Today (one July), Lido DAO has officially vetoed the proposed “ETH 2.0 staking limit”. However, just after this vote, the tough point right here is nevertheless how the Lido will handle the danger of the “concentration of power” difficulty.

Recommend ETH two. staking restrict

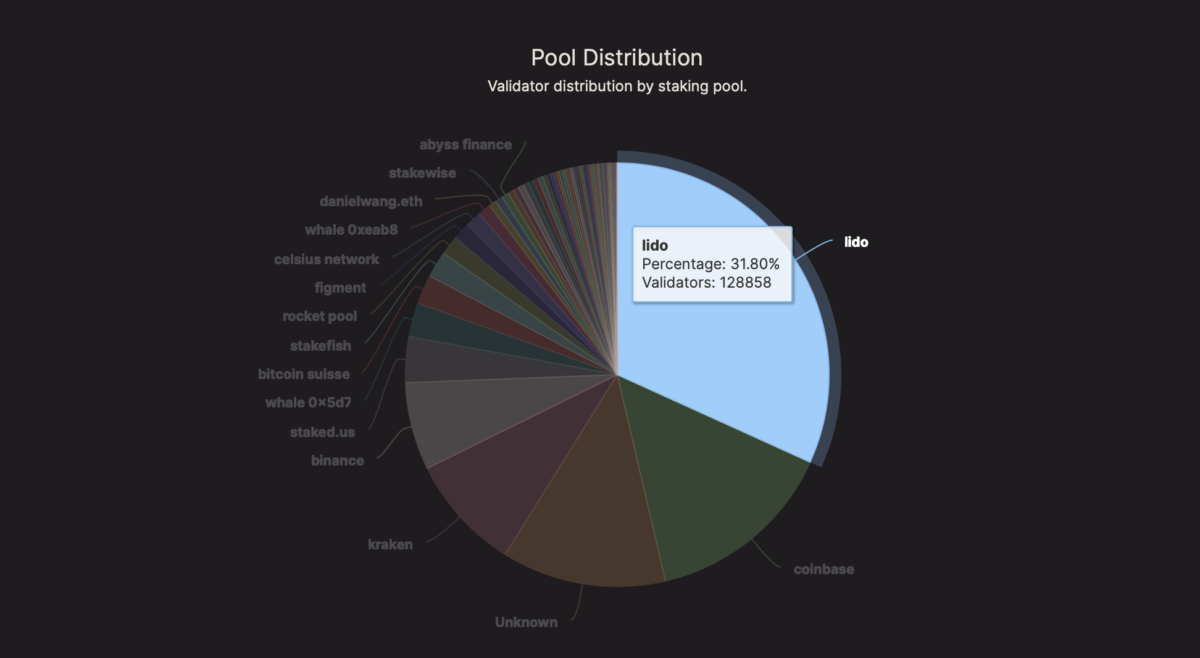

As Coinlive pointed out in earlier posts, the expanding percentage of Lido’s ETH stake in Beacon Chain is progressively turning into a “risk focus” level for the total network.

The proposed ETH two. staking restrict has been announced and voted on. About this proposal, you can read through beneath!

> See additional: Lido DAO begins voting on the proportion of the Ethereum two. staking pool

Although this vote lasted right up until the afternoon of July one, but with the big difference in the variety of votes (~ 99% towards), this proposal was eventually accredited early.

The dangers of the concentration of electrical power

At the time of creating, in accordance to information from beaconcha.in, Lido represents about 32% of the validators on the net. It closely follows the Coinbase staking pool.

However, the liquidity dilemma of big stETH-linked institutions brought on the token to fall from the one: one anchor with ETH. This will motivate consumers to obtain stETH immediately on the market place at a price reduction, as an alternative of putting ETH in Lido to obtain stETH. This occasion also contributes to the slowdown of ETH staking at the Lido and will partly calm the controversy on the difficulty of “centralization of power”.

Speaking of the Lido’s proposal to lower the staking ratio, lots of argue that this alternative is not satisfactory mainly because subsequent staking pools will regularly enhance the charge, bringing the bulk of the controlling electrical power back into the hands of the candidates behind.

For the over good reasons, this alternative can only be thought of as a short-term alternative and it isn’t going to make a lot sense.

So what is the alternative to the over dilemma?

The Ethereum neighborhood has had a great deal of heated discussions on this subject. Ethereum founder Vitalik Buterin himself also proposed to enhance the commission to be paid by these who join the stake pool if the charge exceeds 15%. This commission will produce strain to push the wagering ratio to 15% as a purpose.

Speculative and controversial get: We ought to legitimize value scams by big stakeholder pool companies. For instance, if a holding pool controls> 15%, it ought to be accepted and even * anticipated * that the pool will carry on to enhance its charge right up until it drops beneath 15%. https://t.co/cOtuM7Occd

– vitalik.eth (@VitalikButerin) May 14, 2022

However, this proposal has also met with conflicting views in the neighborhood on fairness, additionally, it has also developed limits and has not promoted the growth of the staking network.

Recently, Hasu (KOL on Twitter, contributor to organizations like MakerDAO or Paradigm) posted a proposal “Double government”. This proposal relatively mitigates the dangers if the Lido DAO is breached.

As a end result, LDO token holders will carry on to have voting rights as normal. However, this proposal will have a critique time period and stETH holders will have the appropriate to veto the proposal in situation of opposition. So far, Hasu’s proposal is thought of the most appropriate to safeguard these who have staking ETH and blocking capital in the staking pool with Lido, specifically in the context in which ETH are unable to be withdrawn from staking just after The Merge. .

Finally, other Liquid staking remedies are anticipated to regain market place share from Lido, assisting to decentralize staking. These desirable remedies incorporate names like RocketPool or Stakewise.

News coming quickly

Recently, the Gray Glacier tricky fork was efficiently implemented on Ethereum. This update will delay the Network Difficulty bomb and may well end result in The Merge occasion getting carried more than.

> See additional: Ethereum Gray Glacier tricky fork succeeds, continues to delay “difficulty bomb”

After The Merge aired, 1 of the notable milestones was the Shanghai tricky fork. With this hardfork, lots of notable improvement proposals linked to the advancement infrastructure for Layer-two will be implemented.

>> See additional: What is EIP-4844? How will Layer-two remedies advantage?

However, the most notable level is the unlocking of ETH staking rewards. Currently, Beacon Chain staking rewards are only credited to validators and are unable to be withdrawn from the network. The Shanghai hardfork milestone is estimated to be implemented six months just after the accomplishment of The Merge.

Synthetic currency 68

Maybe you are interested: