[ad_1]

Lido’s Ethereum-based liquidity staking solution has seen its Total Value Locked (TVL) skyrocket by 25% over the past 30 days. Lido’s TVL is on track to hit a historic high of $40 billion, a level it reached in March.

Despite the increase in the index, the Lido DAO Token (LDO), the native Cryptocurrency of the DeFi (DeFi) project, may find it difficult to continue increasing in value. Here’s why.

Confidence in Staking on Lido returned to its peak in March

In October 1, Lido’s TLV reached $24.60 billion. TVL measures the total value of assets locked or staked on a blockchain. As TVL increases, there is a large influx of assets into the platform.

This growth typically enhances liquidity, boosting user confidence, which can lead to increased demand for native Tokens. On the contrary, a decrease in TVL shows a massive withdrawal of assets, signaling a decline in investor confidence.

According to DeFiLlama, the protocol’s Total Value Locked (TVL) currently stands at $38.57 billion, placing it $2 billion below its historical high. This growth shows renewed confidence in Lido’s ability to deliver competitive yields.

This wave is consistent with a 10% increase in LDO’s price over the past 24 hours. The price increase can be attributed to the Grayscale Lido DAO Trust, indicating that institutional investors can now access the Cryptocurrency.

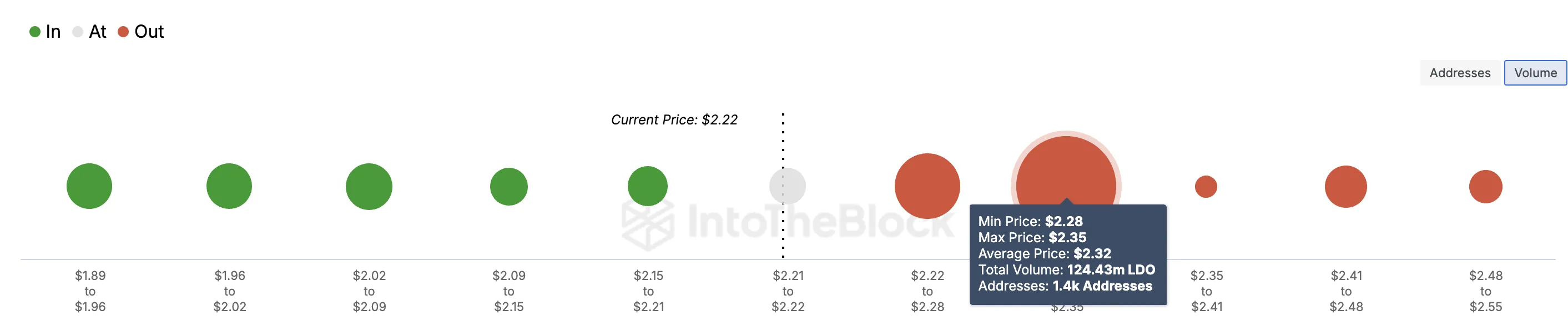

However, according to In/Out of Money Around Price (IOMAP) analysis, the altcoin’s price increase may be difficult if it wants to reach the $3 mark. This is due to significant resistance around $2.32.

For context, IOMAP classifies addresses based on whether they are in the money zone, out of money zone, and addresses at the break-even point. When there is a large cluster of tokens in the in-the-money zone, it indicates resistance, while a large cluster in the out-of-the-money zone indicates resistance.

As seen above, approximately 1,400 addresses hold 124.43 million and accumulate at an average price of $2.32. This volume is higher than those bought between $1.89 and $2.22, indicating strong resistance around current values. Given this situation, the LDO can suffer a significant drop.

LDO Price Forecast: Altcoins Aiming Lower

From a technical perspective, the Awesome Oscillator (AO) indicator on the daily chart is positive. However, AO, which measures momentum, has red histogram bars. The red bars on the AO indicate that the dynamic around the LDO is decreasing.

Like AO, the Moving Average Convergence Divergence (MACD) indicator also supports the bearish trend. Usually, when MACD is positive, it means bullish price momentum.

However, in this case, the negative index suggests that LDO’s price could fall to $1.65. This is the level where the 61.8% Fibonacci retracement indicator is located.

If buying pressure increases, which may not be the case, LDO could rise to $2.38. If that growth is sustained and reaches Lido’s TVL peak, the altcoin could surpass $3 in the short term.

General Bitcoin News

[ad_2]