The Juno blockchain (JUNO) venture developed on the Cosmos platform is getting a sizzling subject in the cryptocurrency neighborhood due to the new phase of “self-destruction”.

Drama among Juno and the Japanese “whale”

Juno (JUNO) is a intelligent contract building protocol for the Cosmos ecosystem, launched in 2021.

In February 2022, Juno carried out an airdrop of his JUNO token to the holders of the Cosmos ATOM token. Specifically, individuals who stake ATOM tokens on Cosmos Hub will get JUNO with a ratio of one: one. The Juno advancement staff has set the highest airdrop restrict for each and every wallet at 50,000 JUNO to avert the token from staying centralized by a number of end users.

However, Juno’s staff did not consider into account the truth that a “whale” with numerous wallets could get a massive sum of tokens. This is precisely what occurred when Takumi Asano, a 24-12 months-outdated Japanese cryptocurrency investor, acquired an airdrop of additional than ten% of JUNO’s complete provide, really worth above $ 120 million at the time.

Most notably, Asano is the head of CCN, a Japanese cryptocurrency investment neighborhood with above 50 ATOM staking portfolios by members. Answer the interview CoinDesk, Asano claims he acquired a believe in from his neighborhood for the ATOM web-site and split it into 50 wallets “for security reasons”. He announced that he would distribute JUNO to members primarily based on their contribution price.

Realizing that their fledgling network would quickly be concentrated in the hands of the “whales”, the neighborhood of Juno in March initiated Proposition sixteen, a proposal that necessary the confiscation of Asano’s money and the reduction of only 50,000 JUNO in the portfolio of this investor equals the highest you can get. Juno then authorized the proposal with forty.85% in favor, 33.75% towards, 21.79% abstention and three.59% towards with a veto.

What occurred subsequent produced the scenario even additional complicated. Also in March, the Juno network was attacked and blocked for various days, creating the rate of JUNO to drop by additional than 60%. Asano then claimed that it was Juno’s advancement staff that launched the token to reduce the rate in purchase to divert awareness from his proposal to confiscate the token.

【The key result in of Juno’s rate drop following Prop16】

Why did Juno’s rate drop from Prop sixteen?

Is it due to the fact CCN is marketing?

– No, we did not even promote one JUNO from Prop sixteen.So who sells?

– @wolfcontract .https://t.co/Lki8PTzrX9– Takumi Asano (朝野 巧 己) | GAME ⚛️ | Juno Whale🐳 (@takumiasano_jp) April 27, 2022

However, on April thirty, the neighborhood of Juno continued to approve Proposition twenty, figuring out the time to confiscate the Juno of Asano on May five, 2022, with mind-boggling assistance of up to 70%.

Proposal twenty stated that following negotiating with Takumi Asano, Juno’s staff recognized that the nature of CCN is a cryptocurrency support and not an investment fund, so it does not meet the situations to get the airdrop. The proposal for that reason closed the likelihood of confiscating all tokens in Asano, leaving only 50,000 JUNOs.

The story of the blockchain tough fork reverses transactions

The blockchain tough fork to cancel a transaction is not unusual, the most famed staying the 2016 Ethereum (ETH) The DAO Hack occasion. At that time, the Ethereum DAO contract was breached and taken by hackers, paying three.six million ETH, equivalent to 31% of the ETH of the DAO organization. That ETH is now really worth additional than $ eleven billion. Because the harm was so excellent, Ethereum determined to tough fork the blockchain to reverse the transaction and get the revenue back from the hacker.

However, aspect of the neighborhood disagrees with the over method, stating that “The code is law” and can not be modified as this kind of, main to the birth of Ethereum Classic (And so forth), the blockchain on which The DAO Hack occasions nonetheless happen. The identity of the hacker was not unveiled until finally 2022.

Asano declares that his act of getting the tokens is fully legitimate and states that CCN is a genuine neighborhood, the project’s lure to the neighborhood to consider away his tokens is an abuse of energy when in actuality all his actions do not violate any legislation and also do not assault the venture. Therefore, this “whale” threatens to consider legal action based on the subsequent move of the venture.

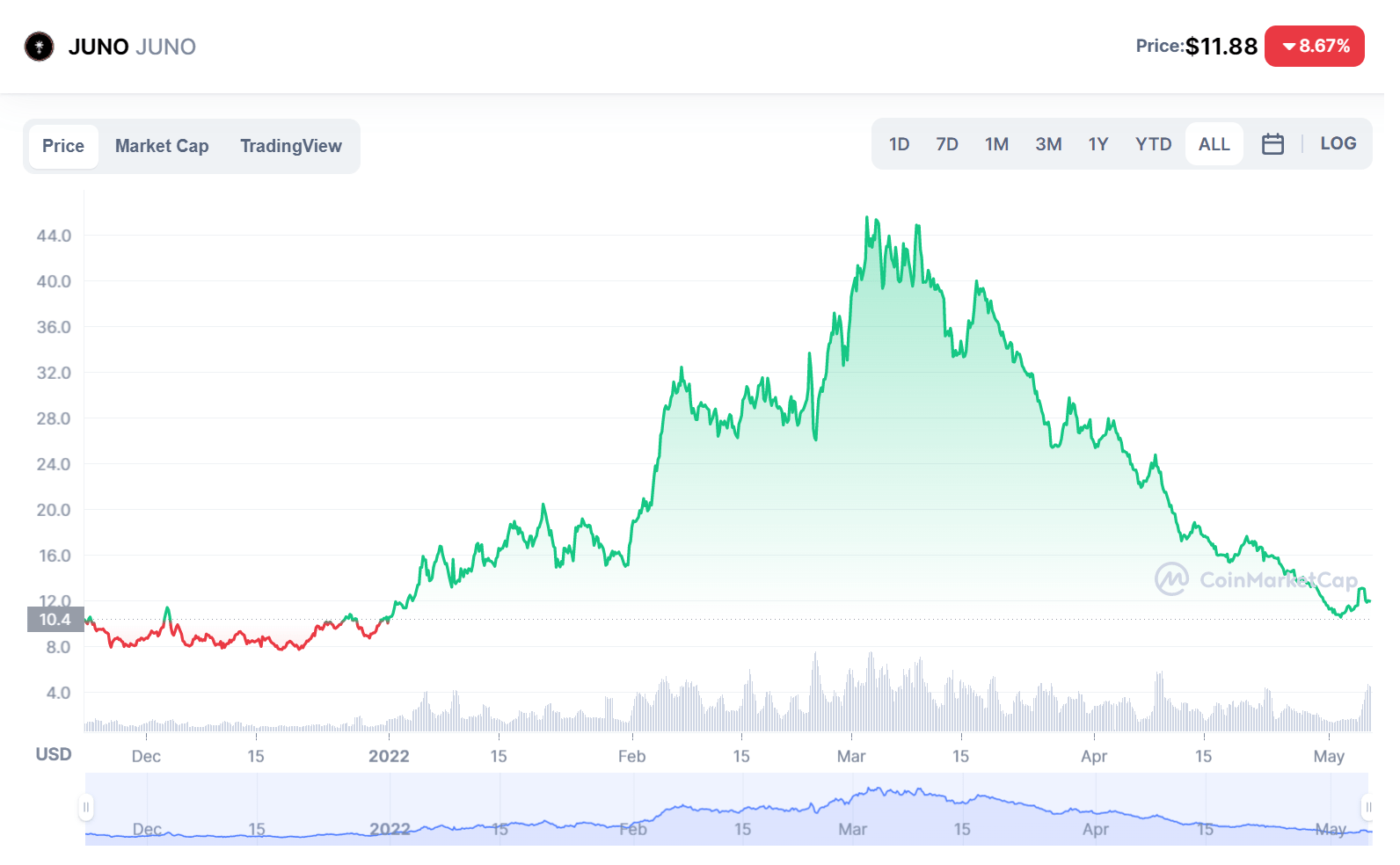

During that time, JUNO’s rate continued to drop from a peak of $ 45 to about $ eleven at press time, and the $ 120 million Asano token is now only really worth about $ 36 million.

Copy-paste error produced $ 36 million JUNO “go underground”

I imagined a great deal of drama was sufficient, but the Juno neighborhood nonetheless knew how to develop additional highlights.

After approving the selection to confiscate the token, the venture carried out a blockchain tough fork on May five. However, following the update was implemented, the advancement staff did not see the revenue from Asano’s wallets transferred to the deal with they specified, though Asano’s wallet had previously been deducted.

After some checking, they had been shocked when they discovered that as a substitute of copying and pasting the getting wallet deal with into the update code, they pasted the incorrect transaction hash. As a outcome, the other $ 36 million really worth of tokens was sent to “nothing”.

– Takumi Asano (朝野 巧 己) | GAME ⚛️ | Juno Whale🐳 (@takumiasano_jp) May 5, 2022

Specifically, the Juno network has up to 120 validators, which are accountable for verifying transactions and checking for updates this kind of as Proposition twenty, but none found this vulnerability until finally it was as well late.

Daniel Hwang, the head of Stakefish, 1 of Juno’s validators, provides an interview CoinDesk:

“We made an unacceptable mistake. It is true that programmers may have faulty code, but in the end it is the validators who are responsible for verifying the lines of code we launch ourselves ”.

However, as a substitute of agreeing to “burn” the aforementioned token, Juno’s advancement staff swiftly ready Proposition 21, a tough fork blockchain as soon as once again to reverse the transaction by sending revenue into thin air to the project’s wallet.

Synthetic currency 68

Maybe you are interested: