What is Port Finance (PORT)?

Port finance is an unsupervised revenue industry protocol on Solana. Its objective is to carry a complete set of curiosity charge solutions, like: floating charge loans, fixed charge loans and curiosity charge swaps to the Solana blockchain.

The existing floating charge product or service has variable curiosity charges based mostly on provide and demand, cross mortgage loan and quick loan.

Port Finance seeks to be a liquidity gateway to the Solana DeFi ecosystem by means of a easier consumer interface, reduced collateral prerequisites, and an adjustable liquidity and volatility-based mostly liquidity threshold. .

What solutions does Port Finance have?

Variable Rate Loan Protocol

The underlying lending protocol has a Compound Finance-like implementation on Ethereum with 3 principal characteristics:

- Rate of Change Based on Usage: The curiosity charge increases with utilization charge and vice versa with an adjustable yield curve

- Cross-Collateral Support: The protocol supports loan initiation employing many digital assets across numerous collateral choices.

- Fast Lending: The protocol supports rapidly lending, permitting end users to arbitrage chance-absolutely free in between unique Serum markets or in between Serum and Raydium.

At the velocity of the Solana blockchain, Port Finance provides considerable incentives in contrast to the existing loan and liquidation on Ethereum. Since liquidators can participate in the loan industry extra effectively, Port Finance end users can appreciate a reduced collateral ratio (collateral worth versus loan worth), in other phrases, borrow extra with much less collateral. .

Main use instances

The capability to deliver assets for revenue and to borrow assets towards current cryptocurrency holdings is desirable for:

- Long-phrase SPL-twenty token holders wanting for further revenue

- Trader wanting for leveraged trading

Fixed Rate Loan Protocol

In the subsequent phase, Port Finance aims to create a fixed charge industry employing Serum’s buy guide. This will deliver two advantages:

- Products with a fixed maturity and fixed curiosity charge

- The curiosity charge detection mechanism is extra exact and delicate than the website link curve

Port Finance will at first deliver loans to the industry for seven days. These loans can be renewed or converted into 14-day, 21-day, and so forth. The platform will also introduce pToken, a one-to-one derivative token exchange (can convert to a variable connection) to charge much less curiosity for to start with payers) on the base loan. Additionally, there will be markets for pToken and the underlying tokens on the platform: USDC / pUSDC, SOL / pSOL, ETH / pETH, and so forth.

Borrowers are necessary to deposit assets and produce corresponding pTokens they want to borrow with a loan-to-worth ratio. Specifically, if a borrower needs to borrow a SOL, they will deposit the residence and produce a pSOL with a percentage low cost on the collateral.

Lenders are necessary to go to the respective marketplace to promote their assets and receive the corresponding pToken. Once the loan is due, they can then exchange the pToken for the base token (comparable to loan repayment). Having a separate pToken eliminates the have to have to record loan quantities and terms for every pair of lenders and borrowers and supplies transferability and composability of loan ownership.

Interest Rate Swap Protocol

Finally, Port Finance aims to put into action an curiosity charge swap industry in between fixed and floating curiosity charges. Essentially, fixed charge lenders want the highest achievable curiosity charge so they can get the highest assured return, whilst variable charge lenders want the highest achievable charge as lower as achievable so they can revenue when the floating charges rise extra than fixed charges. . This connection is comparable to a purchaser and a vendor in a central restrict buy guide (CLOB) in which the purchaser is a variable charge loan company (who needs the lowest fixed charge) and the vendor is the loan company. curiosity charge). Port Finance can build this kind of a industry by employing the serum matching engine.

Basic details about the PORT token

- Token identify: Port Finance

- Ticker: PORT

- Blockchain: Solana

- Token regular: SPL-twenty

- To contract: Updating

- Token style: Utility, Governance

- Total offer you: a hundred,000,000 PORTS

- Circulating provide: Updating

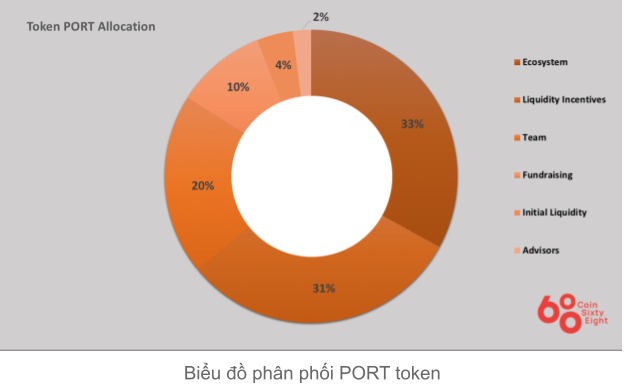

Token allocation

- Ecosystem: 33%

- Liquidity incentive: thirty-to start with%

- Squad: twenty%

- Fundraiser: 10%

- Initial liquidity: 10%

- Advisor: two%

What is the PORT token for?

It acts as a governance token to determine many system parameters, like highest loan-to-worth ratio, which assets to help, and also settlement thresholds and other fund protocol adjustments.

Share the loan charge in accordance to the protocol and also the swift loan charge when the staking routine is established.

PORT token storage wallet

Since PORT is an SPL-twenty token, you can retailer this token on the Sollet Wallet

How to earn and personal PORT tokens

Updating

Where to invest in and promote PORT tokens?

Updating

Roadmap

seven/2021

Start fundraising for a personal round based mostly on speedy development and seed round benefits

- Deposit restrict boost

Deposit restriction eliminated based mostly on audit benefits and local community suggestions

August 2021

- IDO and funds extraction

Provide token incentives for end users to deposit and borrow

Investors

What is the potential of the Port Finance undertaking, need to I invest in PORT tokens or not?

Port finance is a lending protocol that aims to deliver a complete selection of fixed cash flow solutions like variable charge loans, fixed charge loans and curiosity charge swaps. Through this post, you ought to have by some means grasped the fundamental details about the undertaking to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you good results and earn a whole lot from this probable industry.