- JPMorgan’s $102 million investment in BitMine signifies Ethereum growth.

- BitMine becomes largest Ethereum reserve company.

- Potential Ethereum market impacts from JPMorgan’s stake.

JPMorgan Chase & Co. disclosed a $102 million investment in BitMine Immersion Technologies, holding 1,974,144 shares, according to a November 7 SEC filing.

This signifies growing institutional interest in Ethereum as BitMine transforms into a major Ethereum reserve entity, affecting crypto market dynamics and signaling confidence in ETH’s future.

JPMorgan Chase & Co. disclosed via a 13F-HR SEC filing on November 7 that it acquired 1,974,144 shares of BitMine Immersion Technologies as of September 30, 2025. This acquisition equates to a valuation of approximately $102 million.

BitMine Immersion Technologies, once a Bitcoin mining firm, has transitioned into an Ethereum reserve company in early 2025. This strategic shift mirrors MicroStrategy’s earlier pivot, indicating a growing corporate confidence in holding Ethereum as a treasury asset.

The investment provides JPMorgan with indirect exposure to Ethereum’s price movements, solidifying institutional confidence in Ethereum-related assets. BitMine’s reserves of over 3.24 million ETH further affirm its position as the world’s largest Ethereum reserve company.

The move signifies a notable milestone for Ethereum, potentially boosting its market standing amidst recent market fluctuations. JPMorgan’s confidence in Ethereum could incite similar actions from other financial institutions, expanding Ethereum’s role in corporate treasuries.

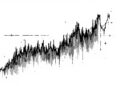

Market analysts from JPMorgan note a downturn in crypto market value, impacting futures and staking metrics. This decline offers a challenge for cryptocurrencies amidst institutional adoption efforts, as noted in JPMorgan’s research notes.

Previous trends, like MicroStrategy’s Bitcoin acquisition, suggest similar potential regulatory and technological pivot points for Ethereum. Historical corporate strategies in cryptocurrency acquisitions further illustrate changing institutional investment behaviors, which could influence future market developments.

“Overall, we believe that perpetual futures are the most important instruments to watch in the current juncture, and the message from the recent stabilization is that deleveraging in perpetual futures is likely behind us.” — JPMorgan Research Analysts, JPMorgan