfolio fund has grown to four.29 million GBTC shares.

Example: Morgan’s Growth Portfolio reported four,293,502 shares, an raise of 18%.

Here is a spreadsheet with the new percentage modifications for every single fund. The symbols you see commencing with “M” are Morgan money:https://t.co/hVClRTPyva

Data is as of December 31st.

Here are today’s information …

– MacroScope (@ MacroScope17) February 28, 2022

However, when you appear at the greater image, traders will have to come to feel definitely “shaky” about the complete worth of the shares held by Morgan Stanley. It is estimated that by November 2021, in addition to the Growth Portfolio fund, the Morgan Stanley Insight fund has enhanced the sum of GBTC shares by much more than 63%, from 928,051 in the 2nd quarter of 2021 to one,520,549. In addition, the Morgan Stanley Global Opportunity Portfolio fund owns one,463,714 GBTC, up 59% from 919,805 shares in the 3 months of the exact same time period.

Global Opportunity Portfolio (as of June thirty): 919,805

shares

Global Opportunity Portfolio (as of September thirty): one,463,714 sharesOther Morgan money that very own Grayscale BTC also showed robust percentage increases.

View all new paperwork right here:https://t.co/de7st3ZAmC

– MacroScope (@ MacroScope17) November 24, 2021

From the over proof, it can be mentioned that Morgan Stanley has been and is one particular of the biggest institutional traders in Bitcoin and is probable to even further raise its publicity this 12 months. However, there are now no clear indications from the financial institution on including much more BTC to their portfolios or possibly Morgan Stanley does not want to disclose this publicly.

But the basis for the over action is wholly justified. Because prior to stepping into the game with the cryptocurrency marketplace, Morgan Stanley ready pretty very carefully in all elements and created quite a few daring selections that couple of conventional banking institutions are “confident” ample to discipline.

The initially is the official move to give prospects the appropriate to invest in Bitcoin, albeit only below selected circumstances, the growth of choices for BTC investment money and last but not least the launch of a investigate group to conserve their cryptocurrency. . This is ample to see that Morgan Stanley has wonderful ambitions for the potential and it is hugely probable that it will not “stop” appropriate now. Recall that in March 2021, immediately after rumors spread that important gamers had been going to “activate” Bitcoin by way of an unprecedented “Justice League” in background, Morgan Stanley was the identify that fired the initially shot for this occasion.

Synthetic currency 68

Maybe you are interested: