[ad_1]

What is Lithium Finance Project?

Lithium Finance is a pricing platform for illiquid assets. Oracle Valuation of Lithium Finance is a collective intelligence version of platforms like PitchBook and Crunchbase, powered by cryptocurrency incentives that leverages the immutability of Ethereum’s global asset system to deliver quality information reliably quantity. In addition, participating saints develop a reputation that enhances their earning potential and rewards increasingly accurate information.

The problem of valuing projects illiquid projects

Currently oracles data does not provide regularly updated pricing for private companies. In fact, the only way to value an illiquid asset is through an expensive and slow valuation process. This limits valuation to very high value properties.

Lithium solves this problem:

- Lithium is the protocol FIRSTLY to value frequently illiquid assets

- Lithium can do this quickly and inexpensively, allowing prices to be determined for illiquid assets, like stocks.

- Lithium’s proprietary consensus mechanism lays the groundwork for real assets incorporating DeFi

Lithium Finance accelerate the convergence of many growth areas:

- The asset pipeline is available globally that any professional anywhere can bet and get rewarded.

- Immutable blockchains store a permanent record of previous transactions to ensure reputation.

- Experts can come from anywhere with just a smartphone.

- Advances in cryptography and information theory allow sourcing information with minimal knowledge of its quality, other than the answer itself. i.e. no need for expert certification, source verification etc which greatly reduces costs and opens up access. Reputation is additive, not required.

- We engage users by creating market-based incentives to source data for the network and create value: we are essentially solving the problem of information asymmetry in the private market .

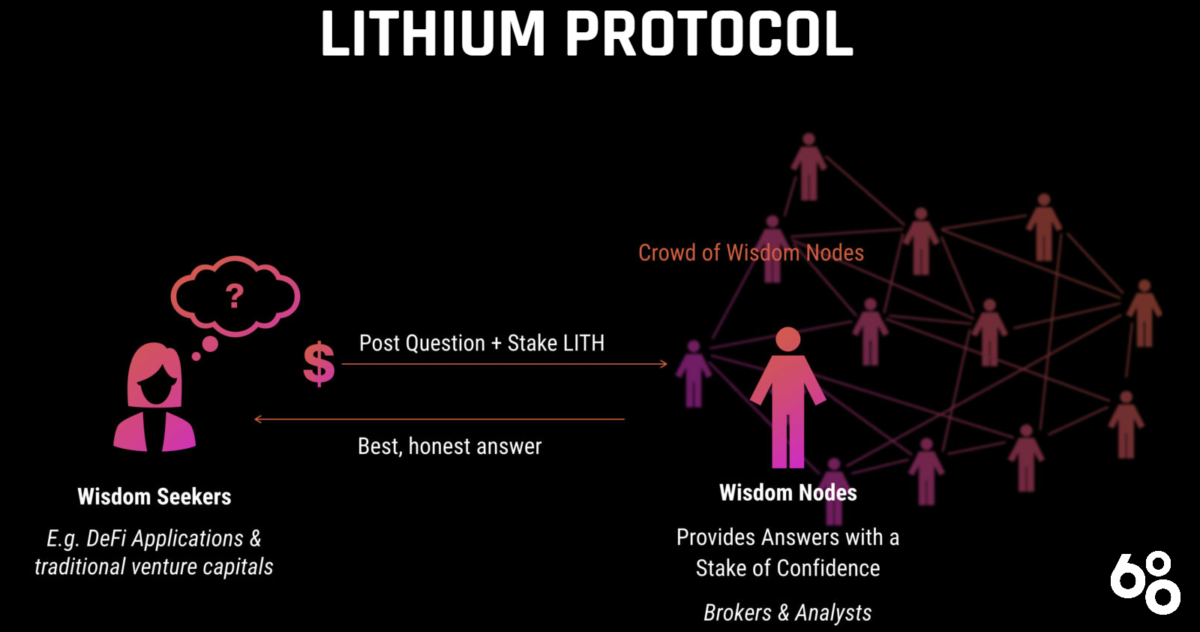

Lithium Protocol Active Structure

Wisdom Querier (Pricing Seekers): Wisdom Querier (Price Seeker)

Cryptocurrency projects, investors, private equity firms, mergers and acquisitions investment banks, street analysts – all these companies are looking for information. exact price to make decision. Aggregating the global pool of information will result in the best rates available. These players will also provide feedback on the final accuracy of the pricing information, resulting in the most accurate rewards.

Therefore Wissdom Seeker will stake LITH with questions to find information.

Wisdom Node (Pricing Providers): Wisdom Node (Pricing Service Provider)

Experts have knowledge of the latest prices of private companies – they can be brokers, investors or anyone familiar with the workings of the private market. A broker usually has the latest trading prices of private companies. However, they currently have no incentive to disclose prices to peers, creating an opaque market. Investors who have regular relationships with their portfolios are also better able to estimate price changes.

Wisdom Node also stakes LITH to provide information on price data.

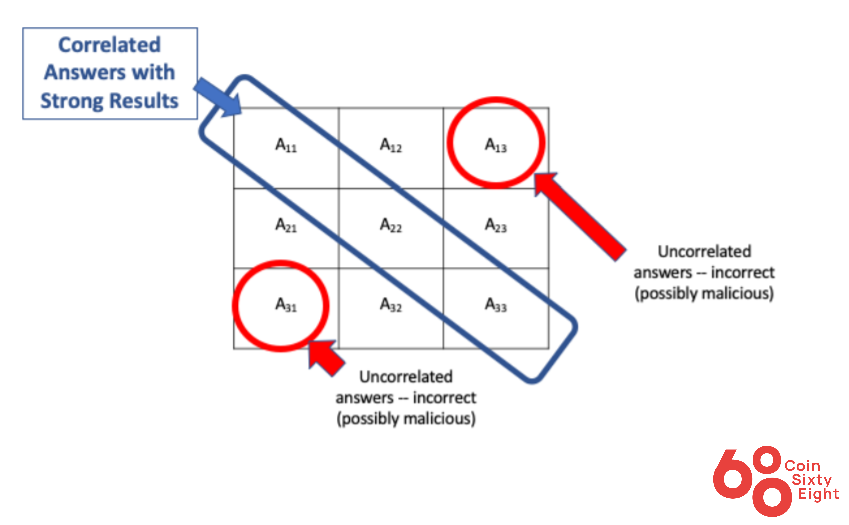

Mechanism of choosing answers and rewards

The answers will be combined with the matrix as above. The incorrect questions will fall far from the common correct questions.

‘s answer Wisdom Node wrong, the stake token will be Slashed (cut off and distributed to the correct answerer) will be distributed to the correct answer and at the same time accompanied by a reward from Wisdom Querier

Roadmap

Updating

What is LITH token?

LITH is a utility token issued by Lithium Finance platform with reward mechanism and stake token for questions and answers. During the question and answer process, each individual will stake a certain amount in the form of a bonus (when asking a question) or confidence (when answering). This combination of zoning produces stronger signals towards the best information. Usage of tokens is as follows:

Wisdom Queriers rewards encourage Wisdom Node to answer

- The more valuable the information is to someone, the more they are willing to pay for an answer. In the aggregate there are many people who want access to the same information, the bonus can become substantial.

Mark the Nodes to signal the confidence level of their answers

- When each Wisdom Node provides an answer to the question, they stake a certain amount of LITH tokens to signal their confidence. This along with their reputation in the field of answers increases their influence and also the potential reward of a bounty plus other misplacers

Rewards for wise buttons for correct answers

- Once the answer is known, the LITH bounty and the Wisdom Node stake will be pooled and distributed according to how close their answer is to the underlying truth.

Tokenomics

- Token name: Lithium Finance

- Ticker: LITH

- Blockchain: Ethereum

- Standard Tokens: ERC20

- Contract Address: update

- Current circulation supply: update

- Initial Initial Supply: update

Token Allocation

Updating

How to earn and own LITH

Lithium Finance will be IDO on the platform Convergence Finance on June 24, 2021. Registration to join the Whitelist will be open on June 17, 2021.

IDO information here: https://coin68.com/lithium-finance-lith-se-la-pre-ido-dau-tien-tren-convergence-finance/

Learn about Converage Finance here: https://coin68.com/convergence-finance-conv/

Team

Updating

Adviser

Updating

Partners and investors

Lithium Finance raised $5 million in a first round of funding led by Pantera Capital and #Hashed. In addition, the list of investors also includes Alameda Research, Huobi DeFi Lab, OKEx Block Dream Fund, NGC, LongHash, Genesis Block.

LITH Token storage wallet

The platform will issue ERC-20 tokens to raise capital, which you can save in today’s standard wallets:

- Coin98 Wallet

- Trust Wallet

- Metamask Wallet

The future of Lithium Finance, should you invest in LITH?

Lithium Finance Oracle is an Oracle price data supply platform that allows pricing of illiquid assets. Lithium Finance allows users to access scarce primary market (OTC) price data that is normally held only by brokers, senior managers or experts in M&A activities. Lithium Finance is a platform that promotes public data sharing and privacy. All information in the article is information compiled by Coinlive and does not constitute investment advice. Coinlive is not responsible for any direct and indirect risks. Good luck!

[ad_2]