[ad_1]

Kyros Firechat on Twitter Space is a series of discussions on unique subjects in the cryptocurrency industry led by the Kyros Ventures crew and visitors from today’s best tasks.

On July 9, 2021, Firechat # two with MakerDAO, a prominent undertaking in the decentralized economic ecosystem with in-depth content material on Stablecoins, attracted a whole lot of awareness from the neighborhood.

Firechat # two visitors contain:

- Kevin Booey: Represents Kyros Ventures Join the conversation with new visitors

- Jocelyn Chang: Leader of MakerDAO’s Asia-Pacific improvement crew

- Tran Pond: Top two Degens, BD at Kyros Ventures

Around the subject of stablecoins, visitors had a lively debate on the two the advantages and difficulties of the existing section.

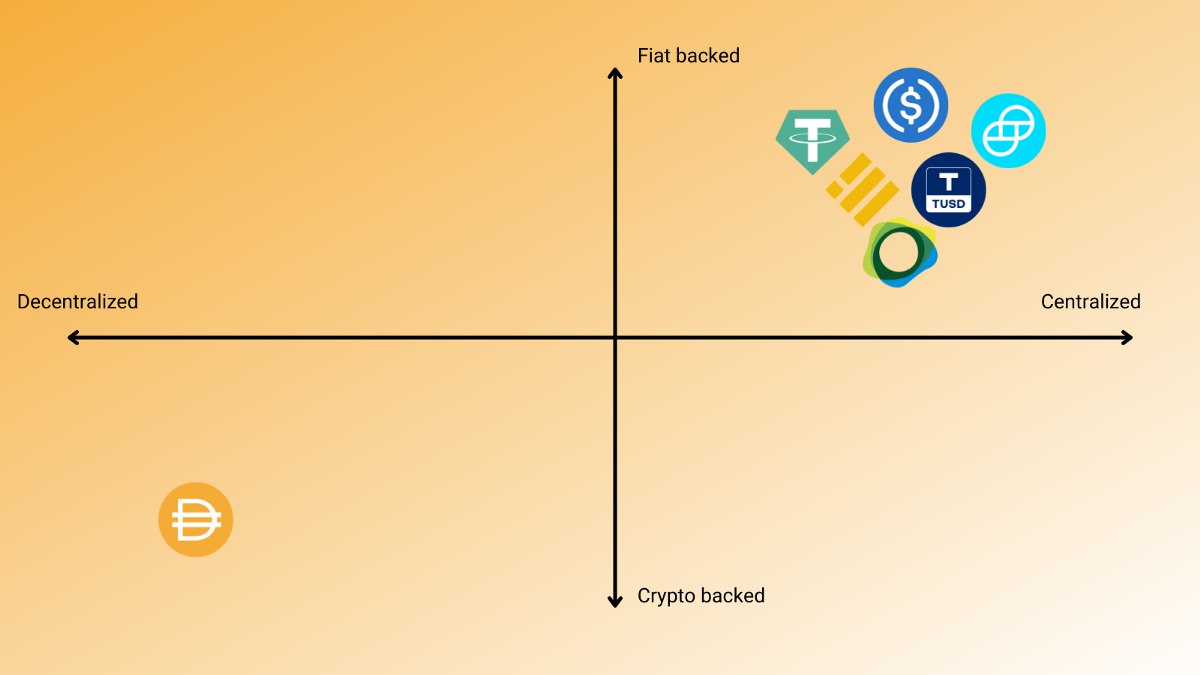

Will crypto-anchored stablecoins outperform fiat-anchored stablecoins?

According to Jocelyn, from MakerDAO’s stage of see, DAI has had a fantastic improvement, from the begin supported only by Ethereum, it is now supported by much more than 35 distinct crypto assets. In the potential, DAI will grow to be much more and much more secure to broaden due to greater demand.

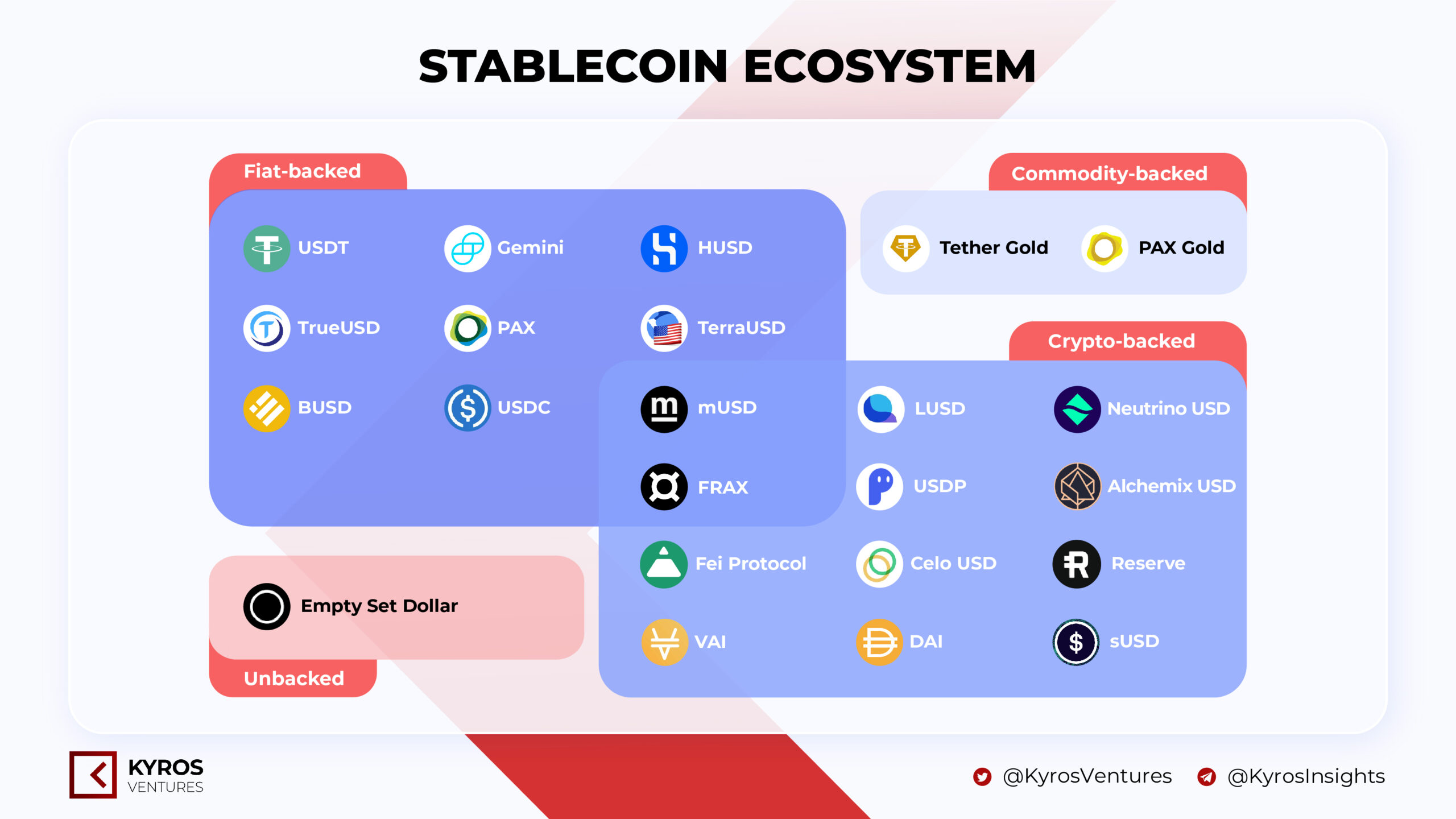

The stablecoin ecosystem is incredibly huge, divided into distinct styles. Interested readers can locate out about Stablecoins from A to Z.

As much more and much more nations all over the planet program to problem CBDCs, is this a risk to stablecoins, specially legally anchored stablecoins?

According to Jocelyn, there is no denying the pace of improvement and growth of CBDCs, but now CBDCs have only been examined internally and have not been broadly made use of. The stablecoins will nevertheless hold their place and coexist with the CBDC.

The point of view on CBDC was analyzed by Coinlive in the write-up CBDC: Does the mystery come from China or is it just a “fox in sheep’s clothing”?

MakerDAO is a single of the most energetic protocols in the DeFi industry with a simplified possibility evaluation mechanism for all collateral. Many gamers have DAI, but DAI pools are generally attacked. So what is the explanation?

According to Jocelyn, DAI is a stablecoin decentralized, DAI is not like other well-liked stablecoins and can be designed by everyone. DAI can’t be frozen or destroyed by any organization or person. And the Maker crew will often build DAI in a entirely decentralized way as effectively without the need of permission.

What is the benefit of DAI in excess of USDT / USDC?

According to Jocelyn, consumers can use BTC or ETH as a ensure to obtain commission-cost-free DAI. If you hold DAI, simply just block DAI and obtain fair accrued curiosity.

DAI’s proposal to decrease the stability charge to an all-time lower also aids build a aggressive benefit for this stablecoin.

However, USDC is now a formidable competitor to the two USDT and DAI. See also the “amazing” statistics on USDC to comprehend much more about this secure coin.

Is there passive cash flow from DAI?

According to Jocelyn, consumers can bet DAI on several DeFi platforms like Aave or Compound, just block DAI on these platforms and earn curiosity (revenue)

To think Also, by sharing, you can lend / borrow DAI on these two platforms or supply liquidity on several other decentralized exchanges this kind of as UniSwap or SushiSwap.

Another tip is farmer it should not be also critical an APY report or reward token.

Even a lower APY does not indicate lower returns.

If you think it ample protocol or governance token it will get worth in the potential. Therefore, never promote reward tokens also quickly, but hold on for a though and promote at the suitable time.

Guests mentioned a whole lot of fascinating facts, but the image of the write-up could not cover almost everything. Please pay attention to the total Firechat # two podcast right here.

Kyros Ventures

Maybe you are interested:

[ad_2]