This proposal comes right after MixBytes, a spouse that develops liquid staking on Polkadot and Kusama for Lido, stopped supporting these networks.

According to a propose Published on the governance forum on March eight, DeFi protocol Lido Finance is thinking of discontinuing liquid staking on the Polkadot and Kusama ecosystems.

The over determination was announced right after MixBytes stopped delivering technical help to Lido on Polkadot and Kusama as of August one, 2023.

MixBytes is a decentralized finance (DeFi) application developer founded in 2016. This organization is a spouse to assist create Lido Finance’s liquid staking support on Polkadot and Kusama.

Kosta Zherebtsov, Product Manager of MixBytes and writer of the proposal says:

“The decision was made due to a number of challenges, including the market landscape, protocol evolution, capacity constraints, and many other priorities.”

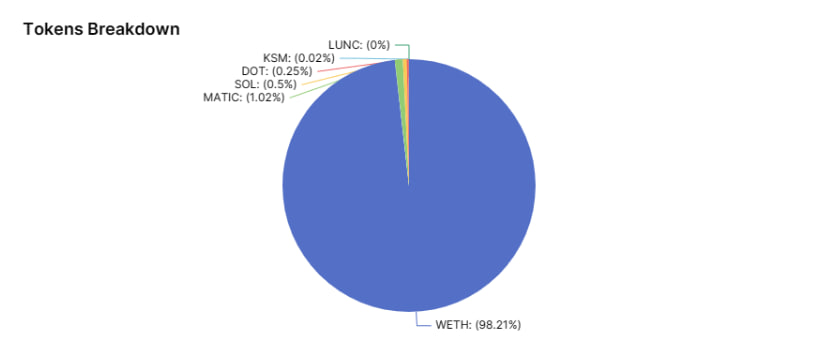

Today’s proposal could have an impact on roughly $25 million in assets. Extract information from DefiLlamaHe at this time has roughly $22.46M of DOT and $two.34M of KSM staking on Lido.

In addition, Zherebtsov also proposed to halt supporting DOT and KSM on the Lido prior to March 15 and instantly withdraw in June.

As reported by Coinliveliquid staking refers to protocols for consumers who participate in staking to get rewards, but will not be blocked, but will get a representative token (this kind of as stETH) in a ratio of one:one to carry on DeFi pursuits on other platforms.

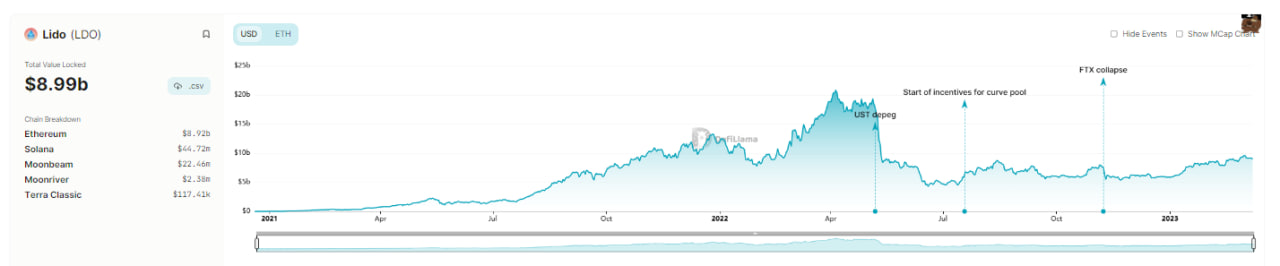

Lido Finance is 1 of the earliest liquid staking options and is dominating the whole array with virtually 9 billion lockouts (TVL) on the platform.

The LDO cost has had a damaging response in the previous number of days, following the general decline across the marketplace as very well rumors of staying tapped by the SEC. As of press time, LDO is trading all around $two.39 and is down virtually six% in the previous 24 hrs.

Synthetic currency68

Maybe you are interested: