Long-term Bitcoin (BTC) investors have begun taking profits since the cryptocurrency’s price attempted to reach $100,000. As a result, Bitcoin price fell to $93,000, affecting the value of the entire cryptocurrency market.

Is Bitcoin price recovering? Short-term investors may want to know about this when on-chain analysis considers the possibilities.

Activity around Bitcoin Declines, Investors Take Profits

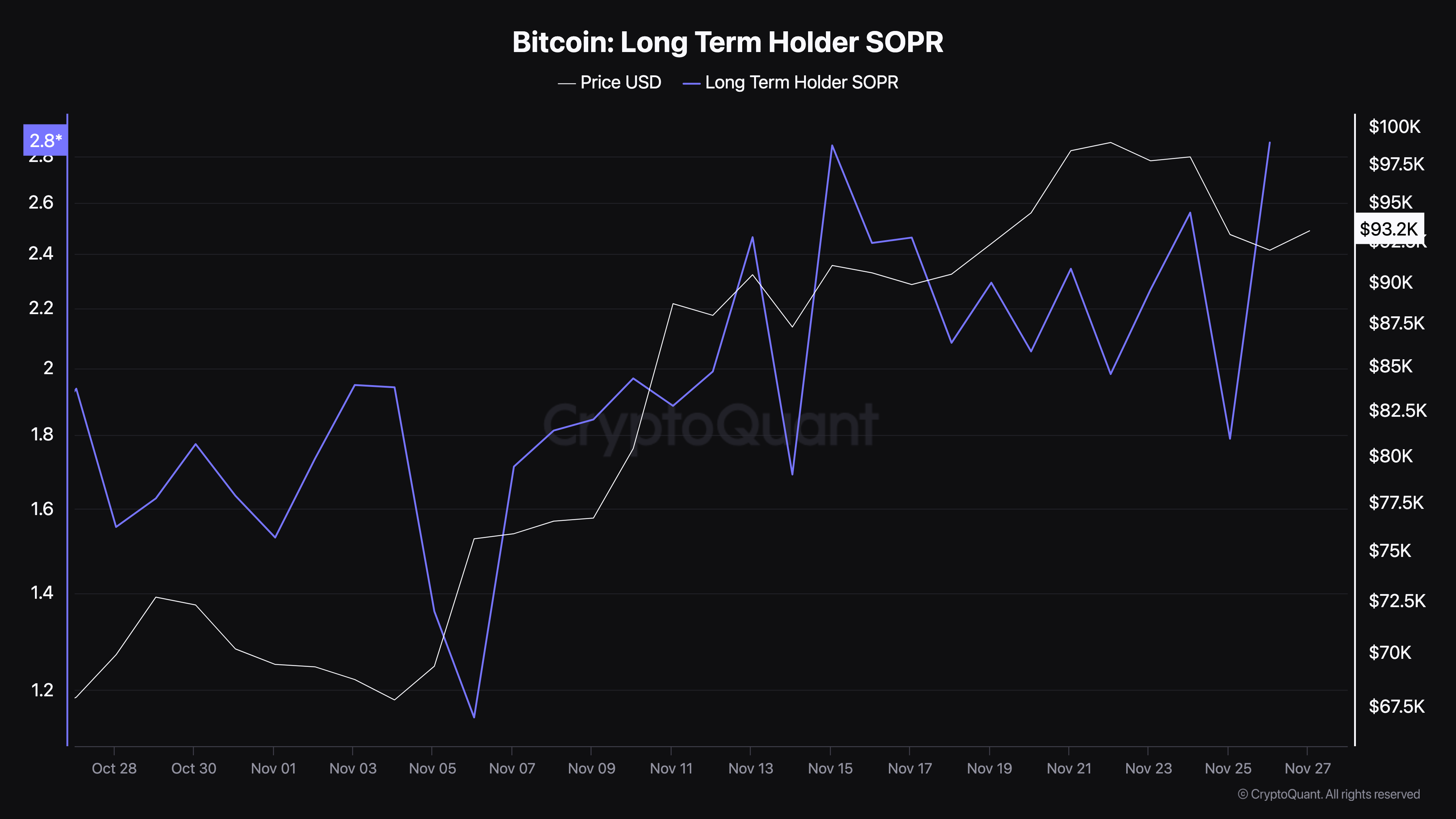

According to CryptoQuant, the long-term Bitcoin return-to-output ratio has increased to 2.86. This ratio measures the performance of long-term investors who have held the coin for more than 155 days.

When this ratio is greater than 1, it means that long-term Bitcoin Holders are selling for profit. Conversely, if the output profit ratio is less than 1, this implies that holders are selling at a loss. Since the index is higher, it suggests that these holders are taking profits from the recent price increase.

Not only that, it’s worth noting that this profit taking is the highest since August 30. If this trend continues, BTC price could fall below $93,000.

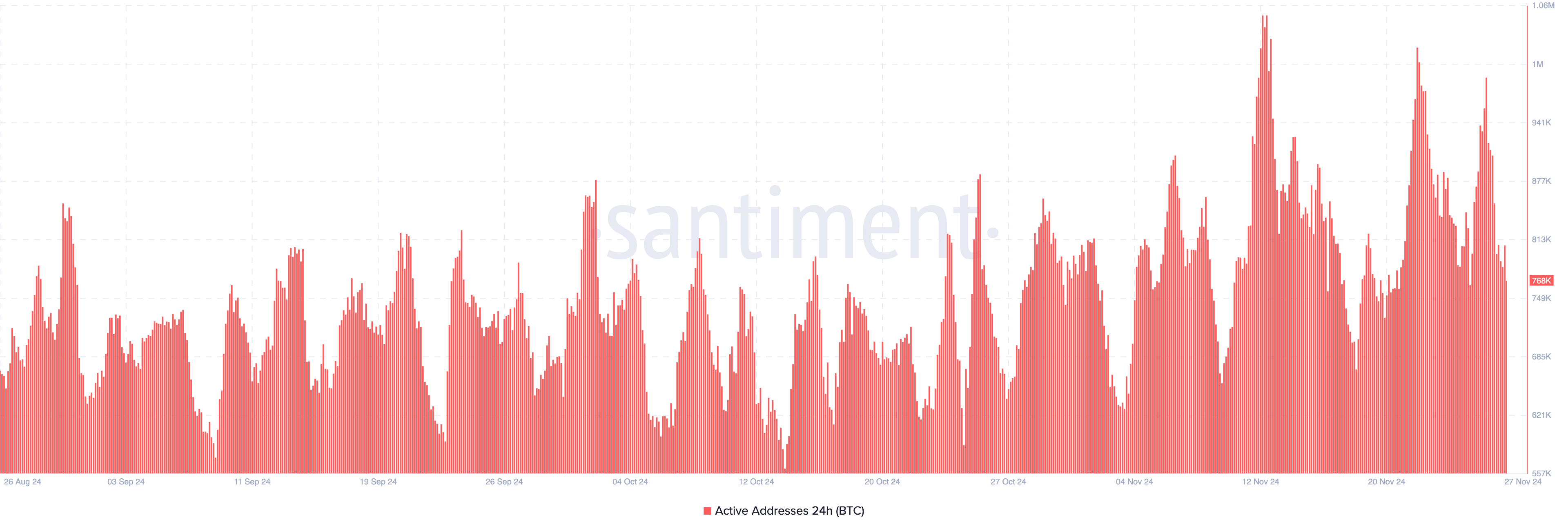

Furthermore, active addresses on the Bitcoin network also dropped sharply this week, which could be detrimental to Cryptocurrency prices if the trend persists. Active addresses measure the number of unique addresses participating in transactions, reflecting user engagement with the blockchain.

As active addresses increase, it shows that network activity and adoption are increasing. Conversely, a decline indicates a decrease in participation.

On November 26, Bitcoin’s active addresses reached nearly 1 million, demonstrating significant uptake. However, at the time of writing, this number has dropped to 768K, a clear decline. If address activity continues to decline, it could signal weakening market sentiment and could contribute to further price declines as mentioned earlier.

BTC price prediction: Time to drop below $90,000?

On the daily chart, Bitcoin price has dropped below the dotted lines of the Parabolic Stop and Reversal (SAR) indicator. This technical tool identifies support and resistance levels.

Dotted lines below the price signal strong support, while lines above the price show resistance that could lead to a decline. Currently, Bitcoin is facing the second scenario.

If this resistance continues, BTC could drop to $84,640. However, if long-term investors reduce their profit taking, Bitcoin value could increase instead, potentially reaching $99,811.