Justin Sun’s series of transactions that issued $800 million well worth of TUSD stablecoins is sparking curiosity in the local community.

Justin Sun took an uncommon action by printing much more than $800 million well worth of TUSD stablecoin

Justin Sun took an uncommon action by printing much more than $800 million well worth of TUSD stablecoin

Justin Sun mint then burned TUSD once again, moving the place to stUSDT

In the early morning of September sixteen, 2023, Justin Sun, a member of the board of directors of Huobi Global (now Cooperative), issued a massive sum of TrueUSD (TUSD) stablecoin. This move caught the awareness of traders as above $815 million was place into circulation in much less than 15 minutes.

TUSD Stablecoin Market Cap Swings Over $800 Million Due to Justin Sun’s Move

TUSD Stablecoin Market Cap Swings Over $800 Million Due to Justin Sun’s Move

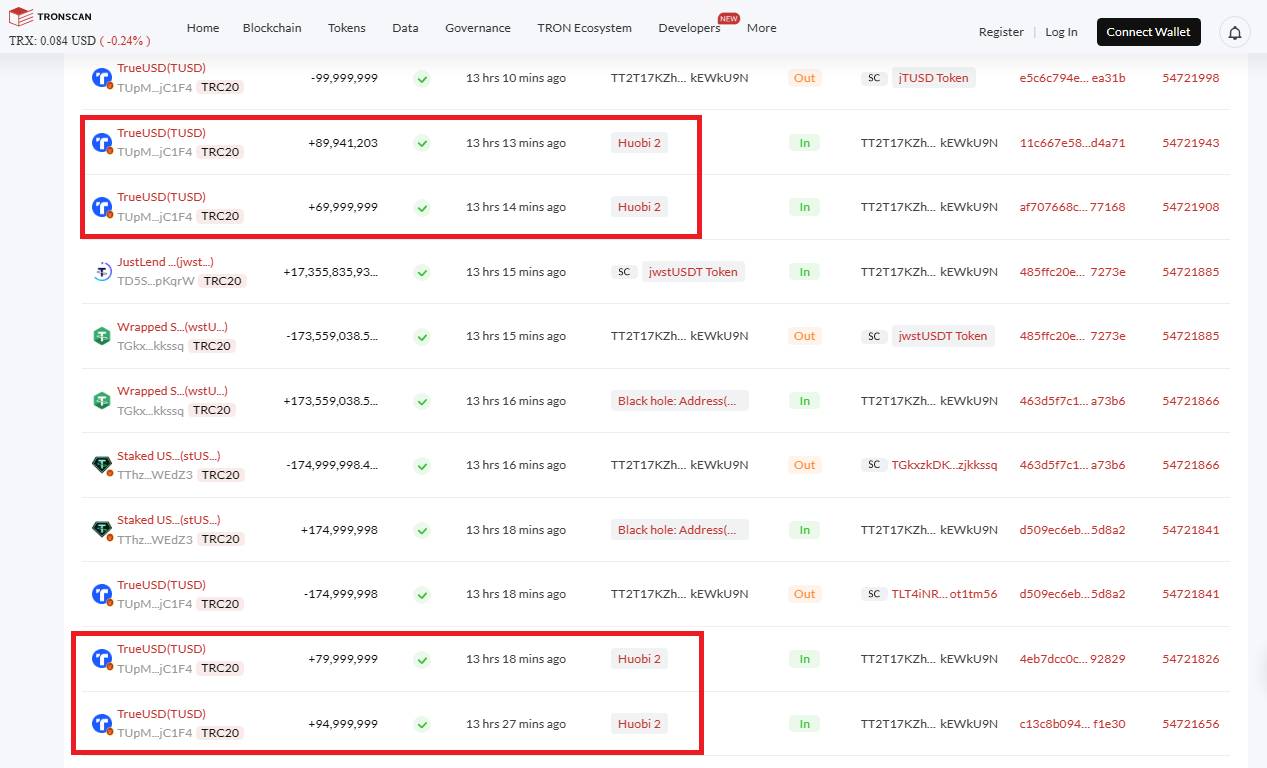

Data Tronscan reviews that as of somewhere around ten.45pm on September 15, 2023, Vietnam time, the $815 million TUSD stablecoin was minted straight on the TRON blockchain as a result of ten transactions. With just about every minting, TUSD is transferred to a new wallet tackle, quickly just after, the over wallet addresses execute all cash transfer orders to the Huobi two sizzling wallet.

So, a series of 9 transactions from Huobi tackle two sent TUSD a complete worth of somewhere around $815 million wallet address “TT2T17KZhoDu47i2E4FWxfG79zdkEWkU9N” Managed by Justin Sun.

The series of 9 transactions from Huobi tackle two sent TUSD with a complete worth of somewhere around $815 million

The series of 9 transactions from Huobi tackle two sent TUSD with a complete worth of somewhere around $815 million

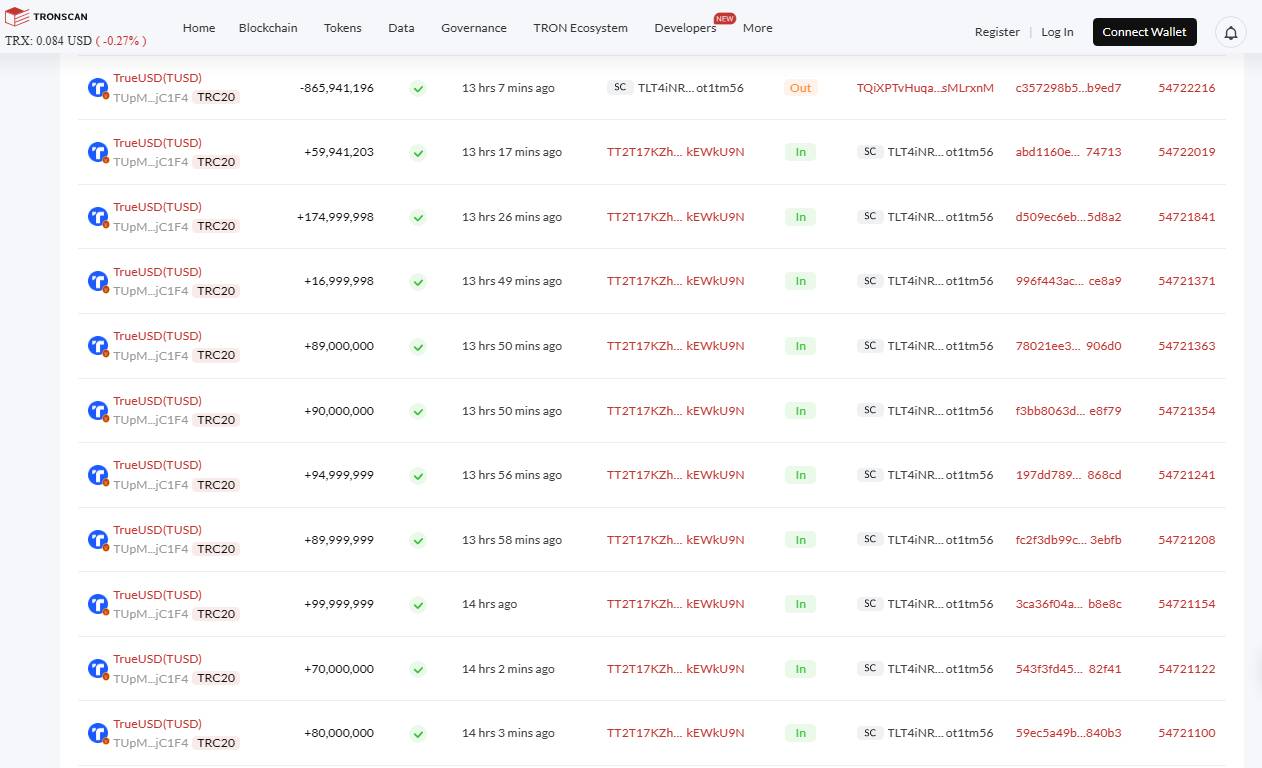

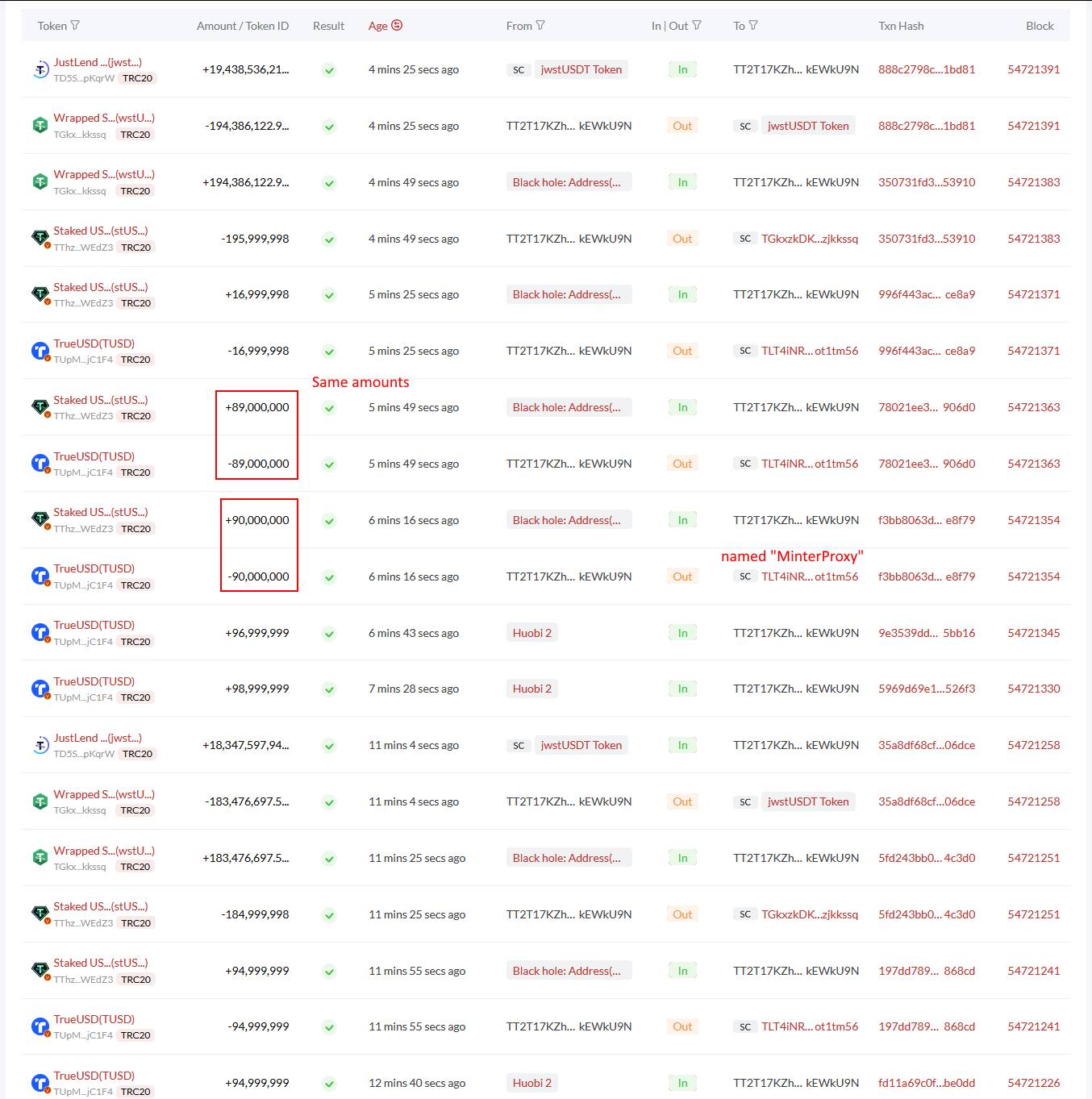

Continuing, the complete sum current in the wallet tackle managed by Justin Sun is sent to one particular Contract without label Is referred to as “MinterProxy”. Minterproxy then sent 865 million TUSD to the tackle “TQiXPTvHuqaBW94pqrbgwptkSFXsMLrxnM”from there proceed to burn up the tokens.

Minterproxy sent 865 million TUSD to the tackle “TQiXPTvHuqaBW94pqrbgwptkSFXsMLrxnM”, from which the tokens had been burned.

However, the burning of TUSD seems to “coincide perfectly” with the minting of stUSDT. In above ten transactions, $865 million of stUSDT was transferred Address wallet “TT2T17KZhoDu47i2E4FWxfG79zdkEWkU9N” from the founder of Tron.

865 million USD stUSDT was transferred to Justin Sun’s wallet tackle TT2T17KZhoDu47i2E4FWxfG79zdkEWkU9N

865 million USD stUSDT was transferred to Justin Sun’s wallet tackle TT2T17KZhoDu47i2E4FWxfG79zdkEWkU9N

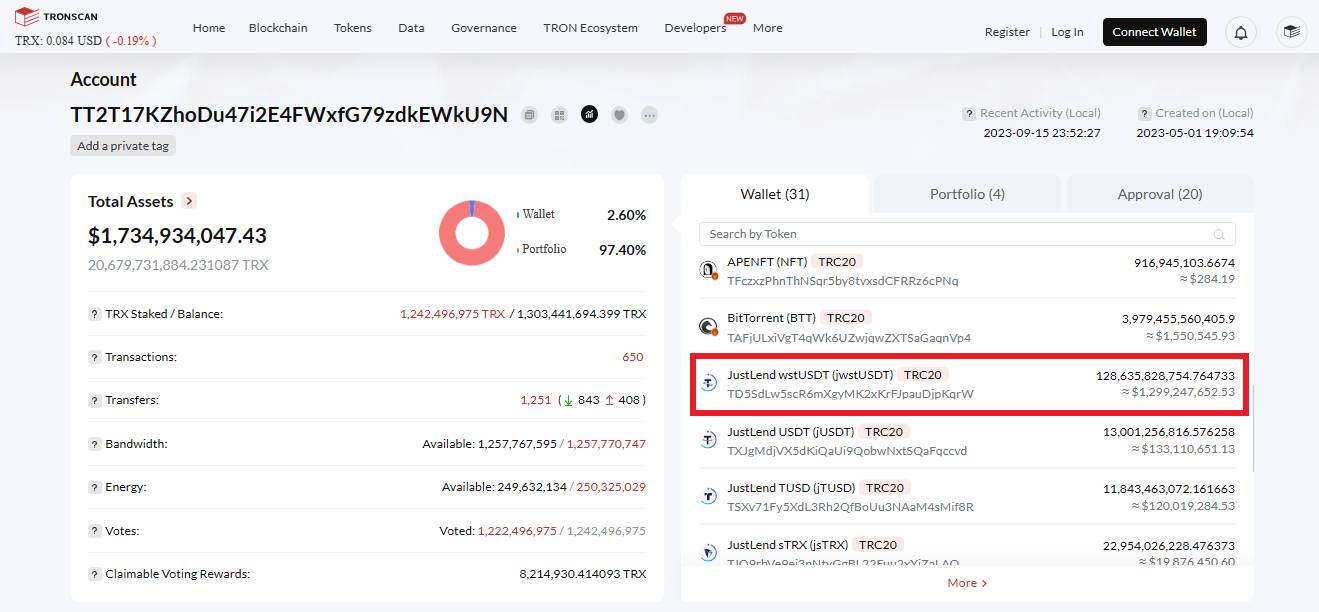

Justin Sun then sent stUSDT to the JustLend lending platform on TRON as a result of six diverse transactions. According to Tronscan information, these deposits signify half of Sun’s $one.three billion JustLend place.

The stUSDT deposit represents half of Justin Sun’s $one.three billion JustLend place. Photo: Tronscan

The stUSDT deposit represents half of Justin Sun’s $one.three billion JustLend place. Photo: Tronscan

stUSDT is the liquid USDT staking token on TRON, now yielding four.21%, with the declare that this yield comes from actual-globe assets (RWA). According to the stUSDT web-site, the yield is produced as a result of “high-quality short-term government bonds.” This merchandise now has much more than 351,000 consumers.

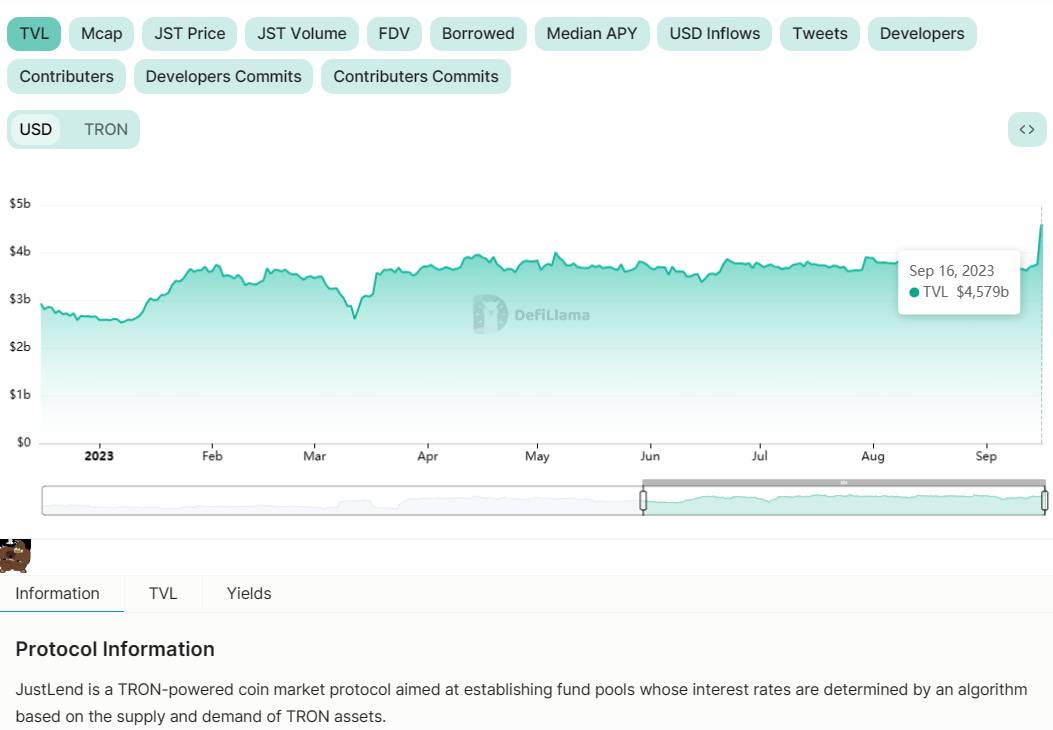

Second data by DeFiLlama, JustLend’s complete worth locked (TVL) enhanced 22% from $three.75 billion to $four.57 billion following Justin Sun’s filings.

JustLend’s TVL enhanced 22%, from $three.75 billion to $four.57 billion, following Justin Sun’s filings.

JustLend’s TVL enhanced 22%, from $three.75 billion to $four.57 billion, following Justin Sun’s filings.

Tether denies association with stUSDT

This revelation came through a statement from a Tether spokesperson. In a current interview by CryptoSlatea Tether representative mentioned that “stUSDT is an independent project and is not affiliated with Tether.”

First/ @Tether_to (USDT), a big stablecoin issuer, obviously denies any affiliation with the Justin Sun-linked Staked Tether (stUSDT) protocol. A Big Contradiction #stUSDTof partnership with Tether. #CryptoNews

as a result of @hardeyjumoh https://t.co/zxV2ihGUVW

—CryptoSlate (@CryptoSlate) September 15, 2023

This statement straight contradicts stUSDT’s declare of a near romantic relationship with Tether, which has been prominently displayed on its official web-site. Among the tasks listed as stUSDT partners are Justin Sun-affiliated entities this kind of as HTX (formerly recognized as Huobi), JustLend, MetaMask, and TrueUSD (TUSD).

Justin Sun, who was charged by the SEC with fraud and other securities law violations in March 2023, mentioned the transactions associated to his personalized money and not Huobi’s organization operations.

Furthermore, in July 2023, the founder of Archblocks accused Justin Sun of becoming the one particular who acquired the TUSD issuing firm as a result of several shell corporations. And due to the fact then, a series of FUD has surrounded the Huobi exchange and founder Justin Sun, prompting the investigation of a variety of senior executives in China and the sale of USDT.

Archblock founder claims Justin Sun was a secret purchaser of TUSD in (not precisely surprising) lawsuit pic.twitter.com/ybTPmSOmtk

— db (@level10k) July 17, 2023

When asked by an investor about the origin of the TUSD reserve money movement and wherever the cash to pay out the stUSDT yields comes from, Justin Sun responded: “It’s all in US Treasuries.”

reply to all: Treasury Bonds

— SE Justin Sun 孙宇晨 (@justinsuntron) September 15, 2023

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!