Blast is the hottest layer two to seem on Ethereum, getting investments from massive money and renowned KOLs in the crypto neighborhood, and pledging to increase curiosity prices for holding ETH and stablecoins.

Layer-two Blast necessitates $twenty million in capital, aiming to increase curiosity prices for ETH and stablecoin holders

Layer-two Blast necessitates $twenty million in capital, aiming to increase curiosity prices for ETH and stablecoin holders

According to the announcement published on the morning of November 21, the layer-two Gust on Ethereum has been launched and officially announced raised twenty million bucks Investment capital from Paradigm, Standard Crypto and eGirl Capital.

Many other very well-acknowledged figures in the cryptocurrency neighborhood on X (Twitter) participated in the funding round.

Further traders incorporate traders @bywassies @evan_ss6 @manifoldtrading @gainzy222 @KeyboardMonkey3 @DoveyWan @JandX_ @0xLawliette @Brentketit @icebergy_ @naniXBT @cole0x

— Blast (@Blast_L2) November 20, 2023

The task claims that Blast is a layer two based mostly on Optimistic Rollups technological innovation very similar to Arbitrum and Optimism and is compatible with EVM so that traders and dApps on Ethereum can very easily connect to it. The workforce behind Blast consists of Pacman, founder of NFT exchange Blur, and other staff who are former MakerDAO staff, graduates of MIT and Seoul University.

Blast is constructed for Promote curiosity-making staking routines on the Ethereum (ETH) network. The task claims that when Ethereum gives a base curiosity charge of three-four% by means of staking ETH, to date there is no layer two alternative that gives more curiosity to build an incentive to hold ETH over as an alternative of holding the income on degree one. .

When holding assets on Blast, the user’s asset stability will be accumulated and curiosity will be calculated. The quantity of ETH deposited by customers on Blast will then be utilized to immediately participate in ETH staking by way of Lido, and then redistribute the block reward to customers.

in distinct, Blast natively participates in ETH staking and the staking yield is returned to L2 customers and dapps. We redesigned L2 from the ground up so that if you have one ETH in your wallet on Blast, more than time it will instantly expand to one.04, one.08, one.twelve ETH.

— Blast (@Blast_L2) November 20, 2023

Furthermore, also degree two Supports sending stablecoins The most well known ones currently are USDT, USDC and DAI. Blast will use the quantity of stablecoins it receives to deposit on protocols that hold US Treasury securities this kind of as MakerDAO, acquire curiosity and then redistribute it to customers by way of personal stablecoin named USDB.

In the long term Blast does not exclude the likelihood of changing Lido and MakerDAO with tasks designed immediately on this layer-two, based on the effects of the neighborhood vote.

Blast announces that it will open a portal with constrained practical experience for customers who will acquire an invitation code. The curiosity charge that traders at the moment acquire will be four% for ETH AND five% for stablecoinswith bonus explosion factors.

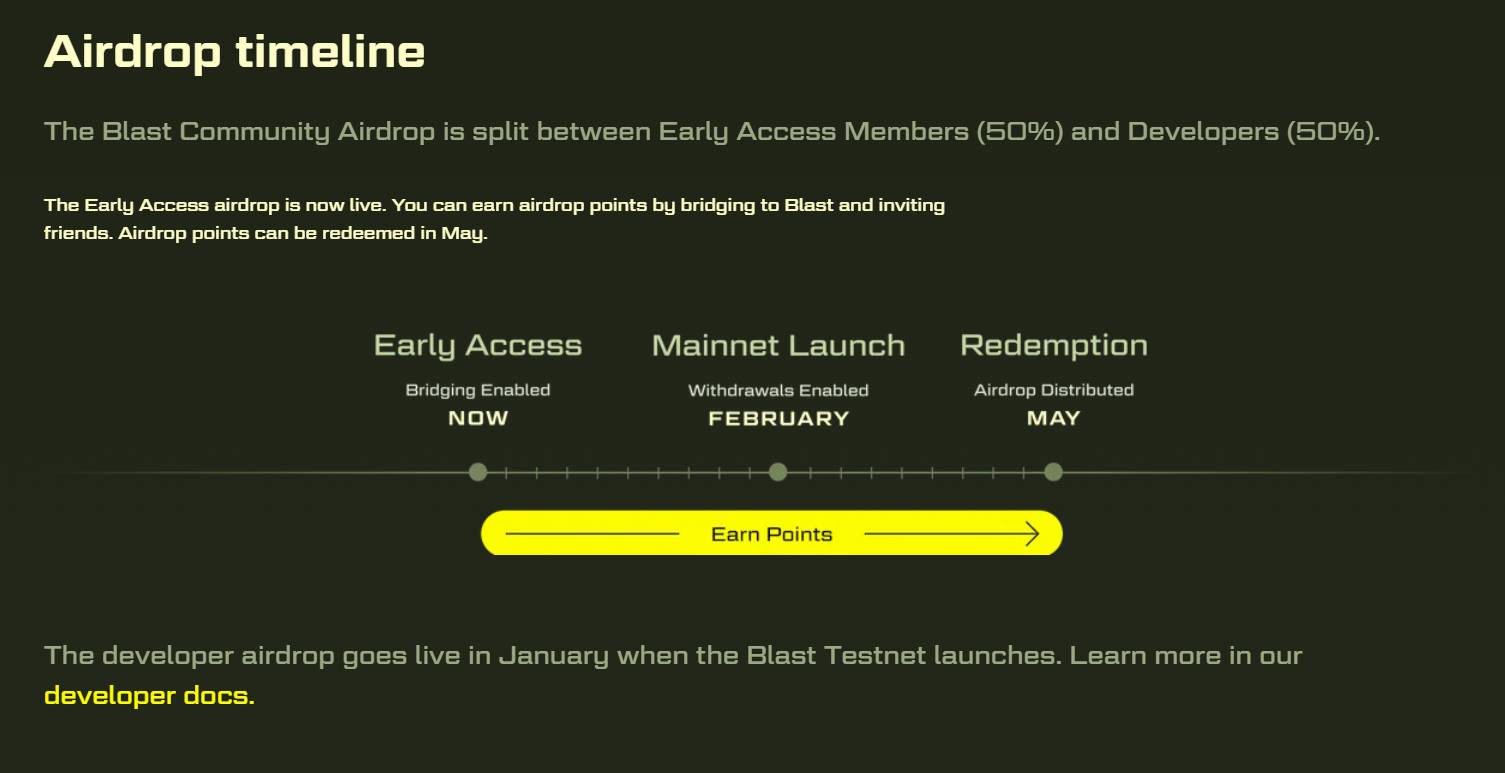

Distribution time testnet of Blast is in January 2024, principal network in February 2024.

Please note that assets when linked to Blast will can not be withdrawn right up until Tier two launches mainnet in February upcoming 12 months.

Reward factors Explosion level will be utilized for the calculation Token launch criteria by Blast. Blast Points can be collected based mostly on the quantity of bridges from Ethereum to Blast, as very well as the amount of people today invited to practical experience layer-two.

Airdrop tour will incorporate 50% for early adopters and 50% for the solution advancement dApps over, but the dApps will acquire the airdrop as quickly as the testnet launches in January and customers will have to wait right up until May 2024 to exchange reward factors for tokens.

Blast advancement roadmap in 2024

Blast advancement roadmap in 2024

As of 9:thirty am on November 21, there was almost $five million well worth of ETH and stablecoins linked from Ethereum to Blast.

Already $five million in deposits https://t.co/WuD8XkvpBG pic.twitter.com/HVmom2jCFE

— Karl (@karl_0x) November 21, 2023

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!