On November 21, 2023, NFT exchange Blur announced the holding of the 2nd airdrop along with the launch of a fully new layer two referred to as Blast. This is a degree two centered on expanding curiosity costs for ETH and stablecoin holders. So what is Blast? Let’s uncover out with Coinlive in the posting beneath.

What is the explosion? Learn far more about Layer two which supplies native yield on the Ethereum network

What is the explosion? Learn far more about Layer two which supplies native yield on the Ethereum network

What is the explosion?

Blast is a layer two blockchain task based mostly on Optimistic Rollups technological innovation and compatible with EVM. Blast’s purpose is to supply curiosity to consumers holding ETH and stablecoins on the Ethereum network, anything no other layer two has accomplished nevertheless.

What is the explosion?

What is the explosion?

For existing Tier 2s, the base curiosity fee when holding assets like ETH and stablecoins is almost %, resulting in the worth of users’ assets depreciating in excess of time. Blast solves this issue by supplying consumers holding assets on this layer two with native yield from Ethereum’s personal layer one.

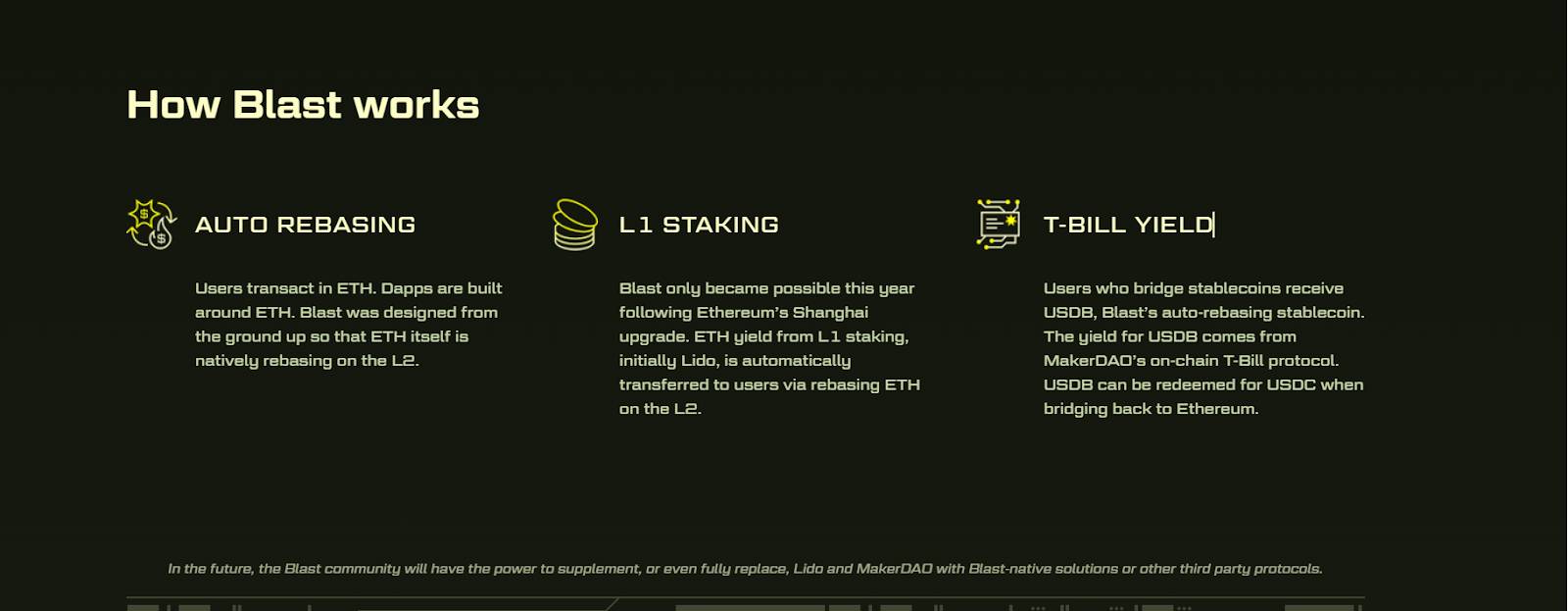

Blast’s working model

Blast’s curiosity stems from Staking ETH and stablecoins. Earned earnings will be instantly passed on to consumers. When consumers deposit ETH into Blast, the task will use them to straight participate in staking ETH through Lido, then split the rewards amid consumers.

In addition to ETH, Blast also makes it possible for consumers to earn curiosity in well-liked stablecoins this kind of as USDC, USDT, and DAI. By depositing these stablecoins into Blast, consumers will acquire a self-based mostly stablecoin USDB. Blast will carry the stablecoins that consumers have deposited to protocols that hold US Treasuries like MakerDAO, acquire curiosity, and then redistribute it to consumers who hold USDB.

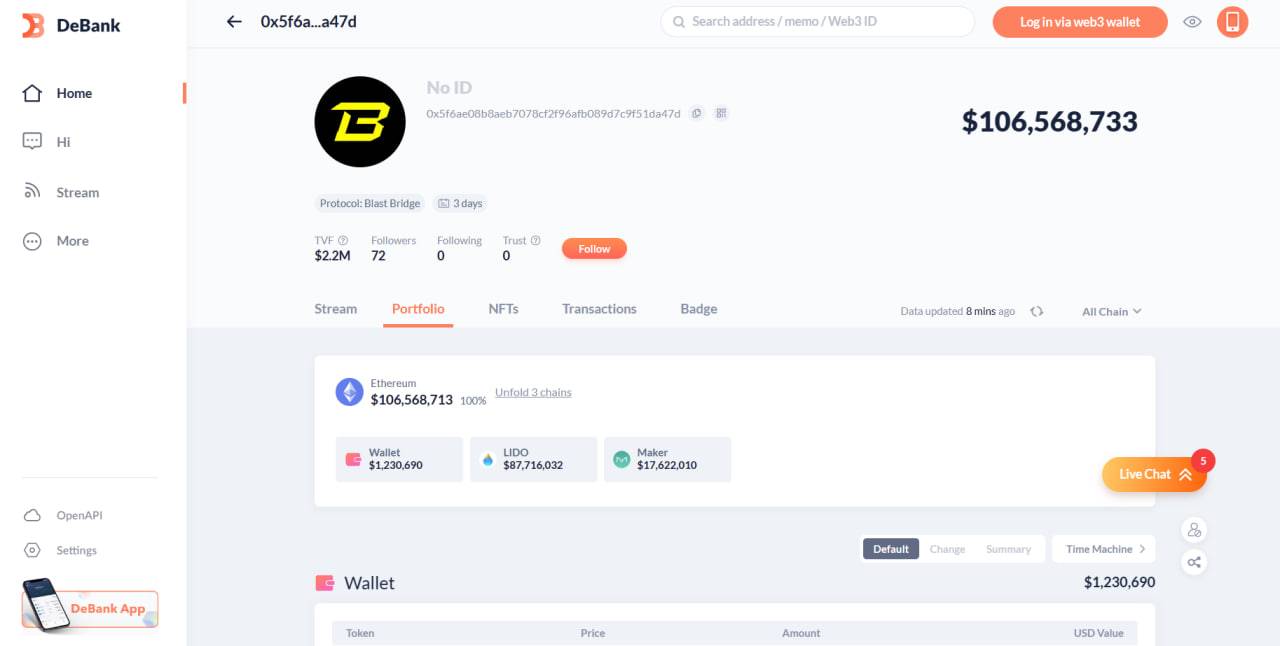

Blast’s bridge contract. Photo: DeBank (November 22, 2023)

Blast’s bridge contract. Photo: DeBank (November 22, 2023)

According to DeBank, as of noon on November 22, 2023, one particular day following launch, the quantity of cash consumers have deposited into Blast is higher. a hundred million bucksof which the vast majority are ETH and DAI.

The anticipated first curiosity costs for ETH are four% and five% for stablecoins. You can check out the complete quantity deposited on Blast employing the following wallet handle: 0x5f6ae08b8aeb7078cf2f96afb089d7c9f51da47d.

One Important note it is a deposit to acquire curiosity are not able to be withdrawn till Tier two deploys the mainnet, anticipated in February 2024.

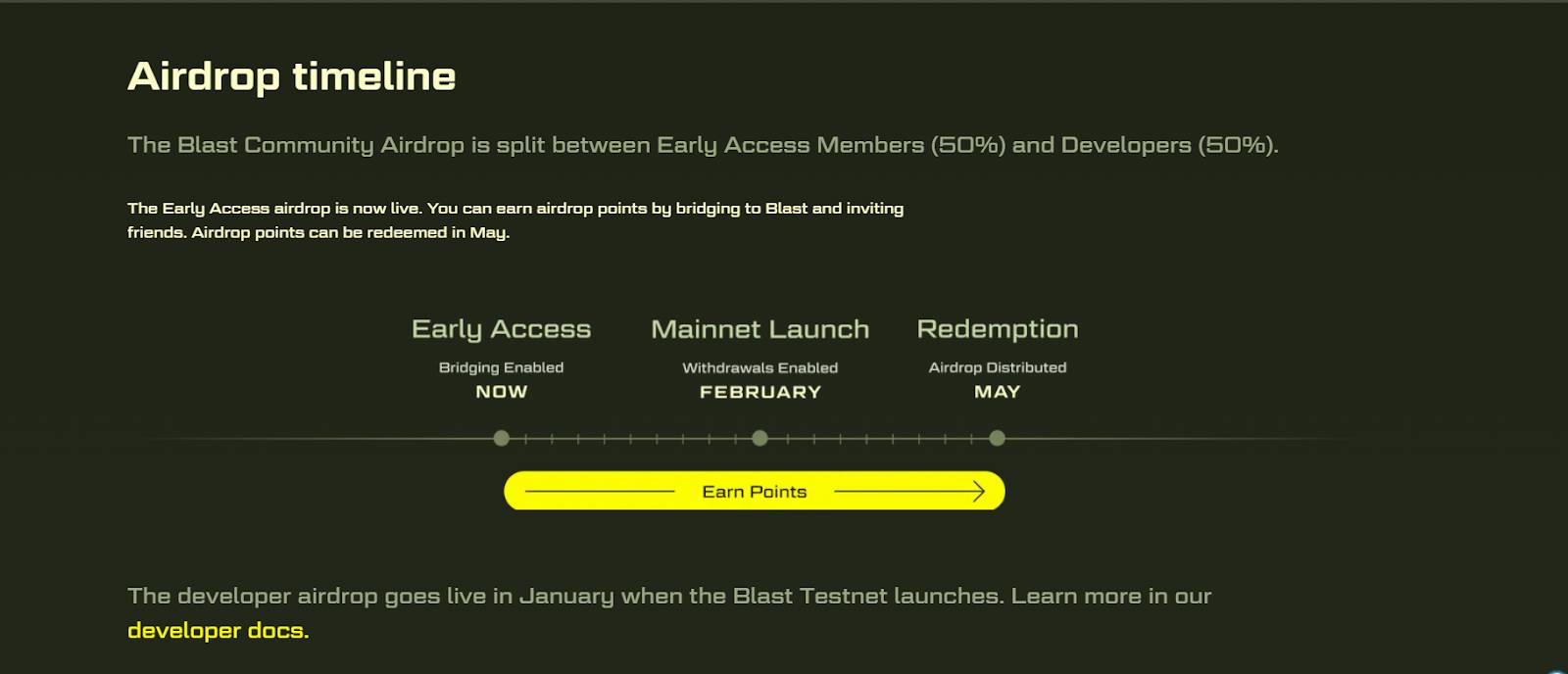

Blast Community Airdrop Program

In addition to the curiosity obtained when depositing cash into Blast, consumers also acquire factors Explosion stage from the Blast Community Airdrop system, accustomed Calculate token launch criteria by Blast. These bonus factors can be collected based mostly on the quantity deposited on Blast, as properly as the quantity of individuals invited to practical experience the task.

The Blast Community Airdrop reward will be divided into two elements:

- Early adopters: Accounts for 50% of complete rewards will be redeemed starting up May 2024.

- Product Developers on Blast: They signify 50% of complete rewards and will acquire rewards straight from Blast’s testnet launch in January 2024.

The roadmap for Blast Community Airdrop is as follows:

- Initial asset (started out): It makes it possible for consumers to connect assets to Blast to earn Blast Points from staking actions and referral codes.

- Main Network (February 2024): DApps turn out to be lively, permitting consumers to withdraw money.

- Redeem Rewards (May 2024): Allows consumers to exchange Blast Points for Tokens.

Project improvement group

The Blast developer crew is led by Pacman from Blur, other members come from FAANG, Yale, MIT, Nanyang Technological University, Seoul National University. They have practical experience functioning on quite a few of the important protocols in the DeFi and Web3 fields, largely on the Ethereum and Solana platforms.

Investors

Blast raised $twenty million from 3 important investment money: Paradigm, Standard Crypto and eGirl Capital along with participation from several other personal traders this kind of as Andrew Kang of Mechanism Capital, Hasu of Lido Finance and quite a few other people for other leads to.

Instructions for participating in the Blast Community Airdrop system

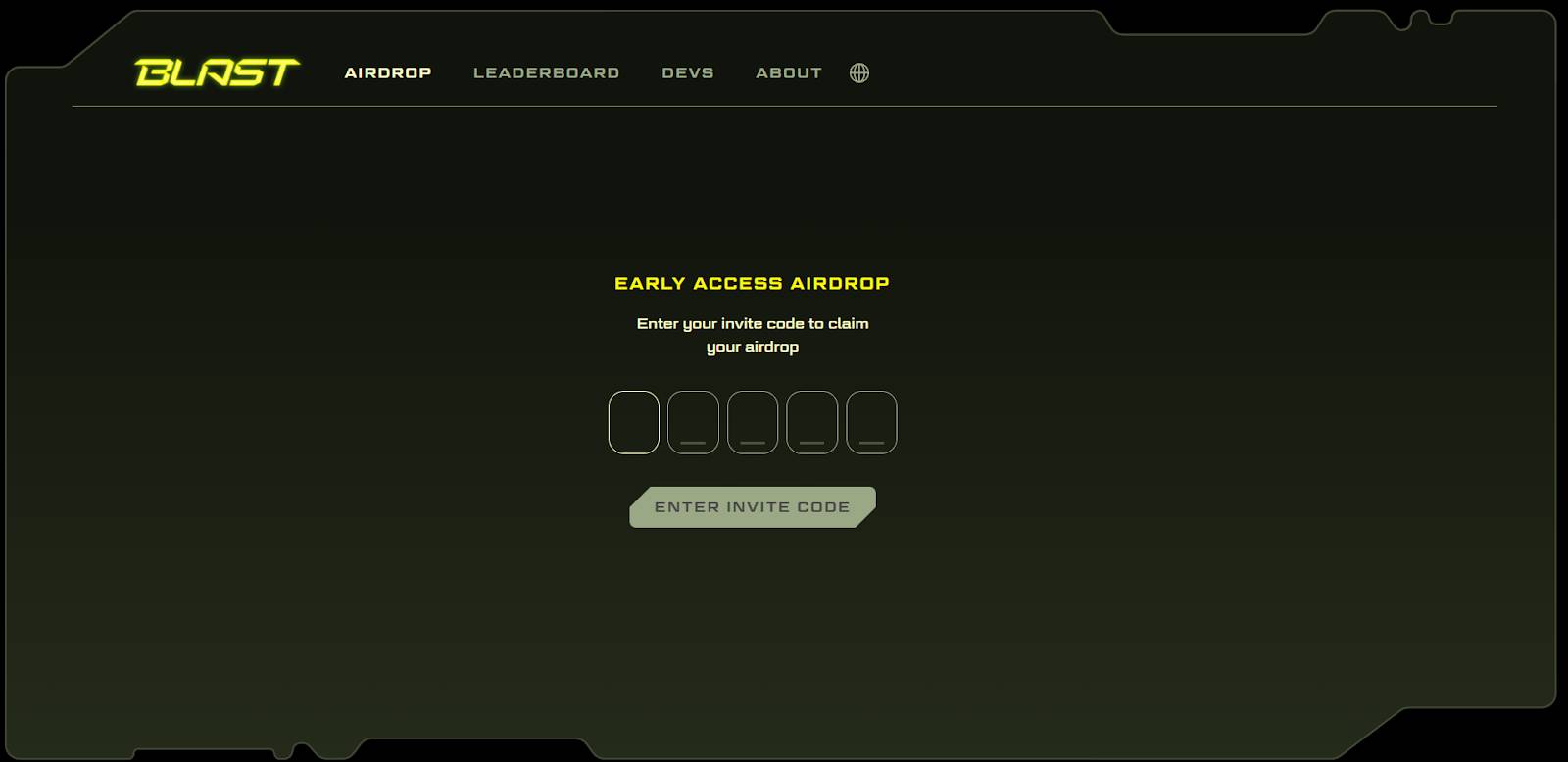

– Step one: Visit the Blast.io web-site then pick Join Early Asset.

– Step two: Enter the invitation code of the previously registered consumer, then pick Enter the invitation code.

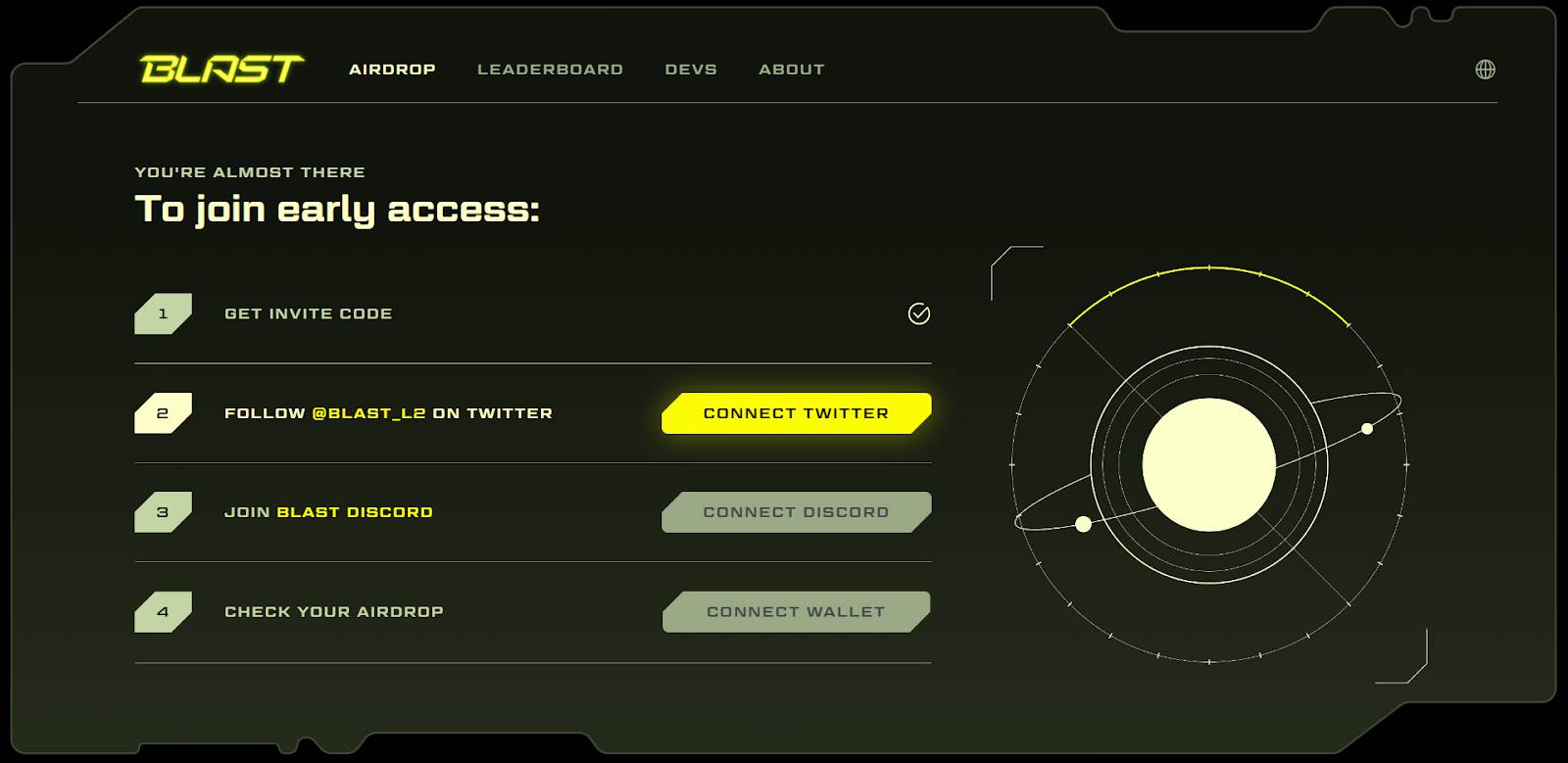

– Step three: Follow X (Twitter) and join Blast’s Discord, then website link your wallet to check out your Blast Points.

– Step four: After verifying, you will need to deposit ETH from the Ethereum network to Blast to retain your Blast Point. The greater the deposit quantity, the greater your Blast Point will be. Additionally, you can also earn Blast Points by employing your referral code to invite some others to join.

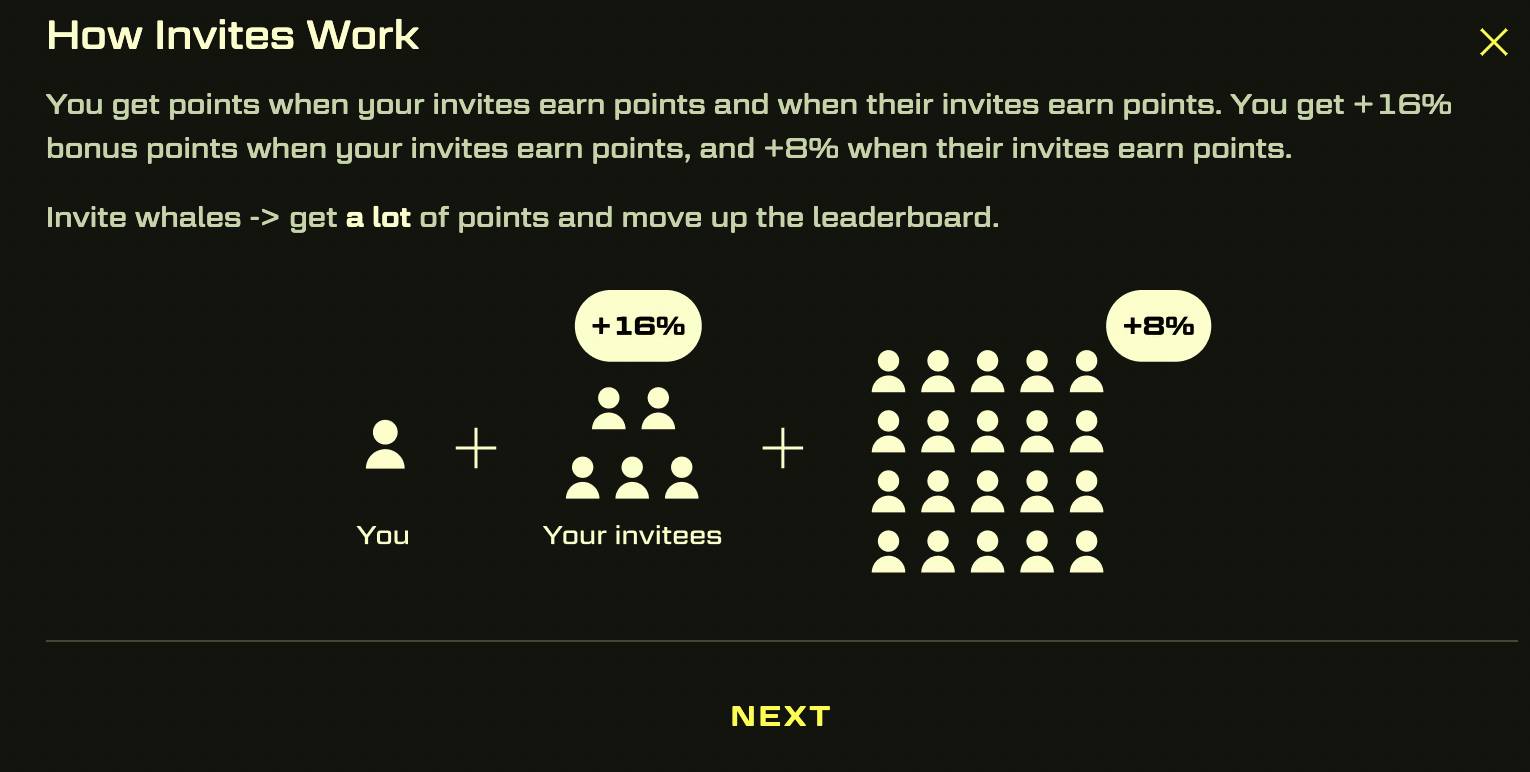

The invitation code system will be calculated in three amounts:

- 1st floor: It’s you.

- 2nd floor: The man or woman straight enters the invitation code from you. With this degree you will acquire sixteen% of the Explosion Points that the man or woman you invite has.

- Plan three: Those who enter the invitation code from approach two. You will acquire eight% blast factors for every single man or woman on this approach.

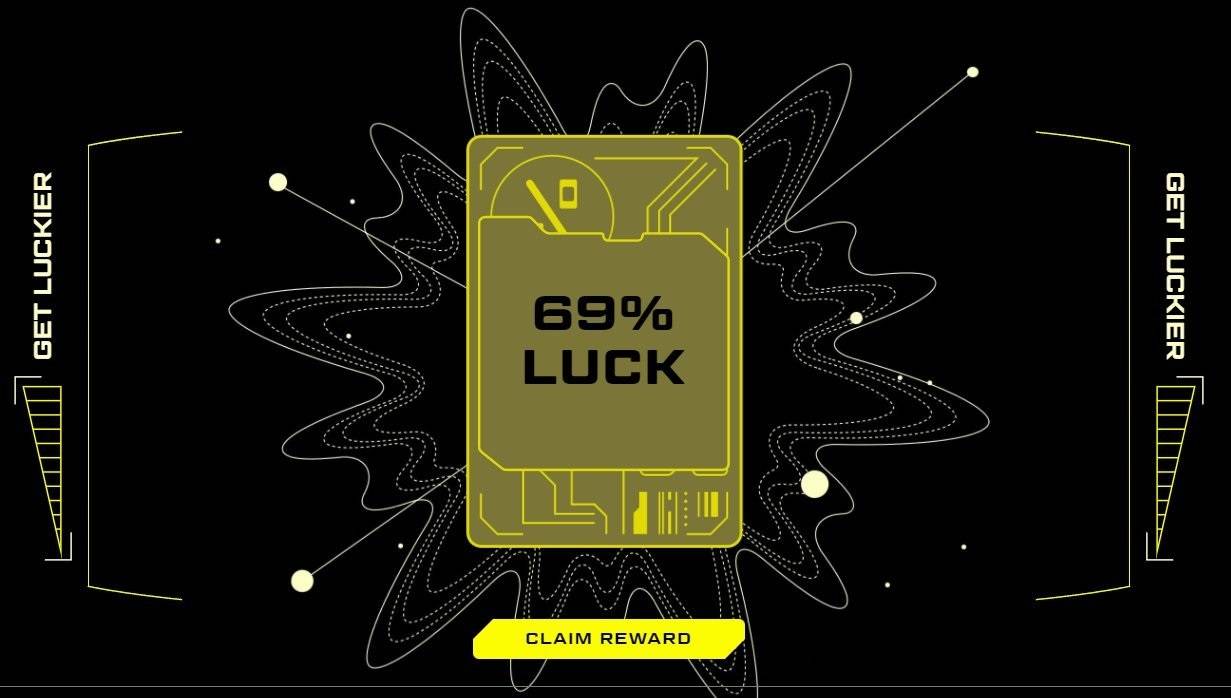

If you and the 2nd floor deposit five ETH or far more on Blast, you will have ten added invitation codes and the possibility to acquire Super Spins, equivalent to ten normal spins when you participate in Blast’s fortunate spin. This fortunate spin is also a further way to get far more explosion factors, which enhance the percentage of bonus factors.

summary

Through the overview posting on the Blast task over, Coinlive hopes that readers can grasp primary info about this task to make their personal investment choices. I want you a prosperous investment!

Note: The info in the posting is not viewed as investment suggestions, Coinlive is not accountable for any of your investment choices. I want you accomplishment and earn a great deal from this possible market place.