The Luna Foundation Guard (LFG) not too long ago announced that it has raised $ one billion by way of a direct sale of the native Terra blockchain token, LUNA.

This is 1 of the greatest fundraisers in the historical past of the cryptocurrency marketplace, led by Jump Crypto and Three Arrows Capital, with participation from Republic Capital, GSR, Tribe Capital, DeFiance Capital and other traders.

one / The extended awaited [REDACTED] 💎3 is right here!

📣 The Luna Foundation Guard (LFG) closed a $ one billion personal token sale to create a $ US Forex reserve denominated in $ BTC! 📣

🧵👇

– Terra (UST) Powered by LUNA (@terra_revenue) February 22, 2022

LFG, which is also an acronym for a rather humorous phrase in the planet of cryptocurrencies (Let’s go to bitches) – a Singapore-based mostly non-revenue organization – was founded final January to enable develop the Earth ecosystem.

The money raised from this $ one billion token sale will be applied to create a Bitcoin foreign exchange reserve for UST, the greatest stablecoin in the Earth ecosystem.

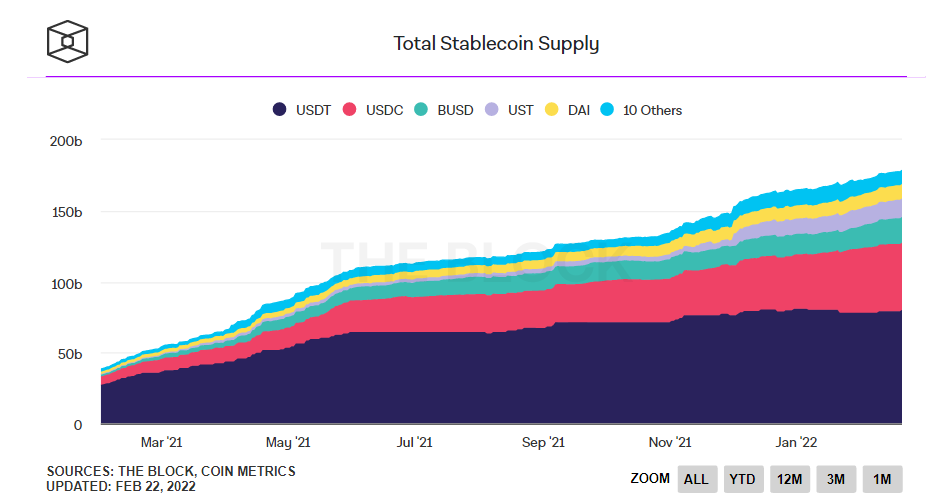

UST is a incredibly preferred algorithmic stablecoin not too long ago in the DeFi discipline. Pegged to the rate of the US dollar, the currency grew swiftly and reached a marketplace capitalization of extra than $ twelve billion, extra than tripled given that final November, in accordance to The Block Research.

See also: Kyros Kompass # seven: Rise of Algorithmic Stablecoin

The LFG explained this reserve will act as a “valve valve” for the UST acquisition is intended to guarantee that the rate of stablecoins stays fixed at the dollar rate in the course of sturdy revenue in the cryptocurrency marketplace.

How does a reserve fund perform?

Unlike older stablecoins, this kind of as people issued by Tether and Circle, options this kind of as algorithmic stablecoins do not use collateral to hold their worth.

Instead, stablecoins like UST hold charges by relying on marketplace dynamics.

Here is an explanation of how it will work, taken from the Terra website:

“When the demand for land in the marketplace is large and provide is constrained, the rate of land will rise. When the demand for land is minimal and the provide is also substantial, the rate of land will go down. The protocol will guarantee that land provide and demand are usually in stability, top to rate stabilization. “

Users can generate new Earth-based mostly stablecoins, generally UST, by burning LUNA tokens, and likewise, they can burn up UST to create LUNA. All these routines are encouraged by the protocol to guarantee that one LUNA dollar can usually be exchanged for one UST and vice versa.

See also: DeFi Discussion ep. 32: Algorithmic Stablecoin (Algorithmic Stablecoin) – New heights of DeFi?

However, this $ one billion reserve is becoming ready in situation a promote-off in the cryptocurrency marketplace erodes these dynamics.

“Reserve assets can be used in the event that prolonged market sales prevent buyers from restoring parity in the UST rate and worsen arbitrage incentives,” LFG explained on the open marketplace of the Land Protocol.

The original reserves will be denominated in Bitcoin, an asset that in accordance to LFG has very little to do with the Earth ecosystem. The task programs to accumulate the reserve with other unrelated assets in the long term, despite the fact that it is unclear which assets will be applied.

The LUNA acquired by Jump and other traders in the deal will be locked for a 4-12 months vesting time period, LFG announced.

Improvement of the DeFi surroundings

Singapore-based mostly Terraform Labs, founded by Do Kwon and Daniel Shin in 2018, is the top developer of the Terra blockchain.

The startup is supported by Pantera Capital, Coinbase Ventures, Galaxy Digital, Binance Labs, Dunamu, Huobi Capital and OKEx. It final raised capital in the course of a $ 25 million Series A round in January 2021.

In the United States, Terraform is now engaged in a legal battle with the Securities and Exchange Commission (SEC). The regulator is investigating no matter if the Terra Mirror Protocol, a platform for trading “mirror assets” relevant to stock costs, has violated US securities laws.

Terraform countered that the watchdog misused Kwon’s quote at a conference in September 2021, arguing that the watchdog did not have the suitable authority to declare the business was headquartered in Singapore.

Synthetic currency 68