It can be explained that Yearn Finance is a single of the essential tasks that lay the foundations for DeFi. Founded and produced by Andre Cronje, a single of the people today regarded a genius in the cryptocurrency industry, Yearn Finance has gone from a modest anonymous task to a single of the most productive tasks. . So now, soon after a great deal of modifications in the industry and inside of the growth group, is Yearn Finance okay? Let’s come across out with me in this post!

Maybe you are interested:

Yearn Finance overview

Yearn Finance is a protocol produced with the aim of assisting traders to make income instantly and very easily with minimal chance by implementing trading, lending, farming … approaches on DeFi.

If you are a retail investor, have ETH accessible, the easiest and best factor to make a revenue would be to deliver that ETH into the AAVE or Compound protocol, lend it and obtain long lasting curiosity. As you attain far more know-how, you can execute far more complicated duties this kind of as:

- Use ETH to present liquidity to a pool on Compound or AAVE to obtain APY, then proceed to carry LP tokens to other protocols as collateral or present liquidity for supplemental rewards …

- Use equipment like flash lending to revenue from arbitrage pools (flash lending is a kind of borrowing and repaying a loan in a single transaction).

However, in actuality, not absolutely everyone can very easily do the over since:

- It necessitates knowledge and great know-how to determine revenue and chance (pooled yield farming or lending platforms are risky).

- It fees a great deal of fuel taxes and hence you may well not be worthwhile.

Yearn Finance will resolve the over complications. You basically have to deposit dollars in the approaches you want and wait to obtain income. Of program, Yearn will charge a portion of your income.

Yearn Finance approaches will operate in accordance to a precise investment system: how to allocate the capital, the place to allocate it, when to move the capital and when to promote or withdraw. In addition to current approaches, in reality, any individual can develop a new technique by posting it on the Yearn governance forum, explaining its logic and probable income to make the local community realize. If accredited by the local community, the technique will go into impact, the creator of the technique will obtain the expense of use, deducted from the real effects of the technique.

The primary goods of Yearn Finance

Time

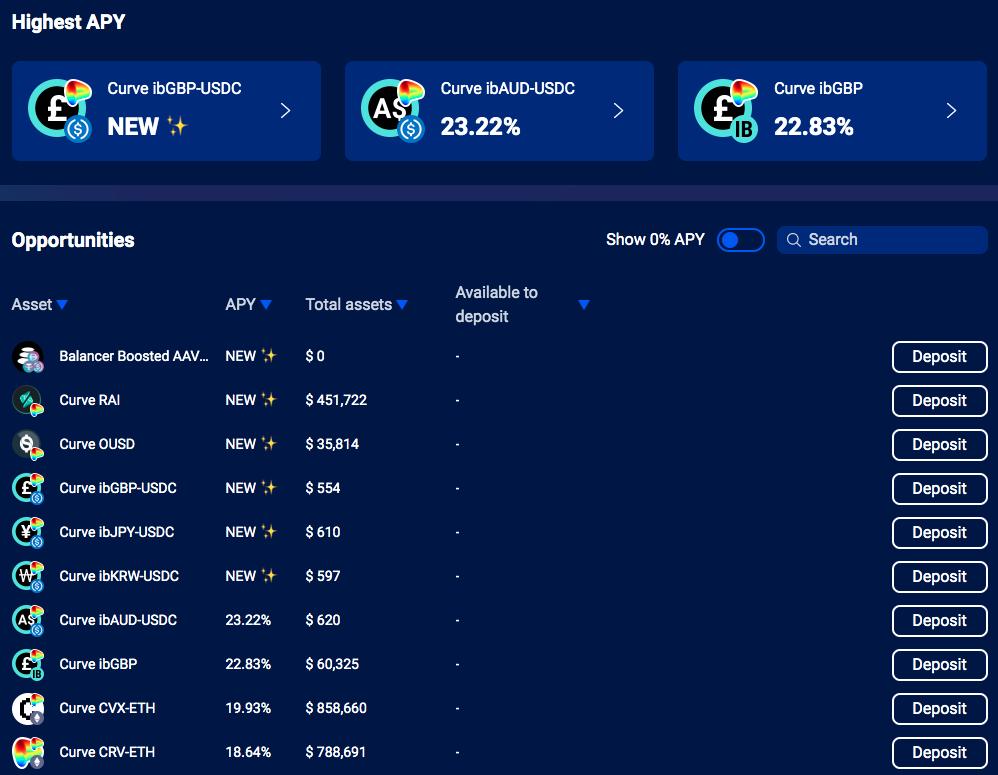

They are Yearn’s vaults with unique approaches that assistance end users make income instantly. Vauts income come from a mechanism that offers liquidity to earn commission on fuel, automates revenue generation and rebalancing, and instantly moves capital when possibilities come up. Additionally, the finish consumer does not need to have to have in-depth know-how of the underlying protocols concerned or DeFi, so Vault represents a passive investment technique.

To use this product or service, end users basically need to have to website link their MetaMask wallet with Yearn, then deposit dollars into the preferred Vault.

Fee Collection Mechanism: Yearn will acquire two kinds of costs which include:

- Performance Fee: Yearn will charge a twenty% charge primarily based on the income earned for Vault.

- Management Fee: Yearn will acquire two% of the complete volume deposited in the Vault set for 12 months 01. This two% will be created by generating far more Vault shares, consequently “diluting” the Vault.

Time V2

Each Vault will have a optimum of twenty approaches: this is to guarantee diversity and assistance the Vault allocate money far more optimally in many industry situations. Each technique will have a optimum capital restrict, keeping away from the situation of also considerably dollars remaining allotted to a technique that are unable to make far more APYs.

Change management purpose: In Vault V2, technique creators and custodians will act as managers, overseeing the execution of the technique and will have the electrical power to get action to increase capital management or get action in essential conditions.

Manage Vault Automatically through Keep3r Network: The execution of transactions and withdrawals is automated through bots on the Keep3r network.

No withdrawal costs: This is a modest update, but it will assistance end users conserve really a bit of dollars in the context of large fuel tariffs.

laboratories

As the title suggests, Yearn’s Labs is a location to check technique with larger than typical chance. You will need to have to get your obligation when participating in approaches in this region.

yCRV

yCRV can be witnessed as a product or service to make the most of Yearn’s place on the curve. In a word, Yearn will incentivize end users to lock their CRVs through Yearn to make income on Curve, in return Yearn holds far more voting electrical power above Curve and governs the Curve protocol.

To come across out far more, you can study about Curve Wars right here.

Update the operational predicament of Yearn Finance

As a revenue aggregation protocol, Yearn’s well being is reflected in essential metrics like complete locked worth, income, and end users.

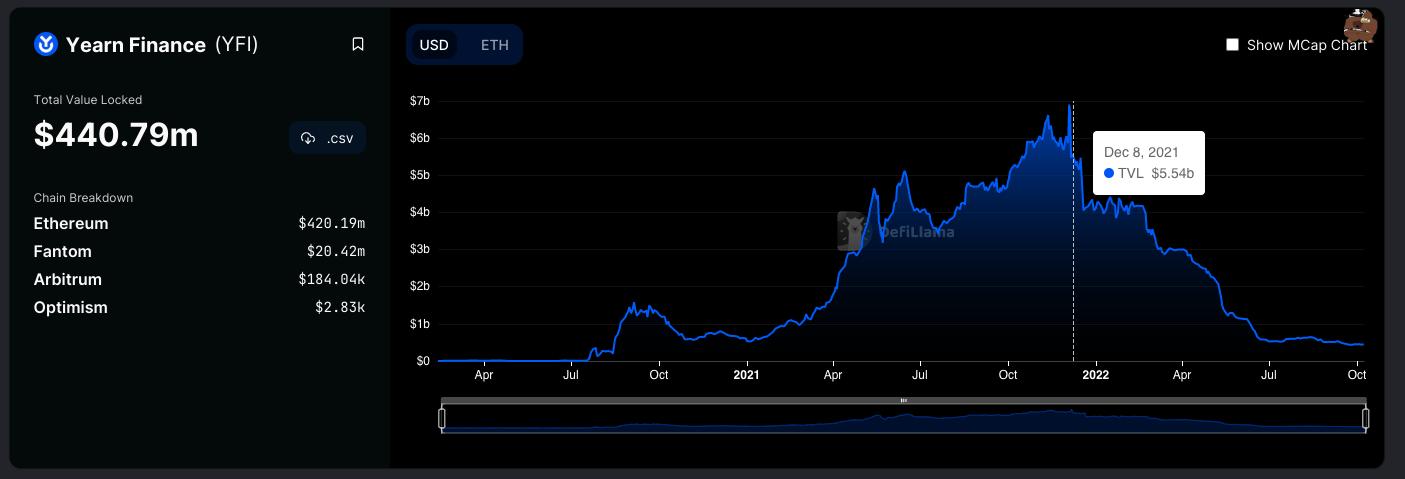

Total blocked worth (TVL)

From December 2021 to the existing, TVL Yearn Finance has plummeted so far, only about $ 441 million, or a drop of 92%.

The over lessen stems from a amount of good reasons this kind of as:

YFI Token

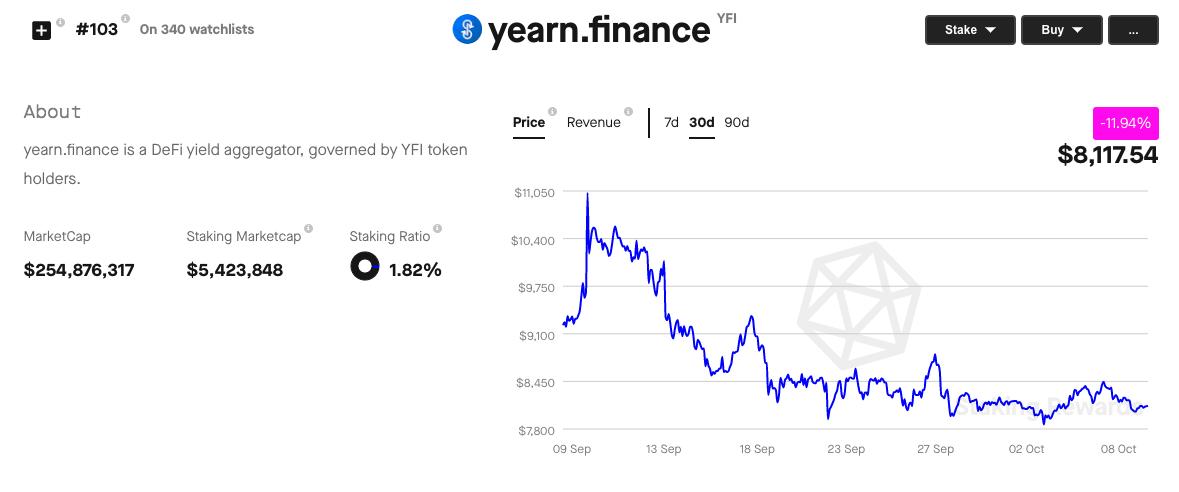

YFI is the governance token of Yearn Finance, in addition to the performance that makes it possible for end users to bet and obtain a portion of the share earned by the protocol.

Currently, lots of YFI staking information monitoring web-sites are almost out of date. I use the information on StakingRewards.com:

According to information from StakingRewards, YFI’s Staking Ratio is only one.82%, an incredibly minimal amount. This exhibits that most YFI holders are no longer interested in participating in task management or revenue sharing from the task. The primary explanation possibly stems from the extreme decline of TVL as we analyzed over, which prospects to the project’s inability to make income.

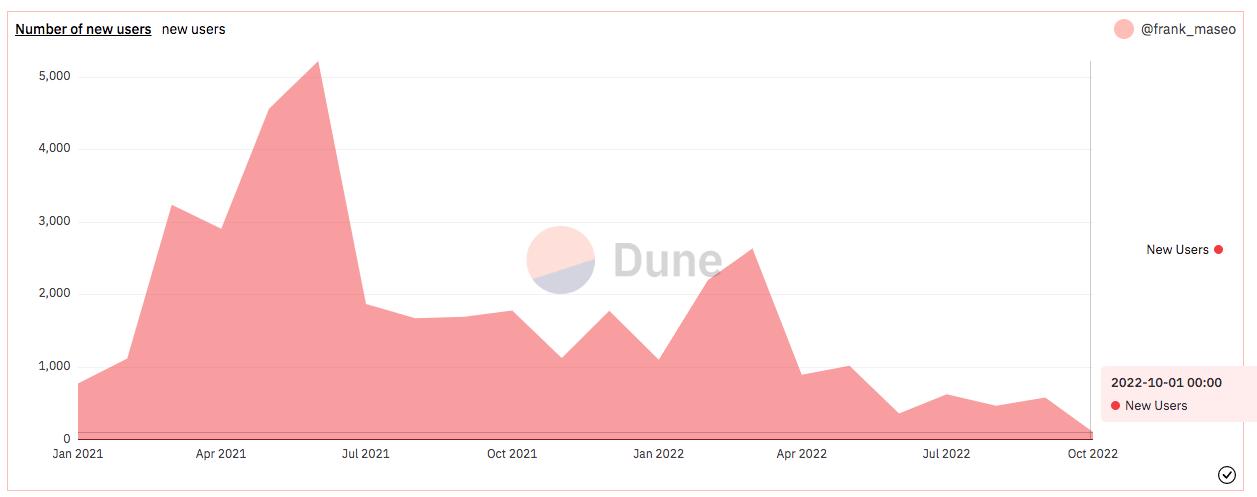

User

Similar to TVL, the new end users of the task decreased considerably. With the inability to entice new end users, though previous end users depart the task, Yearn Finance is exhibiting a really unsafe predicament.

It can be explained that Yearn Finance is a DeFi task with lots of troubles and complications:

Product information and facts: Yearn’s goods are at present tricky to update, dropping their appeal to end users, particularly in challenging industry occasions.

From the local community side: it is a task in the path of local community governance, but soon after lots of occasions, Yearn no longer has the identical help as in the previous.

On the side of the group: If you stick to the Yearn web site, you will recognize that in the previous they really typically up to date quarterly fiscal reviews or regular monthly operational reviews on an ongoing basis. However, from April 2022 until eventually currently, the task has entirely stopped functioning. On Twitter, in spite of remaining nonetheless energetic, the information posted by Yearn no longer has any worth.

finish

Perhaps it is also early to make a damaging comment on Yearn Finance. To proceed to keep and survive in this minute, I think the task requirements to do far more. However, the standing quo of this task is no longer great sufficient for even the most optimistic traders.

What is your view on Yearn Finance? Leave a comment to go over with us!

Poseidon

See other articles or blog posts by the writer of Poseidon: