Ethereum Lido Finance’s (LDO) staking protocol continued to propose a new token sale proposal immediately after its vote on the difficulty was just rejected by the local community.

Like it Coinlive reported on July twenty, Lido Finance proposed to promote two% of the complete LDO provide, equivalent to twenty million LDOs, to investment money to assure that there are ample economic sources to maintain venture operations in the market place cycle in contraction phase.

Dragonfly Capital will get the lead in this round of purchases with an allocation of ten million LDOs to the fund, the rest will be purchased by other investment money. However, as the token acquire agreement in between Dragonfly Capital and Lido Finance does not have a distinct timed token blocking necessity, it implies that the token will be paid straight away.

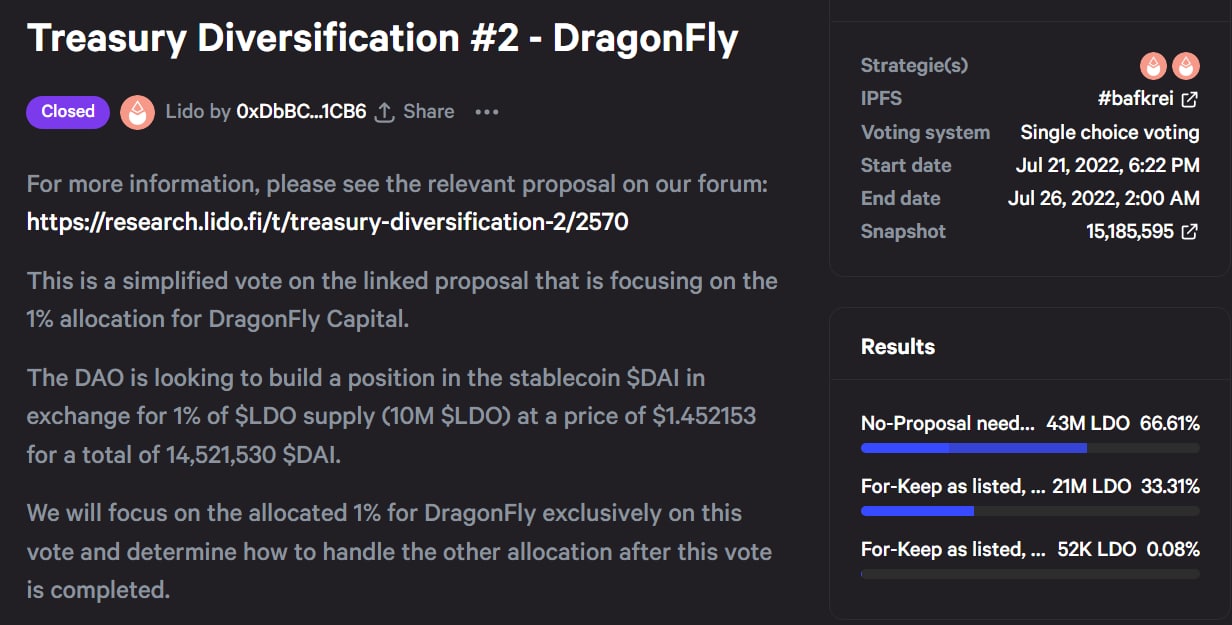

Largely due to considerations that Dragonfly Capital will “oust” LDO as quickly as the deal is finished on July 26, the over proposal has been wholly failed due to the solidarity of the Lido DAO local community, with 66% I Total winning votes signify 43 million LDO Tokens from almost 600 members.

And now a new proposal linked to this occasion has just appeared on the Lido side. Specifically, the Sales Manager of the venture Jacob Blish nevertheless would like to “restore” the intention to promote one% of the complete provide of LDOs to Dragonfly Capital on the complete two% he would like to promote, the remaining one% will be managed in the potential by other anonymous investment money.

An up to date treasury diversification proposal was shared on the Lido governance forum.https://t.co/S3jhtLE5Ts

The proposal will be place to the vote about 22:00 UTC. pic.twitter.com/aIFGFQldam

– Lido (@LidoFinanza) July 27, 2022

Instead of Lido agreeing to promote at one.452153 USD / LDO as previously proposed, in this round it will be one.45 USD / LDO, with the prediction that Dragonfly Capital will have the ideal to withdraw from the dedication if the LDO value exceeds two, $ 25 above the up coming 7 voting days. The up coming variation to observe out for is that the new proposal will have a one yr token lockout time period.

However, Lido Finance’s most recent move showed that the platform “really needs the money” ideal now. In the previous Lido Finance had proposed to promote up to ten,000 ETH in buy to have to deduct the important quantity of stablecoins to place in the protocol’s asset reserve in situation the market place possibility continued to plummet, but it was also rejected. refused.

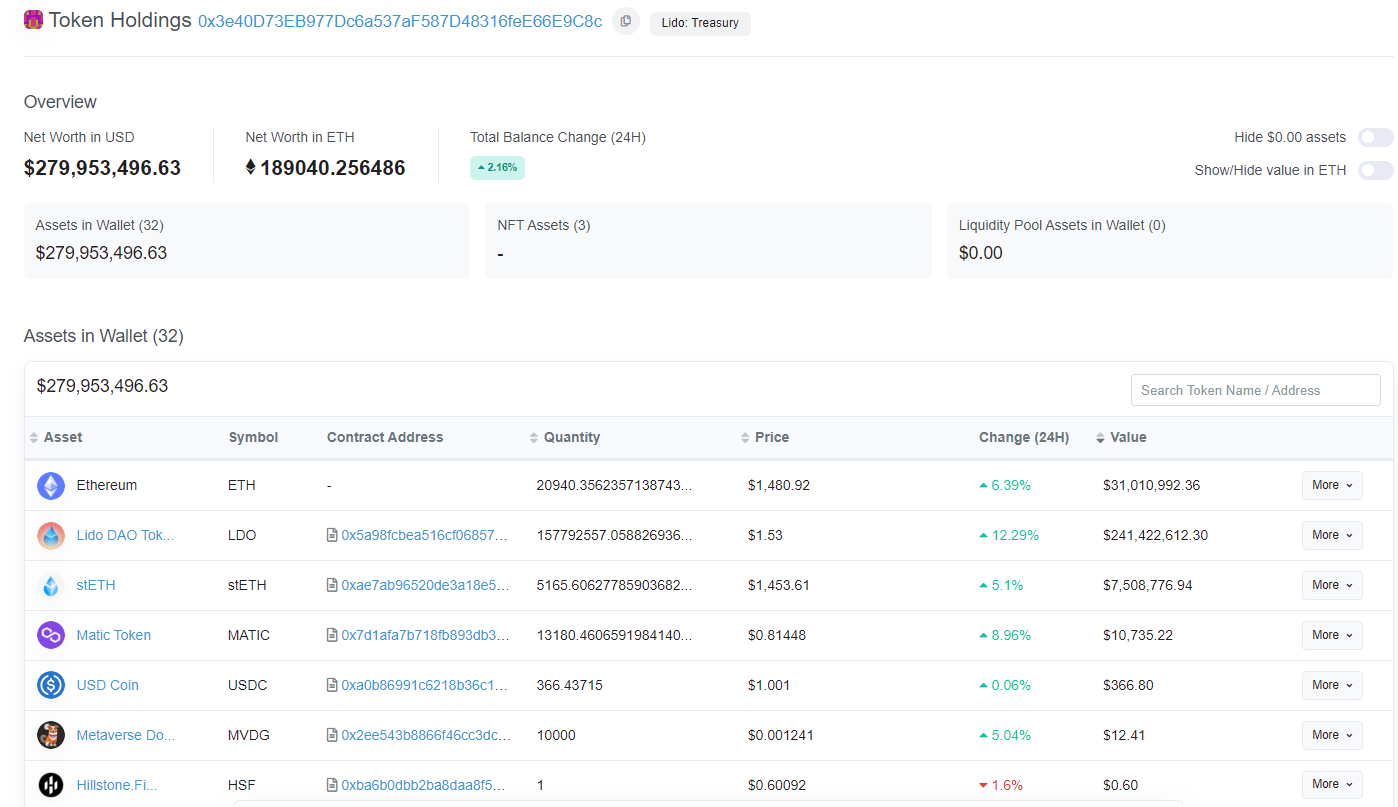

Because at the time of creating, the Lido DAO fund only owns assets that are purely tokens such as twenty,940 ETH, 157.seven million LDO, five,165 sETH and 13,180 MATIC with no stablecoin.

Synthetic currency 68

Maybe you are interested: