KuCoin Token has emerged as the top performing cryptocurrency in the market, with a 3% increase in the past 24 hours. This price increase has brought significant profits to a part of the short-term Holder group (STH).

However, the nature of these investors, who often aim to take advantage of short-term price movements, threatens the sustainability of KCS’s recent gains. The analysis below explains why.

Short-Term Holding Threatens KCS

KCS has seen a 376% increase in trading volume over the past 24 hours, pushing the price up another 3% over the same period. Thanks to this rally, many KCS STHs are now profitable, reflected in the MVRV Long/Short Difference index at a 30-day low of -7.98%.

An asset’s MVRV Long/Short Difference measures the relative returns between long-term and short-term holders. When this index is positive, it suggests that long-term Holders are more profitable, indicating bullish sentiment and continued upside potential.

Conversely, as with KCS, a negative index indicates that Short-Term Holders (STHs) are more profitable, signaling pessimism and possible price decline. These investors, who typically hold assets for shorter periods of time, have the ability to sell assets during short-term price fluctuations to secure a profit.

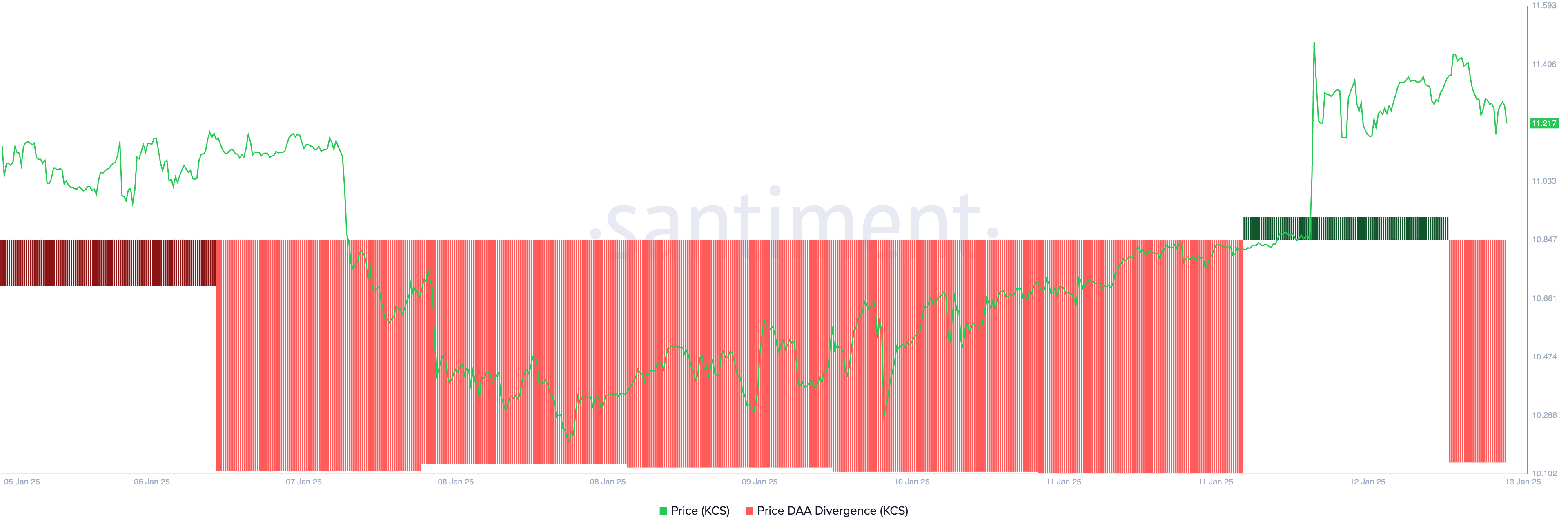

Additionally, even though KCS has been bullish, its DAA (Daily Active Addresses) Price Divergence index only gave a sell signal today.

This implies that although the price is rising, network activity is not supporting this increase, indicating underlying weakness. If this trend persists as speculative traders take profits, a price reversal in KCS is inevitable.

KCS Price Prediction: Bearish Divergence Indicates Possible Reversal

Evaluating the one-day KCS/USD chart shows the possibility of a bearish divergence forming between the alt-currency price and Chaikin Money Flow (CMF). At press time, the index is trending down at 0.01 and is preparing to fall below zero.

An asset’s CMF measures the cash flow into and out of its market. When it falls during a bull run like this, a bearish divergence is formed. This divergence signals increasing selling pressure, which could weaken the sustainability of bullish momentum.

If KCS’s CMF falls below zero, confirming increasingly strong selling, its price will reverse the current trend and drop to $10.15.

However, if buying pressure increases, this pessimistic outlook will be invalidated. In that scenario, the price of KCS could break above the resistance at $11.42 and climb up to $13.82.