JPEG’d is an Ethereum-primarily based protocol that will allow NFT holders to use their NFT as collateral to borrow funds. Find out with Coinlive via the write-up under!

one. What is JPEG?

JPEG’d is an Ethereum-primarily based protocol that will allow NFT holders to open Collateral Debt Positions (CDP) to borrow funds (PUSD) via the use of NFT as a collateral challenge.

JPEG’d is a decentralized and unregulated protocol, aiming to connect DeFi and NFT, therefore raising the use instances for NFT in the long term.

two. Mechanism of action

two.one. Warranty

JPEG’d will assistance some NFT collections. At the time of first launch, the undertaking supported collateral for Crypto Punk, which was later on expanded to consist of EtherRock and Bored Ape Yacht Club. Proposal and approval of more collections will be via governance (by JPEG token holders).

The worth of the NFT will be established by the minimal value, nonetheless in some instances distinctive worth NFTs can be valued individually (through the administration).

two.two. Fee

The commissions on JPEG’d are of two kinds:

- Loan curiosity charge: two% / 12 months.

- Loan disbursement charge: .five% of the disbursed volume. For instance: Alice mortgages NFT, borrows ten,000 PUSD and withdraws the complete volume => Alice has to spend a withdrawal charge of .five% or 50 PUSD.

two.three. LTV (loan-to-worth ratio)

To make sure that the protocol performs appropriately, JPEG’d sets the LTV for loans, which is understood as the ratio of the loan to the worth of the collateral.

Currently, JPEG’d will allow end users to borrow up to 32% of the collateral worth, the loan place will be liquidated if the LTV ratios> 33%.

For instance: Bob mortgage loan one NFT with a worth of a hundred ETH => Bob can borrow up to 32 ETH. If the NFT worth decreases or Bob borrows extra ETH triggering this ratio to boost to> 33%, the loan will be liquidated.

Additionally, JPEG’d also has a greatest loan disbursement restrict for some NFT collections. For instance, with Crypto Punk, the lending restrict is PUSD ten million. If this threshold is reached, end users will no longer be ready to borrow. This restrict boost / reduce can be transformed via protocol administration.

two.four. Insurance (Insurance)

As a remarkably volatile asset lending protocol, JPEG’d will allow end users to decide on insurance coverage coverage for their loans.

Specifically: Users can acquire insurance coverage for any loan place. Therefore, in the occasion of liquidation, the consumer has the appropriate to “redeem” his NFT from the DAO immediately after repaying the debt + paid the insurance coverage premium (calculated from 25% of the residual debt worth at the time of payment). and accrued curiosity). The insurance coverage premium will be equal to one% of the volume disbursed.

Example: Bob has mortgaged one NFT and borrowed ten,000 PUSD. Bob chooses to safe his place on loan. So Bob has to spend one% of ten,000 which is a hundred PUSD. Bob’s complete volume paid out immediately after deducting costs is PUSD 9850 (which include .five% disbursement charge). So if the market place is risky, the NFT falls in worth and Bob will get liquidated => Bob will have to repay 9850 PUSD + 25% x 9850 PUSD to the DAO and get back the NFT (assuming the loan is not impacted.).

two.five. JPEG locking mechanism

As I explained, the determination of the NFT worth is mostly primarily based on the protocol governance vote. In individual, the consumer can propose to boost the worth for a provided NFT. When the proposal is authorized, the consumer will have to block the JPEG at a worth equal to 25% of the greatest loan volume calculated primarily based on the proposed NFT worth.

For instance: Alice proposes to boost her NFT to USD 200,000 => Alice will have to block a amount of JPEGs with a worth of 200,000 x 32% x 25%.

three. Tokenomics

JPEG’d has two tokens, JPEG (native-token) and PUSD (stablecoin).

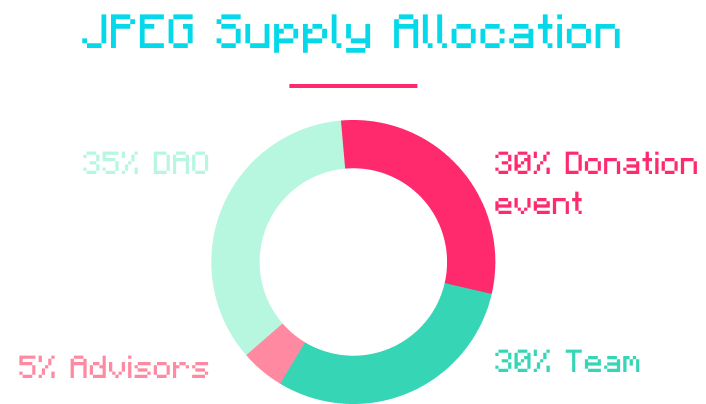

As mentioned over, JPEG is JPEG’d’s native token. The complete variety of JPEGs is 69,420,000,000 tokens, distributed as proven under:

JPEG can be utilised for:

- Staking: participate in governance + obtain income from shared protocol.

- Liquidity extraction: participates in the provision of liquidity.

- Lock: when the proposal to boost the NFT worth is authorized.

- Reward: JPEG is also the project’s reward token.

PUSD is a stablecoin minted immediately after the NFT ensure. To make sure liquidity, the JPEG’d protocol locations PUSD in the stablecoin pool on Curve along with USDC, USDT and DAI.

four. Potentials and Risks

four.one. Potential

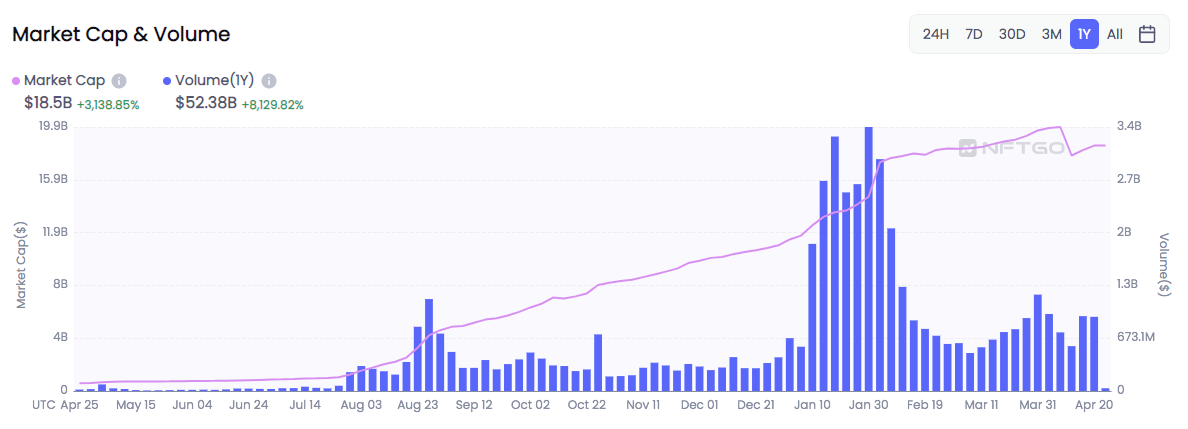

NFT has just lately had a definitely wonderful boom, supplying enormous returns for traders and turning out to be a excellent income movement attraction.

However, 1 of the disadvantages of NFT is its liquidity and restricted use instances. So opening a platform that allows NFT collateral is the way to include worth to NFTs.

JPEG’d is a state-of-the-artwork undertaking, so it will immediately connect with major NFT tasks on the market place, building a aggressive benefit. In 2018, when AAVE launched and begun setting up Defi, no 1 believed it would be so prosperous, now JPEG’d can develop a related story.

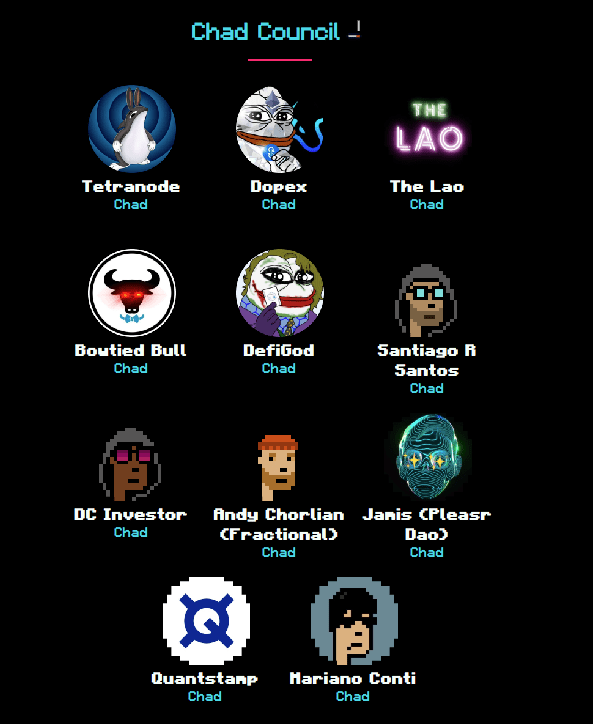

One of the notable factors of JPEG’d is that it is created and supported by a market place major group: DCInvestor, Santiago Santos, DefiGod, Terranode …

four.two. Risk

Firstly, as a undertaking created on the NFT market place, the growth or failure of JPEG’d depends a whole lot on the condition in the NFT market place. Indeed, we have presently noticed the explosion of NFTs in late 2021 to early 2022, nonetheless, this overheated boom will probably lead to a deep correction in the brief phrase, therefore right affecting the undertaking (collateralized NFTs will be withdrawn or liquidated when the value goes down …)

Thereafter, the growth of collateral will encounter numerous hazards in the close to long term. Assessing the worth of an NFT is not an uncomplicated process, particularly when combining its worth with its liquidity. Therefore, as JPEG’d expands its collateral kinds to boost the worth of the protocol, a pretty cautious threat evaluation is expected.

On the other hand, the tokenomic undertaking in my viewpoint is not so great. The distribution of thirty% for the Team is a very little as well significantly, the thirty% for Donation Events is definitely unclear, significantly less transparent. JPEG and PUSD never have as well numerous backlinks to boost worth for every single other like other native token pairs – stablecoins.

In the finish, no matter the place it is, JPEG’d is certain to encounter a whole lot of competitors in the long term. Therefore, if the lead is not grasped and quickly produced in the market place, JPEG’d can effortlessly be outstripped by much better rivals.

What do you assume of the JPEG’d undertaking? Leave a comment to talk about with us!

Poseidon

Maybe you are interested: